Energy Market Insight | March 2024

Energy Market Trends: MARCH 2024

March sees gas and power markets rebound

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

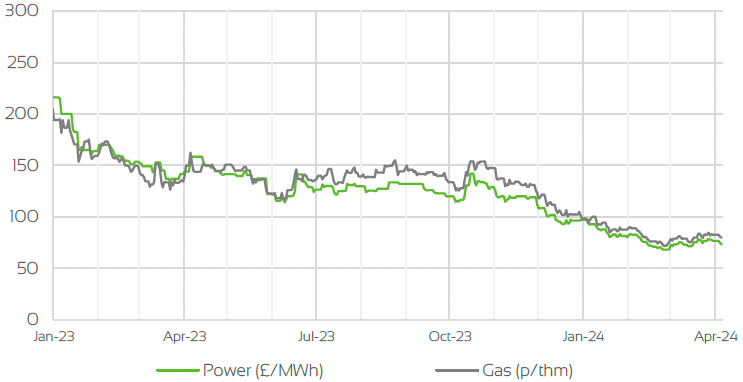

Day Ahead GAS & POWER Prices

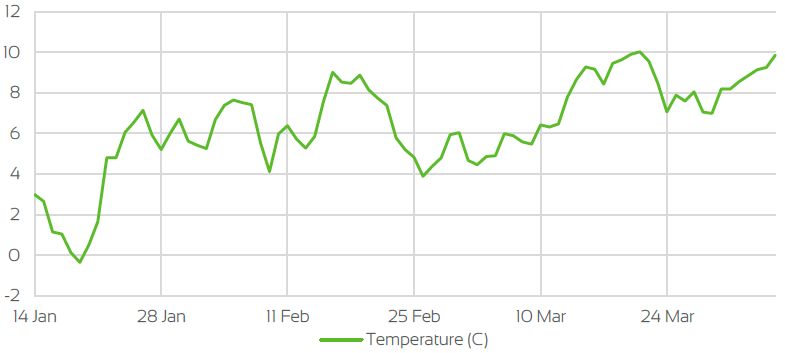

UK Temperature CHANGE

Market Insight: Short-Term

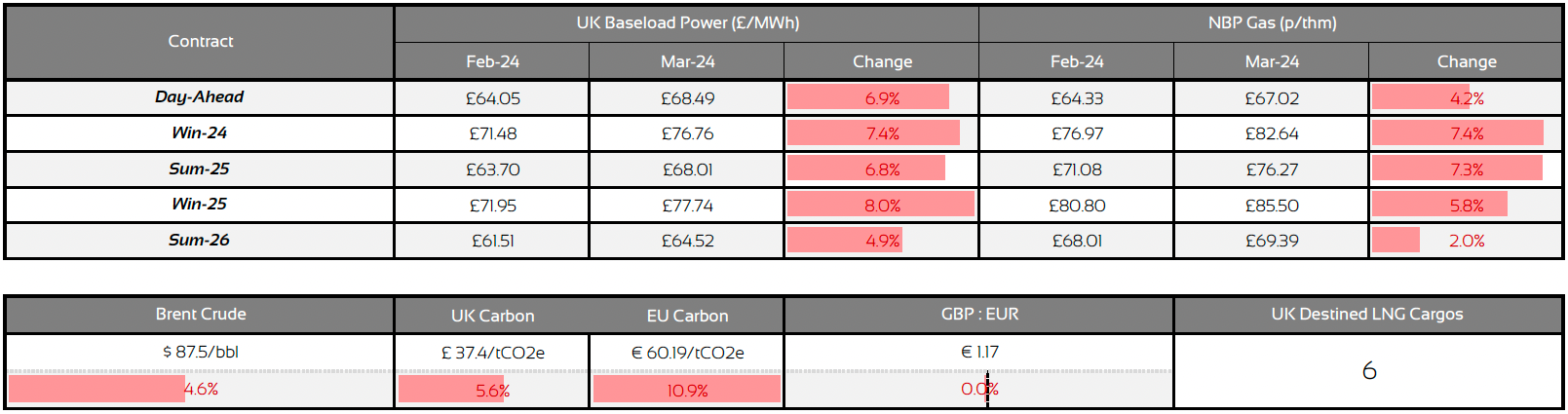

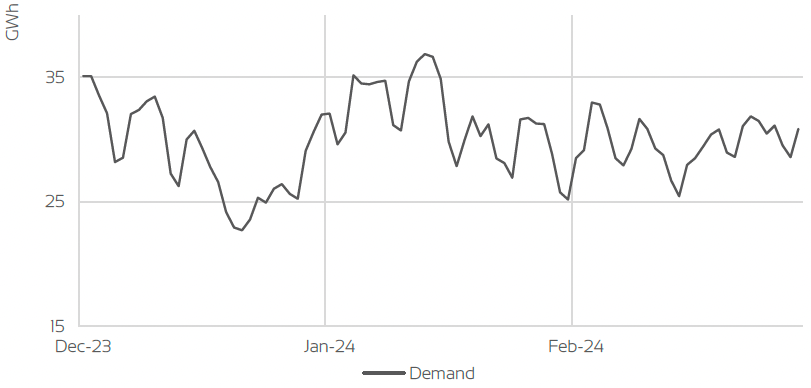

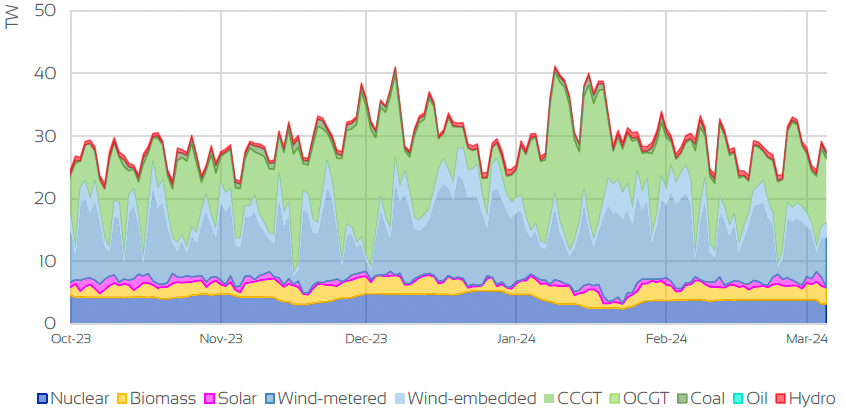

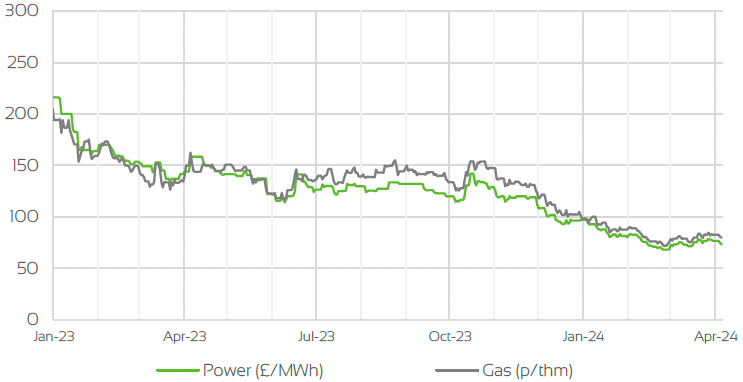

March compared to February was a mixed month in regards to price trends as a lot of the downside reversed after contracts came close to 3 year lows. Despite the supply picture remaining strong throughout March with key fundamentals largely unchanged, index’s across both prompt and seasonal curves rose throughout March which left prices up by the end of the winter period. With that said, the supply picture overall still remains comfortable with gas inventories in Northwest Europe close to the 60% mark and were still above the anticipated level of 56%.

As prices closed in on 3-year lows, the market typically plateaued as profit taking and higher demand in regards to seasonal hedging would have supported some of the upside in March. Norwegian outages which were a mix of planned and unplanned occurrences also added bullish sentiment back into markets with several facilities experiencing maintenance which curbed nominations to both the UK and the Continent.

Wider geopolitical risks were still prominent in March with both wars in Ukraine and the Middle East showing no signs of ending. A call of a ceasefire in the Middle East has been rumoured but there has been no concrete evidence of this materialising despite efforts from the U.S. As the war in Ukraine continues, Russian energy facilities have been a focus which typically caused concerns especially within oil markets, as fears of supply disruptions rose.

Though as March was a month of temperatures above seasonal norms, with forecasts of milder conditions at the beginning of April, coupled with comfortable gas supplies from Norway and LNG exports, a lot on the upside would have been limited. Therefore, leaving prompt contracts just below the 70p/Therm mark for gas, and power prices hovering around the £60/MWh mark.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

