Energy Market Insight | December 2023

Energy Market Trends: DECEMBER 2023

December trend continues in bearish fashion amid a strong supply picture & mild temperatures

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

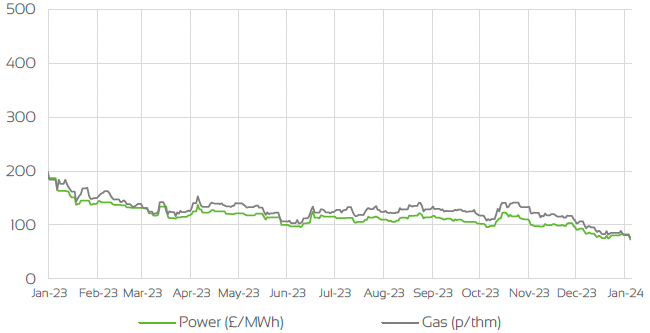

Day Ahead GAS & POWER Prices

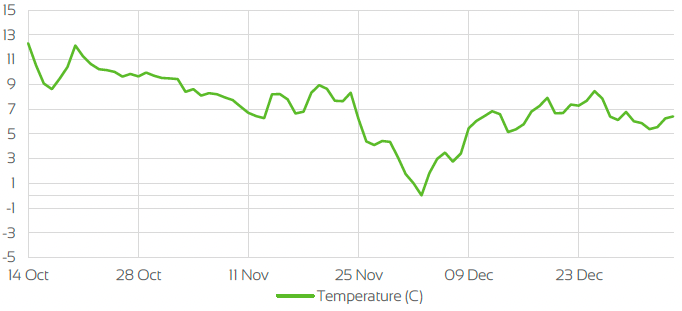

UK Temperature CHANGE

Market Insight: Short-Term

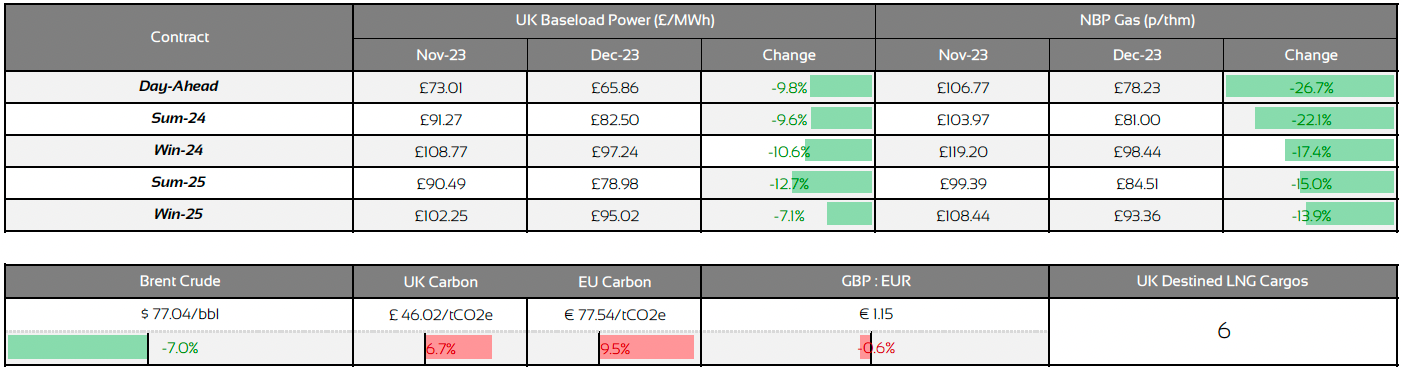

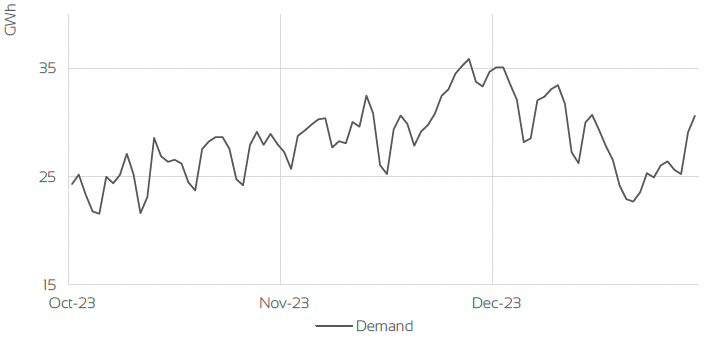

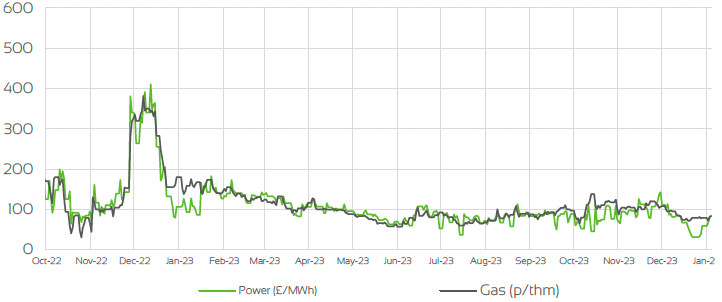

December was a month of significant downside as gas and power contracts on both the near and front seasonal curves were comfortably within double figures. Continuation of a strong supply picture overall, combined with mild temperatures leading up to the new year were the main contributors in seeing prompt power prices under £90/MWh along with gas sitting around 85p/therm across Jan/Feb/March contracts.

Front seasonal indexes also saw losses at a similar level. As the Christmas holidays approached us, gas storage levels across Northwest Europe were still above 90% fullness, and with weather forecasts suggesting milder temperatures for the majority of December, the outlook over the short-term remained