Daily Market Insight - 22nd March 2022

Markets rise due to expectations of colder temperatures and poor wind generation

Key Market Drivers

- Wind generation set to remain below seasonal norms for the rest of the week

- Cooler temperature outlook supports today’s gain across gas markets

- The EU still in limbo as to whether they should ban Russian oil exports

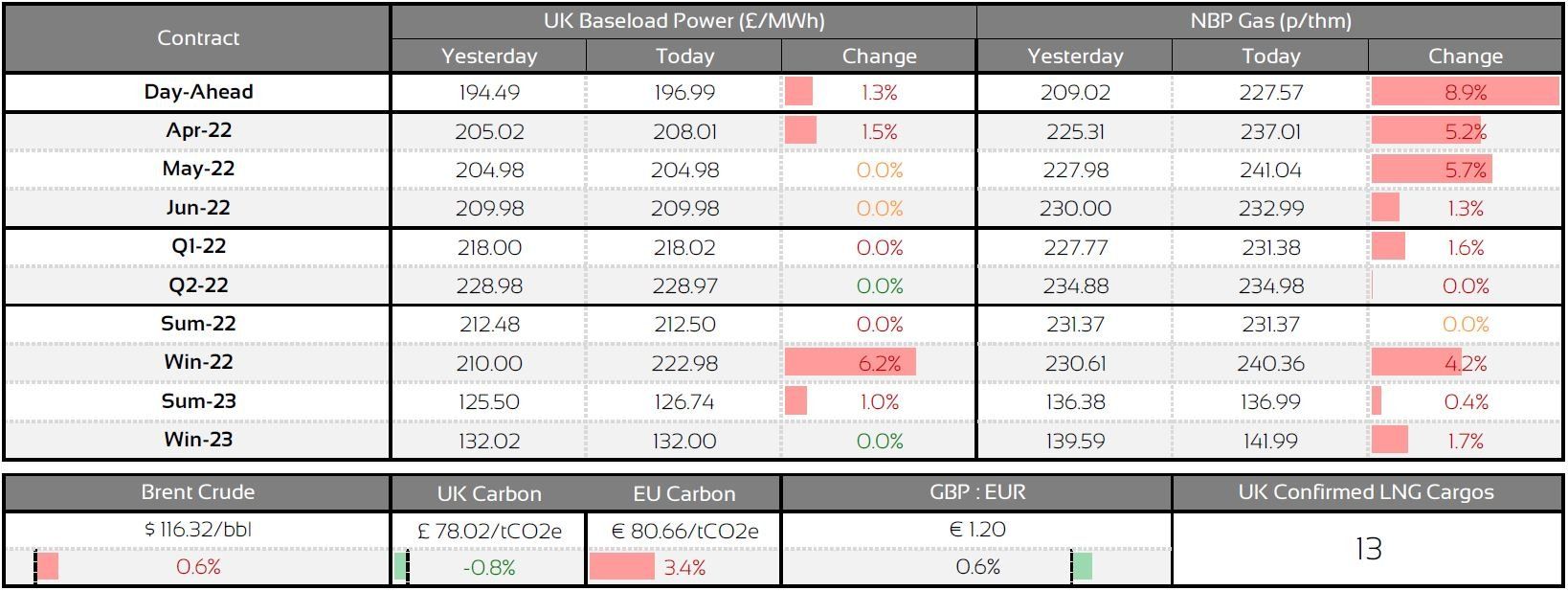

Market Prices

Front Seasonal Prices

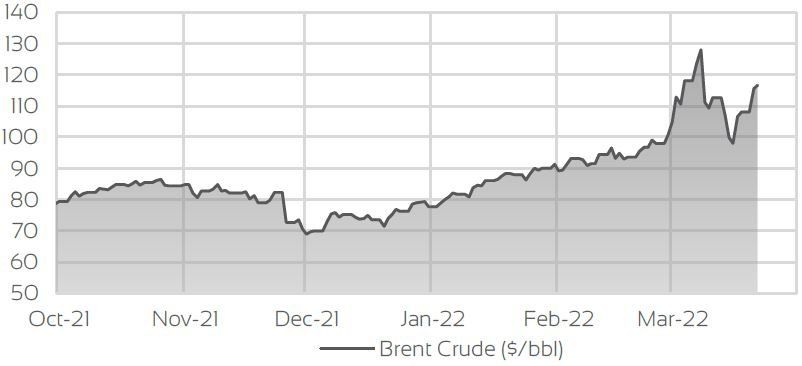

Brent Crude Price

UK, EU & US Currencies

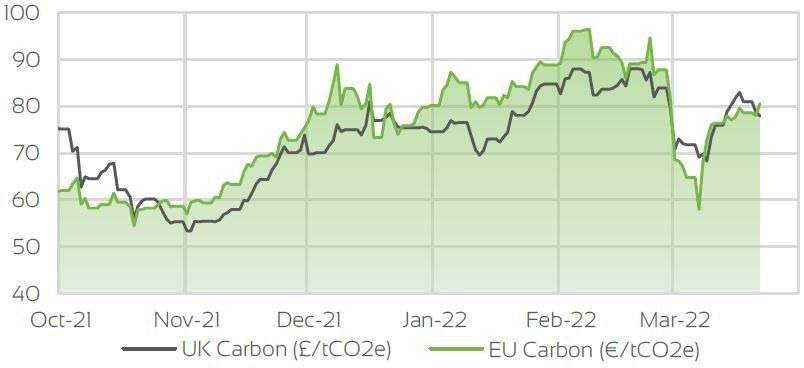

Carbon Price

Market Insight

Gas prices across the near and front seasonal markets rose today, as forecasts of colder temperatures combined with the poor wind outlook suggests more demand will be put on gas burn for power. Wind generation is low and is expected to peak at 4GW today, falling further tomorrow to around 3GW and is forecasted to remain below seasonal norms for the rest of the week.

In turn this has led the gas system to open up undersupplied which was also supported from a drop in Norwegian flows. Overall, the supply picture remains stable as stock level on the continent improve but uncertainty still surrounds Russian gas flows as the war continues.

Carbon markets remained relatively rangebound with EU prices nudging over the 80/tCO2e mark. Oil prices remained bullish as the uncertainty of Russian exports lingers, with Europe still in discussions as to whether it should follow the UK and the U.S and put an embargo on Russian oil.

We're here to help

Our Energy Procurement team are on hand to assist and advise with your gas and power supply demands.

The market pricing information provided by Optimised Energy under this Agreement does not constitute recommendations, advice or guarantees. The Reader accepts that wholesale energy prices are subject to change.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.