Energy Market Insight | June 2023

Energy Market Trends: JUNE 2023

Prices trade higher throughout June supported by reduced supply

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS ?

Short-Term ENERGY MARKET TRENDS & INDICATORS

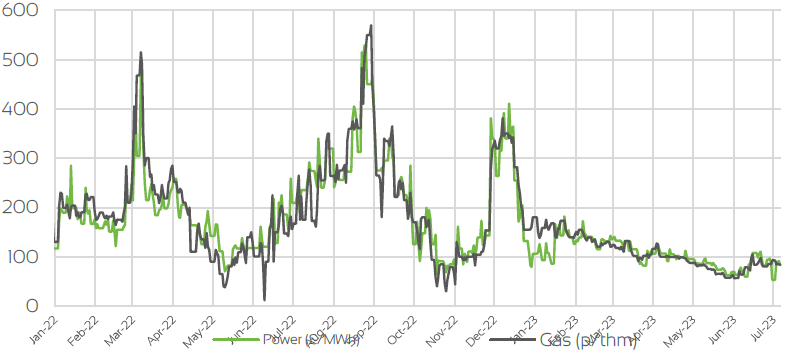

Day Ahead GAS & POWER Prices

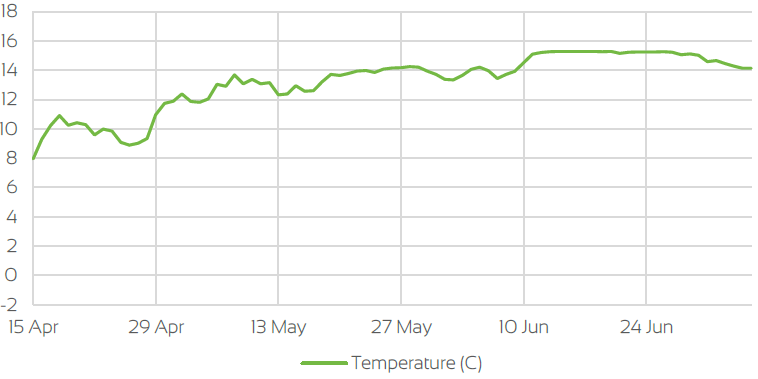

UK Temperature CHANGE

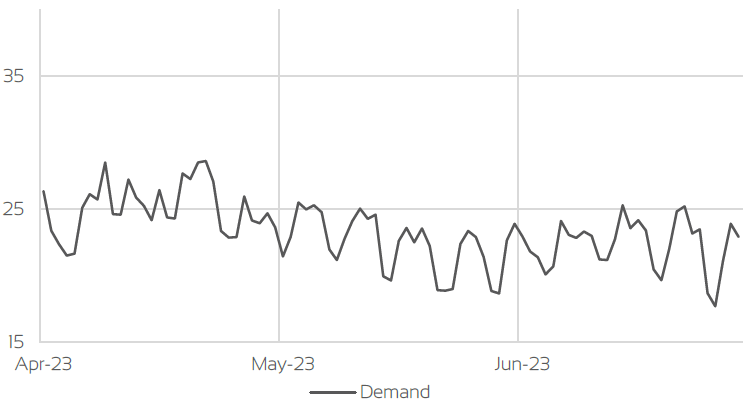

UK Gas Demand - Gigawatt hours (GWh)

UK GAS SUPPLY MIX

Market Insight: Short-Term

Day Ahead and prompt contracts traded higher throughout June, albeit with a significant increase in volatility compared to what we have witnessed in previous months. Prices found support due to the reduced supply into both UK & Europe, which has tightened as the month continued. Flows from Norway continued to be reduced, as scheduled maintenance was carried out.

In addition, it was announced mid-month that the maintenance at the Nyhamna gas plant which is fed by two of the largest gas fields, Aasta Hasteen and Ormen Lange would be extended until 15th July, further tightening supply during this period. Gassco have, however, since announced that they do not expect there to be any additional extensions at this site. As well as shortages from Norway, UKCS production has also been reduced as that too has undergone a period of extensive maintenance, further reducing supply during this period. Further tightening the supply outlook, both UK & Europe have seen a reduction in arrivals of LNG throughout the month, predominantly due to maintenance being carried out at a number of US terminals which, again, has reduced supply.

Throughout the month, short term prices have seen an increase in volatility due to warmer weather which has weighed on demand and helped to offset some of the supply shortages. Additionally, there has also been fluctuating renewable generation, which, when strong has also helped to offset supply shortages and weighed on prices, however, when it has been weak has only exacerbated the tightened supply-demand outlook. As well as the reduced supply, the market continues to be nervous over an escalation of the conflict between Russia & Ukraine and prices twice found support during the month as fears increased, albeit both times, support was short lived, and prices quickly retraced any gains that were made.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