bearish, with key fundamentals remaining unchanged. Norwegian gas flows remained extremely healthy throughout December as any planned and unplanned outages were kept at a minimum, with nominations sitting on average above 350 million cubic meter per day.

LNG imports coming into the UK also remained robust with shipments docking on a regular basis and maintaining high levels of storage injections. As the geopolitical risks from the conflict in the Middle East faded, fresh concerns had risen as Houthi rebels has launched an attack on BP cargoes that were traveling through the Red Sea, which in turn shifted the focus to potential LNG and oil disruptions. With that said LNG exports were largely unaffected and little upside crept into prices as the healthy supply picture offset any potential risk for the time being.

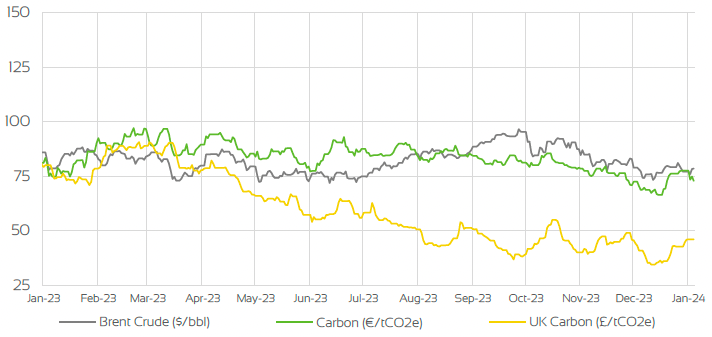

If anything, it played into Europe’s favour as LNG exports avoided that particular route to avoid any delays and therefore docking earlier. Oil prices overall remained relatively rangebound throughout December despite the concerns around the Red Sea incident, as global economic concerns pushed back on further gains.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

