Energy Market Insight | April 2024

Energy Market Trends: APRIL 2024

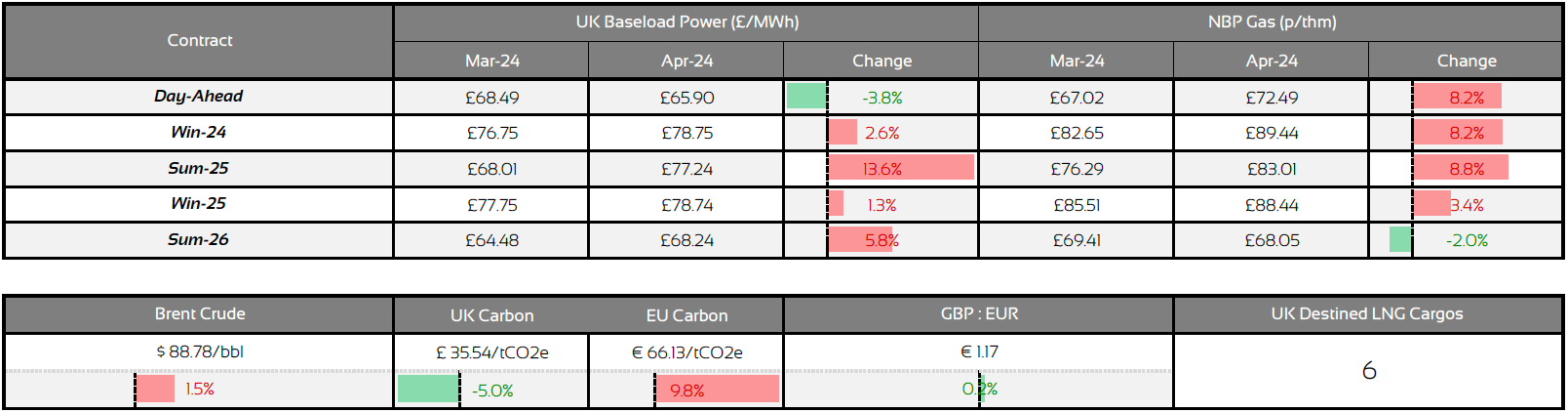

Volatility creeps back into the market as contracts edge higher overall

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

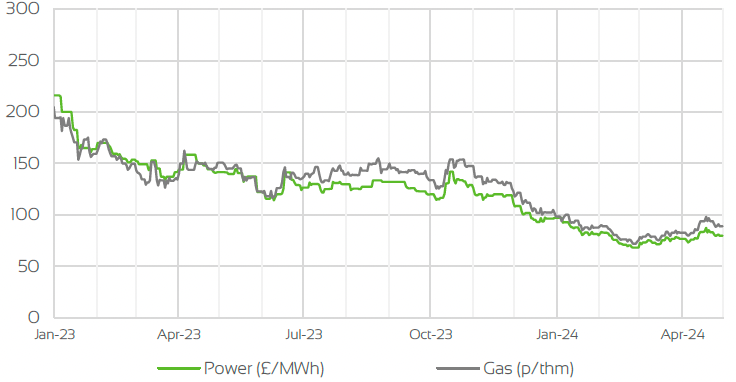

Day Ahead GAS & POWER Prices

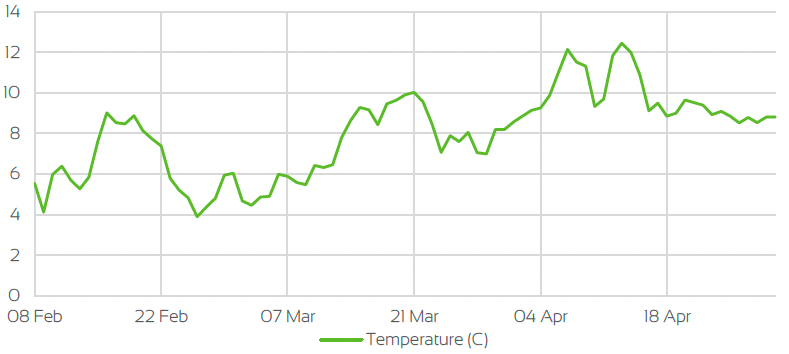

UK Temperature CHANGE

Market Insight: Short-Term

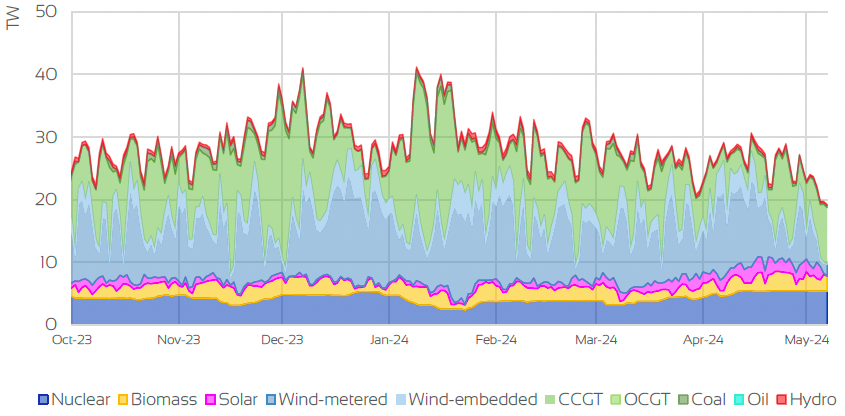

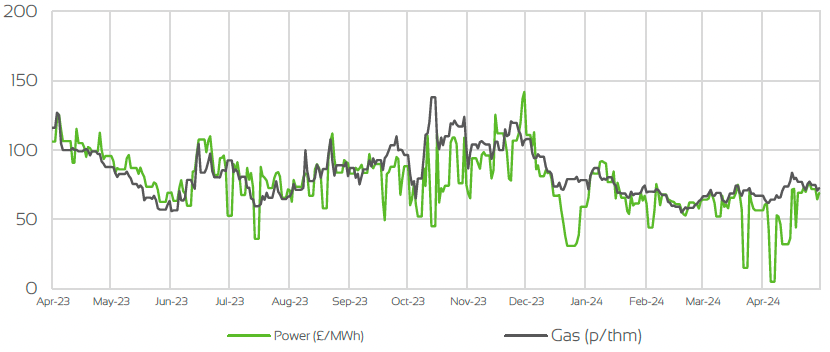

Since contracts back in February were close to 3-year lows, markets have seen a slight increase over the past 2 months. April has faired in the same fashion as March, as contracts across the near & far curve for gas and power experienced a steady increase throughout the month. Despite a healthy supply picture overall, concerns over Norwegian gas flows and LNG shipments have crept back into the market, as planned and unplanned outages coupled with higher demand for LNG from Asia added bullish sentiments.

Gas storage levels across Northwest Europe for this time of the year were sitting at record highs as the winter period proved to be another mild season, therefore leaving Europe in a strong position to replenish stocks for next winter.