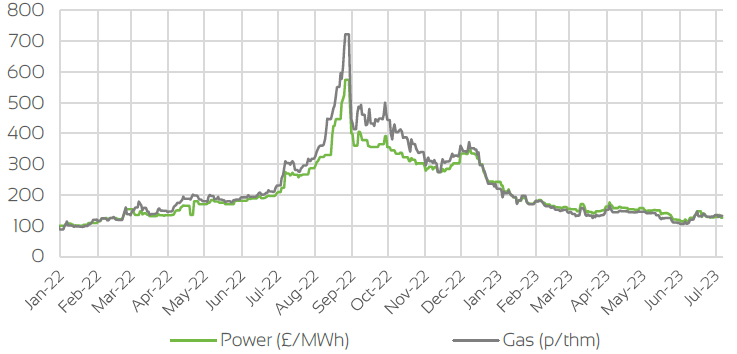

Front Seasonal gas & power Prices

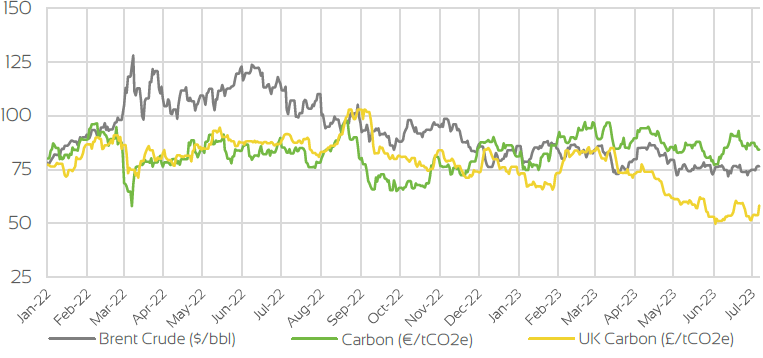

Brent Crude & Carbon Price

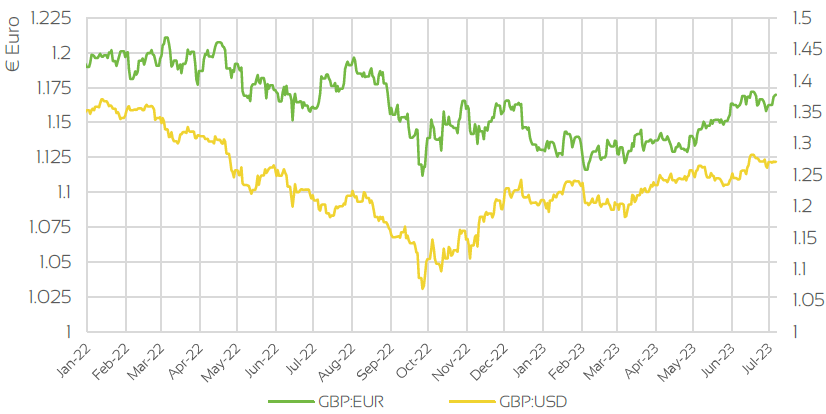

UK, EU & US Currencies

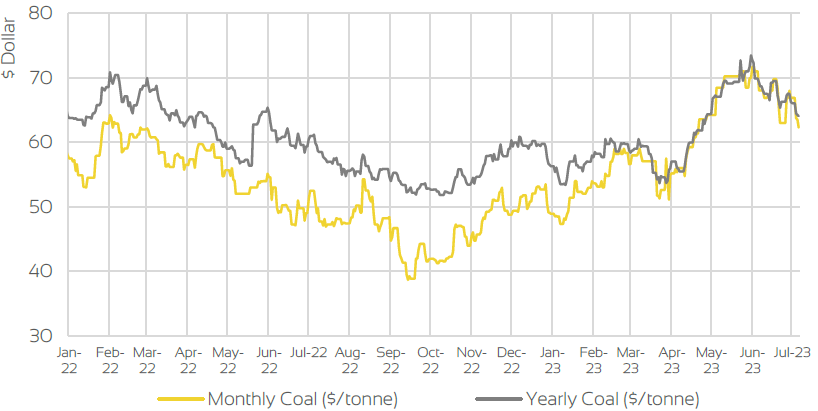

Coal Prices

Market Insight: Long-Term

Similar to the prompt contracts, Seasonal contracts also traded higher throughout the month as they too found support from the reduced supply into UK & Europe. Given the performance of the market over the previous 18 months, it continues to be nervous that supply shortages will extend into the Winter period, which, coupled with the potential for extremely cold & dry weather, both increasing demand and curbing renewable generation, could well see demand outstrip supply during this period.

This is despite European gas storage levels being extremely healthy, as they are currently sat at ~78% full and are expected to be fully replenished prior to the start of October. Supply into Europe via both Norwegian flows and LNG arrivals are also expected to increase from the end of the start of next month which should further alleviate some of the pressure. As with the prompt contracts, the market continues to be nervous around the escalation of Russian conflict with Ukraine, particularly given the two events which occurred in June, following a period where the market was largely unaffected by it.

Firstly, close Putin ally, Dmitry Medvedev said that Russia would be "well within its rights to retaliate" if it was found that any of its enemies had caused the dame to the Nord Stream pipelines, last year. Secondly, the attempted coup by the Wagner group, albeit short lived, also provided support, with market concerned about any retaliatory response from Russia.

Market Outlook

Prices are expected to remain rangebound for the foreseeable future, with the supply shortages expected to continue well into July. Warmer weather, which is expected to continue throughout the month and continue to curb gas demand, although this could cause an increase in demand for cooling across Europe.

Renewable generation is expected to continue to help offset any supply shortages, however the fluctuating nature of its output lends support to further price volatility during this period. Longer term should supply return as expected towards the back of July and into August and should gas storage levels continue to be replenished at its current rate, we could see some downside for contracts in the near term, ahead of the start of Winter as supply-demand concerns ease.

An increase in Asian demand has yet to materialise, and whilst the recovery in Chinese growth is slower than expected, this will continue to play a key part in European gas & power prices, due to UK & Europe's reliance on the LNG spot market, which is where Asia will turn to, to meet any additional demand. Beyond Q3, upside risk remains for the Winter contract, although should the fundamental outlook continue to look healthy, we may see the market mirror last Winter, which saw prices continue to fall throughout early Q4.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.