Front Seasonal gas & power Prices

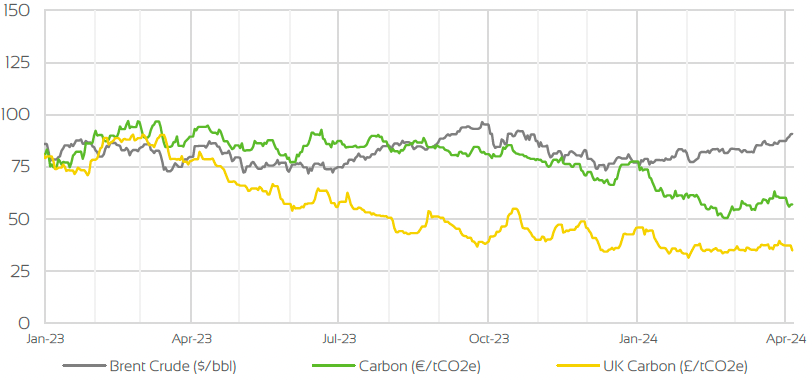

Brent Crude & Carbon Price

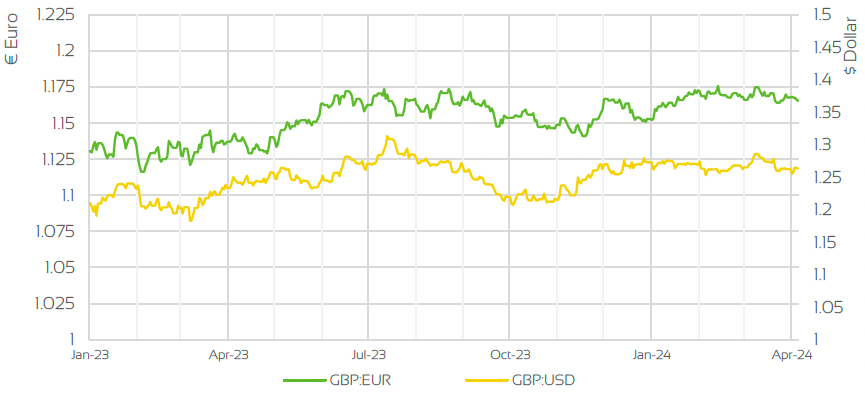

UK, EU & US Currencies

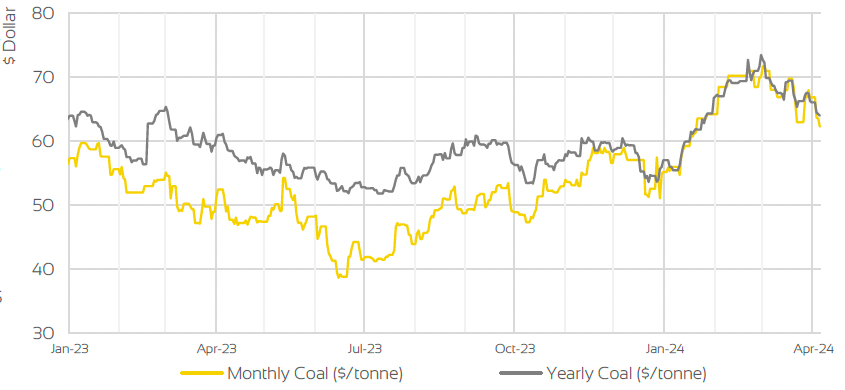

Coal Prices

Market Insight: Long-Term

The longer-term outlook based on a mixed turn of events in March remained relatively unchanged, with it still being relatively bearish but with some key wider drivers potentially becoming more impactful. Front seasonal contracts for gas and power faired in similar fashion to prompt prices as Summer-24 & Winter-24 ended the month higher. As the summer months is a time of replenishment for gas inventories, storage levels were above the forecasted mark of around 56% and the outlook for the Winter-24 period is very comfortable.

With that said, Ukrainian military action towards Russian Energy facilities will still pose a threat to supply disruptions, with oil markets bunting the majority of the bullish sentiment. Oil has therefore risen overall and ended the month around the $85 mark, but gains would have been limited, due to delays around interest rate cuts in the U.S and the ongoing weak economic data from China, who are the world’s 2nd largest oil consumer.

Gas and power markets will also be wary of the fact that tensions in the Middle East are not easing, and with delays on LNG cargo already priced into seasonal contracts but imports remaining robust, focus has turned to gas production in the U.S. Traders will be wary of gas production in the U.S being cut due to their stocks being high and wanting prices to rise, which in turn could impact LNG exports from across the Atlantic.

The Freeport facility is also going through maintenance works which is reported to finish at the end of May. Summer and Winter 24 contracts for both gas and power were up by the end of March but are likely to have settled at a level which seems comfortable considering the current key market drivers.

Market Outlook

As we now come out of the winter months, typically demand will gradually reduce due to the warmer weather conditions and prices in theory should fall. With gas inventories sitting comfortably for this time of the year, coupled with mild temperatures for the start of April, the outlook in the short-term will remain relatively bearish with some further scope of downside as we move deeper into the summer months. With that said, the biggest risks the market faces at the moment, are the ongoing wars in Ukraine and the Middle East which in theory pose potential supply disruptions to both oil and gas supplies.

Despite LNG remaining relatively conformable overall, the longer the war continues in Israel, fears of the war spreading throughout the Middle East will still linger and combined with gas production cuts in the U.S, this could add premiums into both prompt and seasonal contracts in the future. On the wider commodity complex, the focus from Ukraine on the Russian Energy infrastructure could see oil prices push above the $90 mark as the war escalates with no sign of a ceasefire.

Overall, with LNG imports comfortable, Norwegian gas flows remaining stable and demand being curbed due to milder temperature forecasts, the outlook will side towards being bearish for the time being with losses being limited due to the wider geopolitical risks the world faces at the moment.

Related News

EXPLORE OUR OTHER ENERGY MARKET INSIGHTS

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.