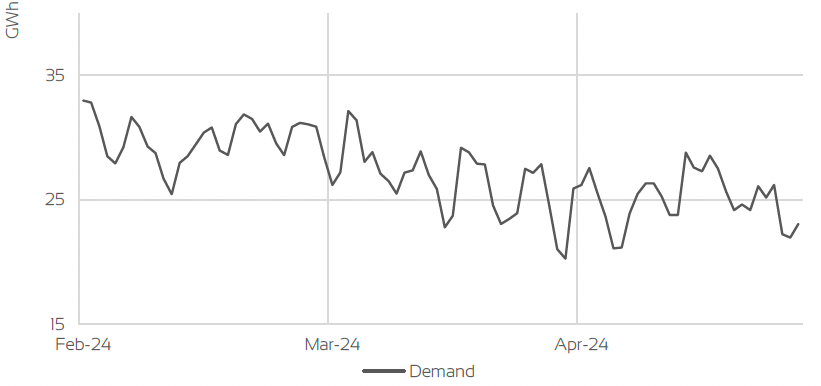

Temperatures throughout the month have remained above seasonal norms, therefore curbing demand throughout April, but with maintenance works across several gas plants in Norway which included Troll and Karsto, nominations to the UK and EU have been reduced during certain periods within the month, which in turn added supply concerns.

Adding support to the bullish trend was the lack of LNG coming into Europe, as outages at the Freeport facility in the U.S continued despite signs of production recovering, and warmer temperatures in Asia which increased demand for the fuel. With warmer temperatures and comfortable storage levels, a lot of the gains would have been limited.

Wider geopolitical concerns were still largely apparent as risks of the war escalating in the Middle East continued to stoke fear into markets, especially when Iran launched a drone attack on Israel, but with limited impact and a retaliation which was somewhat subdued, any price premiums were minimal if anything.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