Front Seasonal gas & power Prices

Brent Crude & Carbon Price

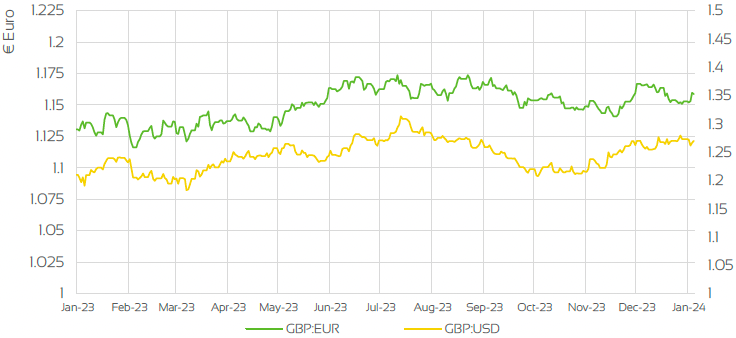

UK, EU & US Currencies

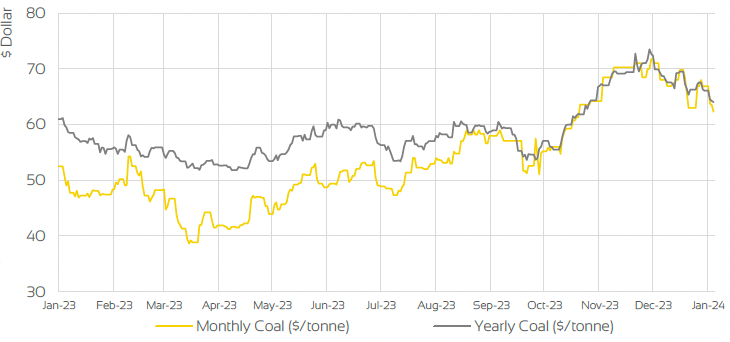

Coal Prices

Market Insight: Long-Term

Contracts further out on the curve faired in similar fashion to prompts markets, as front seasonal prices on both gas and power fell throughout the month amid the strong supply picture and key fundamentals remaining healthy. Winter and summer contracts have seen similar levels of losses to prompt prices as summer-24 hovered around £80/MWh and winter-24 just above £96/MWh. Gas contracts headed in the same direction, as summer-24 reached 85p/therm with winter-24 just above 100p/therm.

Analyst’s are suggesting that come April, gas storage levels in Northwest Europe could still sit around 50% fullness if there weren’t any sudden supply shocks, leaving Europe in a very comfortable position in regards to preparing for winter-24 and achieving their storage targets. Whether this will bring further significant downside is yet to be seen, but there is a strong suggestion that the bearish outlook on markets is set to continue and therefore see a steady decline in prices as the winter months come to an end and we move into Q2.

Even though we are on course to meet winter demand without Russian energy, it is still apparent that there are 2 wars that are still largely present, and despite much of the risk of the Israel/Hamas war not spreading into the Middle East, markets are still wary that the situation could change. The latest Red Sea attacks by Houthi rebels showcases the risks that are still present, and if these factors were to escalate, we could see a lot more bullish sentiment coming into markets or at a minimum limiting any further losses in the longer term.

Oil markets saw losses for around 6 to 7 weeks with prices reaching as low as $73/Bbl, as global demand concerns weighed on markets despite OPEC suggesting further production cuts in the new year and suggesting the wider group should consider this approach. As this was more of a voluntary suggestion, much of the concern surrounding a tighter supply was offset by the faltering demand outlook.

Market Outlook

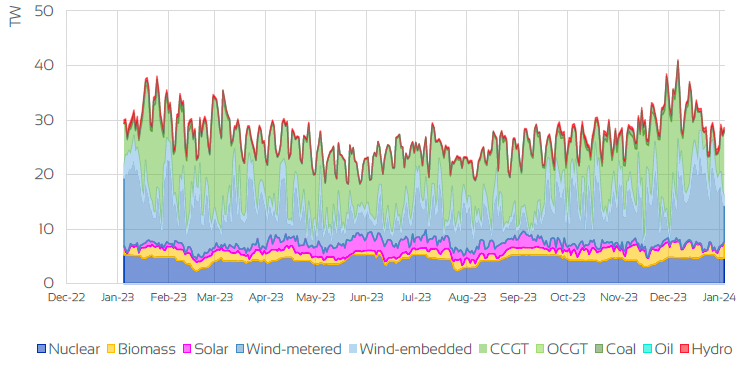

As we head into the new year, December has been a month of losses, as a strong supply picture amid healthy supply fundamentals weighed on contracts. Mild temperatures throughout the month along side strong fluctuations of wind generation added much of the bearishness into markets. The focus will now turn to demand over the course of Q1 and whether any cold spell will be more apparent this side of the winter.

As gas storage levels in Northwest Europe remain extremely comfortable along side Norwegian gas flows and LNG imports, the outlook will remain bearish for the time being. With the conflict in Israel still at large and the latest attacks in the Red Sea, there will be concerns surrounding disruptions to oil and LNG exports. The main concerns at present will be around the latest attacks by Houthi rebels escalating but with the supply outlook remaining comfortable, any upside risk is likely to be limited. Towards the end of the month wind generation remained strong, supporting the bearish outlook as gas demand for power was reduced for this time of the year.

Overall, the current outlook for Q1 will remain bearish for the time being unless there are some unexpected supply disruptions, and we encounter long periods of a cold snap. With that said, geopolitical risks could still play a significant factor into the direction on prices if situations in the Middle East & the war in Ukraine were to change.

Related News

EXPLORE OUR OTHER ENERGY MARKET INSIGHTS

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.