Daily Market Insight - 4th March 2022

Gas prices to end on a weekly high amid supply disruption fears and cooler weather outlook

Key Market Drivers

- The escalation of the Russia/Ukraine conflict continues to push prices up

- Cooler temperatures and poor wind outlook support bullish markets

- Iranian oil unlikely to bridge gap if Russian oil was to be sanctioned

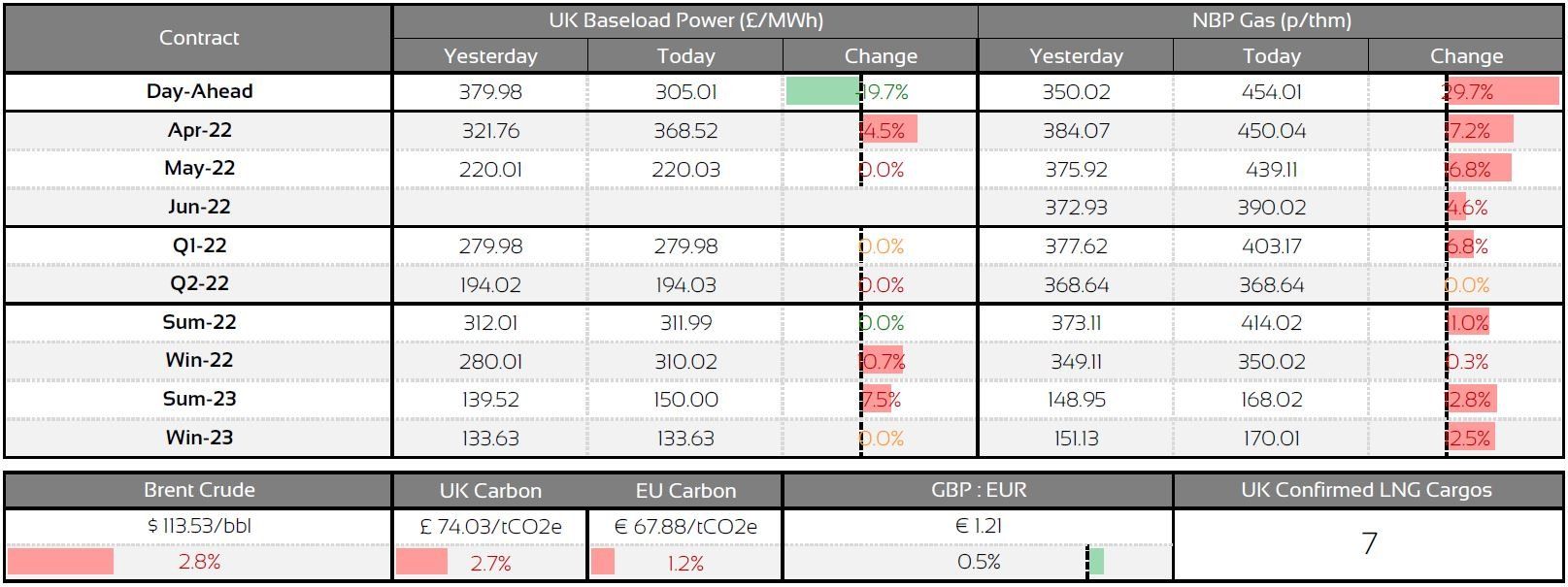

Market Prices

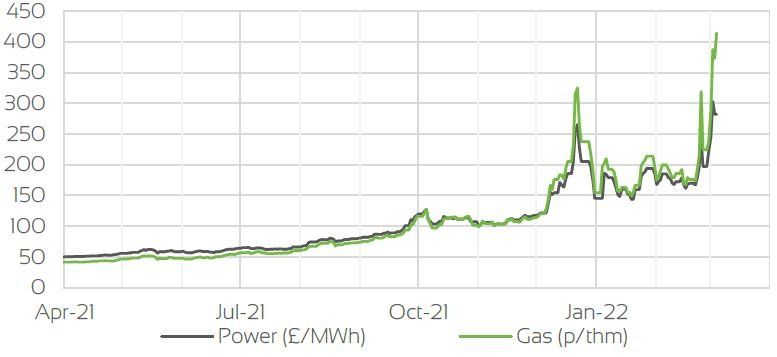

Front Seasonal Prices

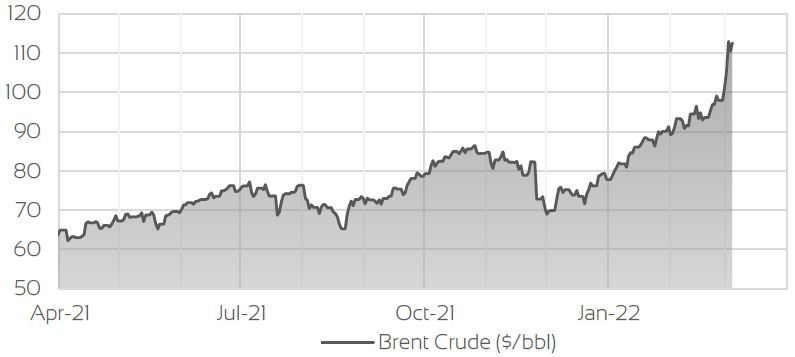

Brent Crude Price

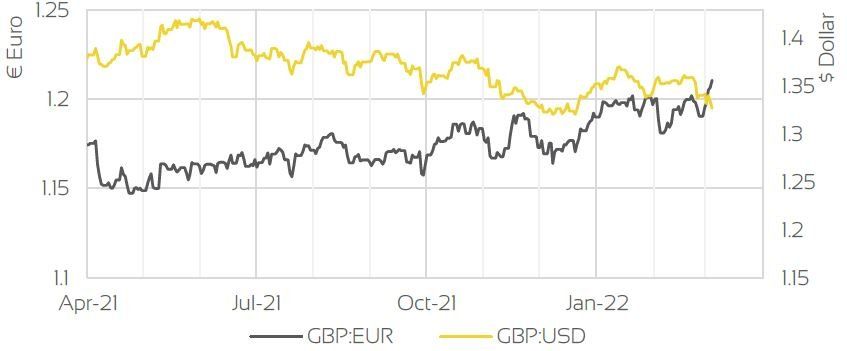

UK, EU & US Currencies

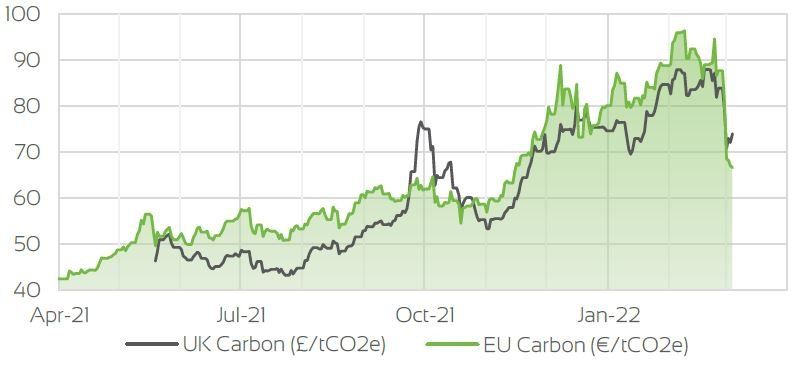

Carbon Price

Market Insight

Gas markets continued to rise today (4th March 2022), with Summer-22 as well as April and May contracts breaking the 400p/Therm mark. The ongoing conflict in Ukraine remains the main driver day-to-day, as supply fears persist. Russia attacked the nuclear plant in Ukraine, which would have been catastrophic for the continent, however failed to weigh in on prices as the fire was quickly eradicated.

Adding support to the markets are the cooler temperatures we are likely to see over the coming weeks, along with reduced wind generation as it dropped significantly today, adding less than 4GW to the stack. Norwegian flows remain stable, helping the gas system open up 9 MCM/d oversupplied.

Oil prices rose above $112/Bbl today due to fears of Russian exports being sanctioned. The prospect of Iranian supply coming into the mix is unlikely to offset any bullishness from Russian oil been banned, due to the significant difference in production levels between the two producers.

We're here to help

Our Energy Procurement team are on hand to assist and advise with your gas and power supply demands.

The market pricing information provided by Optimised Energy under this Agreement does not constitute recommendations, advice or guarantees. The Reader accepts that wholesale energy prices are subject to change.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.