Front Seasonal gas & power Prices

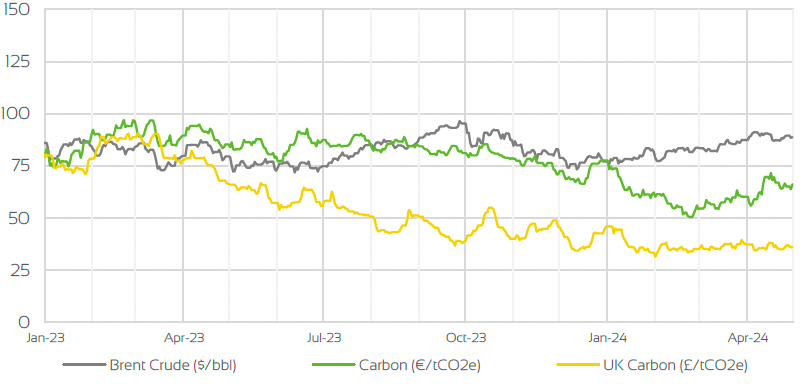

Brent Crude & Carbon Price

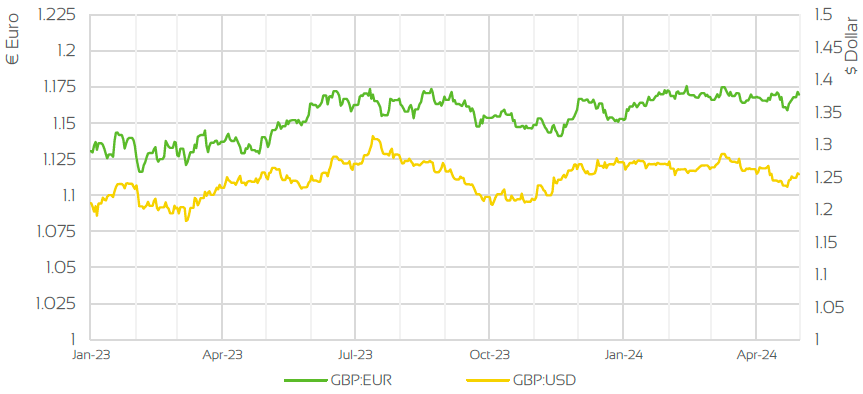

UK, EU & US Currencies

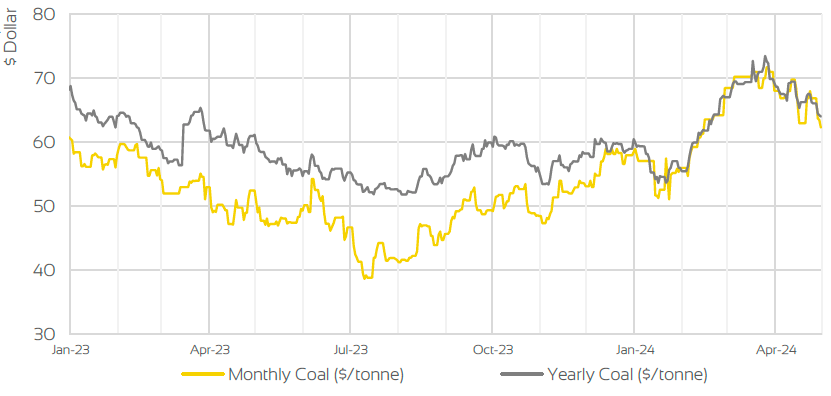

Coal Prices

Market Insight: Long-Term

As we dwell further into the summer months and the injection season now in full flow, gas inventories for Winter-24 look set to hit their targets comfortably (90% by November), as storage levels across Northwest Europe were just below 63% fullness, as April came to an end, which was an all time high. As the supply fundamentals look relativity stable despite ongoing concerns with Norwegian gas flows and the lack of LNG coming into the UK and Europe, Longer terms risks from the current wars in Ukraine and Israel pose the largest threats to front seasonal contracts at the moment.

Both Ukraine and Russia have targeted energy facilities as the war looks far from over with any ceasefire very unlikely despite the war starting in February 2022. With that said, there has been several attempts of a ceasefire from the Middle East, as parties from Hamas and Israel met up in Cairo recently. This in turn shows that the war could see and end sooner rather than later, as pressures from the international community increases. With supply disruptions the main concerns on the back of the war, oil prices have remained flat come the end of April and sat comfortably below the $90/Bbl mark. Prices have experienced monthly highs and lows throughout April, as developments in the Middle East added much of the volatility into oil prices.

Much of the gains have been pushed back as global demand concerns and the lack of movement on interest rate cuts add bearish sentiment into markets. As the summer continues, focus on the wars will still persist, but supply fundamentals such as demand for LNG from Asia and exports coming into the UK and the continent, will increasingly become the main drivers as we approach the winter months.

Market Outlook

As temperatures start to steadily rise as we move deeper into the summer months, demand will typically reduce which will enable the replenishment of gas inventories for the next winter period. As storage levels across North West Europe sit at all time highs for this time of the year, Europe should be set to hit their targets comfortably. With that said, the lack of LNG exports coming into the UK and Northwest Europe has been a slight concern especially with the added pressure of higher levels of demand for the fuel from Asia, amid warmer conditions.

Geopolitical risks are still largely apparent, as concerns over supply disruptions will linger. With recent attempts of ceasefire in the Middle East, there are some hopes that an end to the war could be near, which in turn could add some bearish sentiment back into both the near and far curves. With signs of gas production at the Freeport facility in the U.S looking to increase, there is some scope that LNG exports could improve over the coming months, but with higher demand from Asia and persistent concerns from the war, the outlook will remain somewhat bullish in the short-term despite the supply picture remaining healthy.

Related News

EXPLORE OUR OTHER ENERGY MARKET INSIGHTS

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.