Energy Market Insight | August 2023

Energy Market Trends: AUGUST 2023

Prices edge higher throughout August

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

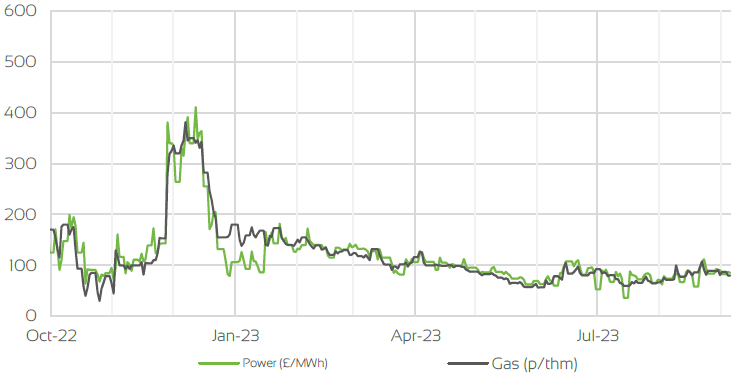

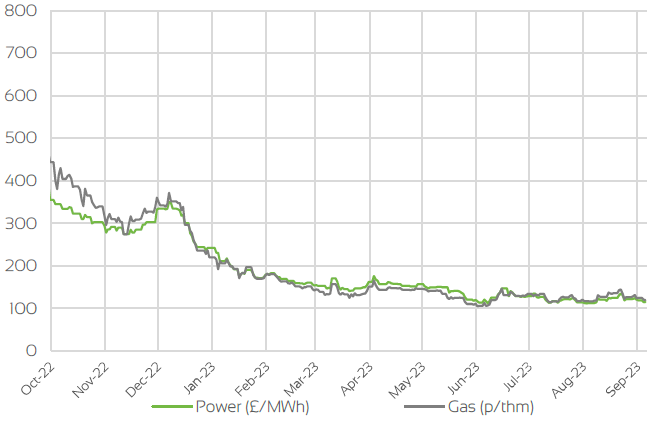

Day Ahead GAS & POWER Prices

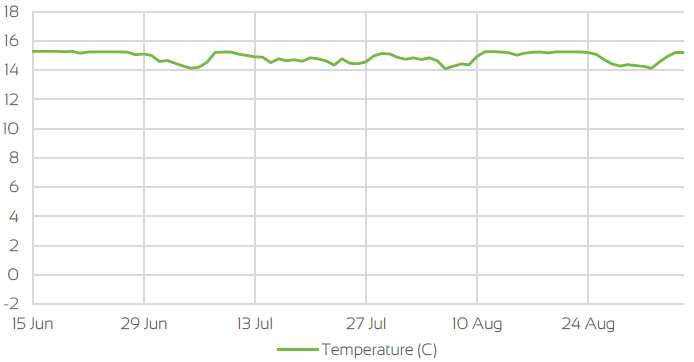

UK Temperature CHANGE

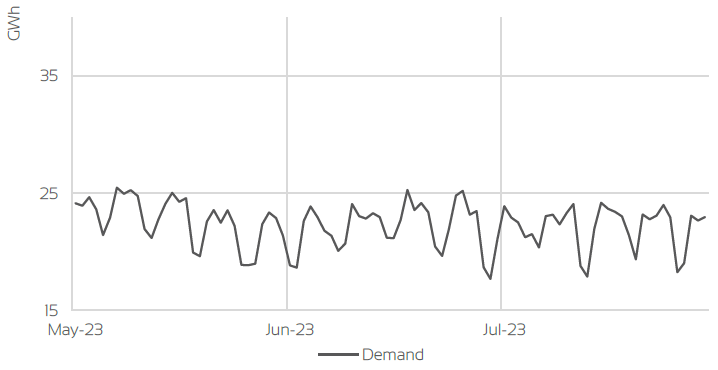

UK Gas Demand - Gigawatt hours (GWh)

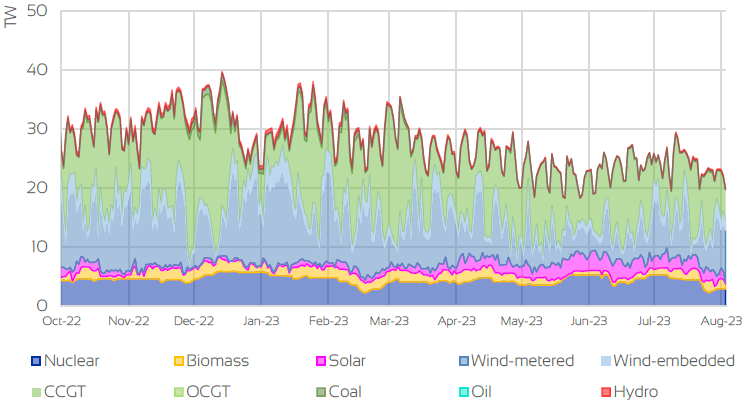

UK GAS SUPPLY MIX

Market Insight: Short-Term

The month of August has seen markets fluctuate due to the uncertainly of industrial action in Australia across 3 LNG facilities. This alongside ongoing maintenance across Norwegian gas plants and increasing storage levels across Europe has meant some volatility has crept back into the market.

Renewable generation has also added support to the volatility, as wind output across the month has been generally poor adding bullishness into markets. Therefore, index’s across the curve have edged higher since the end of July but remains relatively rangebound overall. With the main drivers being somewhat bullish, European gas storage levels has helped cap any further gains.

Targets of hitting 90% fullness by November were already reached by the end of August, and with LNG imports slowly increasing throughout the month, we are currently on track to meet winter demand. Industrial action in Australia has been a key bullish factor this month, as concerns regarding Asia looking elsewhere for LNG cargo could impact imports into the EU & UK. Ongoing negotiations between workers unions and Australian LNG firms continued throughout the month stoking fear into markets of LNG export being lost, as Australia contributes to 10% of the global supply.

As markets throughout the month pushed higher overall, September contracts were up with gas just sitting above the 90p/Therm & power edging under £90/MWh. Day-Ahead index’s remained relatively rangebound compared to July as gas prices were able to remain below the 100p/Therm throughout the month with power also maintaining prices below £100/MWh.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

Front Seasonal gas & power Prices

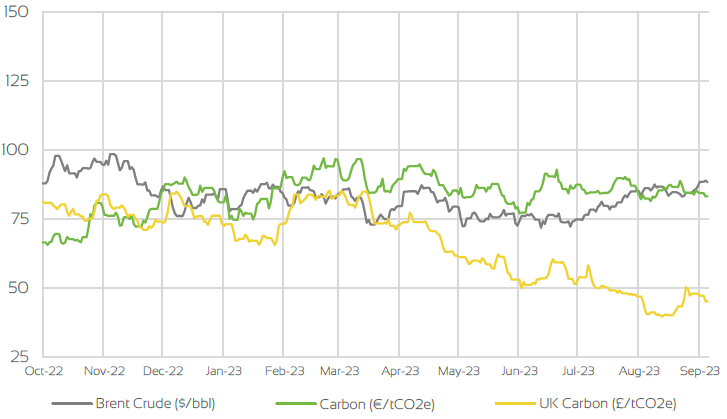

Brent Crude & Carbon Price

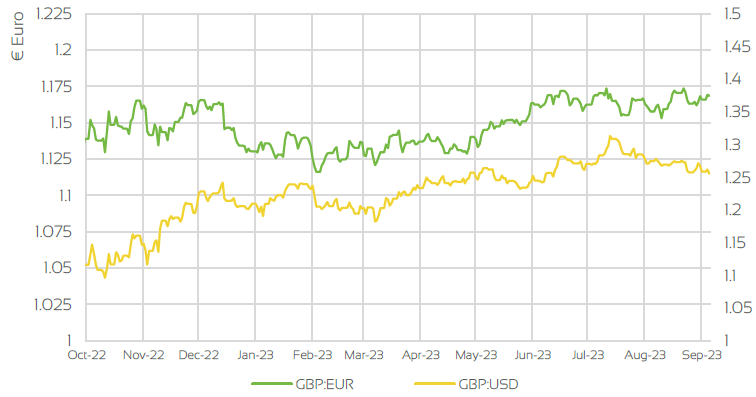

UK, EU & US Currencies

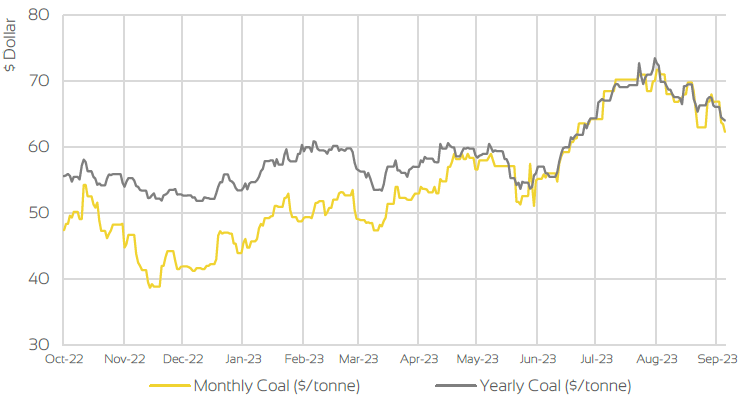

Coal Prices

Market Insight: Long-Term

Front seasonal contracts have overall pushed higher throughout August. Concerns surrounding LNG markets becoming more competitive on the back of potential industrial action in Australia & ongoing heavy maintenance schedules across Norwegian gas plant has added much of the upside risk into markets further out. These drivers are likely to have more of an impact at this time of the year as we are much closer to the winter months. Any downside to LNG imports & unplanned outages will likely add bullishness into markets coupled with the risk of a colder winter than in previous years.

It is still unknown what temperatures are expected in the beginning of October, but early forecasts are suggesting they could be above seasonal norms. Temperatures for September are set to be warmer therefore demand is likely to drop and alleviating some of the pressures of poor renewables we have been experiencing. As we continue without Russian gas, healthy storage levels across the EU & UK continue to push back on concerns of meeting demand for winter. But until we have more reliable forecasts for winter temperatures, front seasonal contracts are not likely to deviate as much unless LNG concerns and Norwegian maintenance were to continue.

Oil markets remain flat and are still hovering around the $85/bbl mark as much has not changed in terms of price. Faltering economies continue to weigh on prices with investors also seeking clarity on the long-term view on interest rates within the leading economies. Fighting back to keep prices elevated are OPEC who have committed to production cuts until the end of September, but there are expectations Russia and Saudi could extend these cuts in an attempt to leave the supply tight.

Market Outlook

Winter is now upon us, and as we move deeper into September, we are likely to have more clarity around temperatures for the beginning of October. As it stands, we could see the warmer weather we are experiencing now continue throughout September, with temperatures staying above seasonal norms heading into October.

With gas storage levels already achieving their targets earlier than expected, there is a case that we could see markets experience some downwards trend especially in the beginning of October, this could be also supported with improving LNG imports coming into the continent. With that said, concerns around LNG could prove to be a stumbling block for any further losses coupled with outgoing maintenance in Norway. This is likely to keep contracts relatively rangebound in the short term at least. If these particular drivers continue to escalate throughout September, there is likely to be more upside risk than downside especially as we are entering the winter months.

With wind generation continuing to be inconsistent, volatility in short term contracts will continue to persist with Day-Ahead prices taking much of the burden. Overall, we anticipate markets to remain relatively rangebound as we head into the winter months, with prompts contracts leading towards the bullish side for the time being.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.