Energy Market Insight | May 2023

Energy Market Trends: May 2023

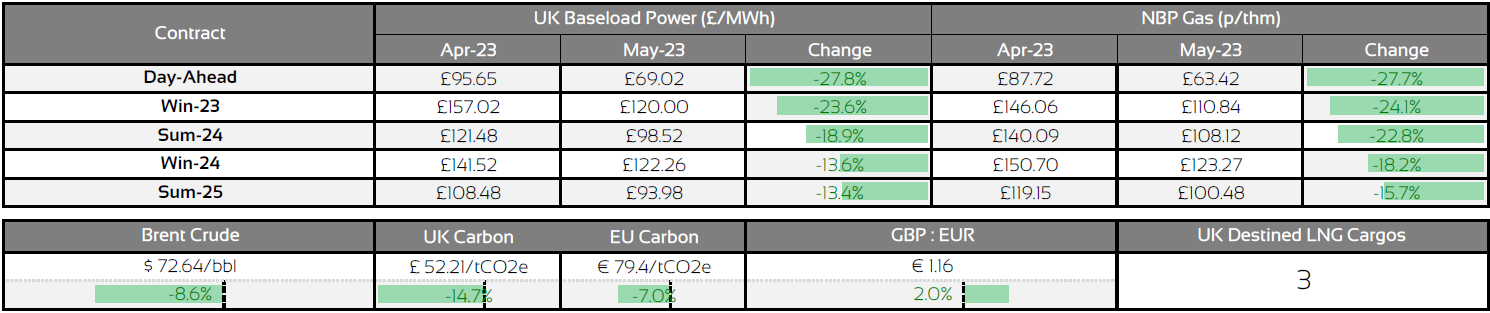

Both Gas & Power contracts sustainED heavy losses throughout May

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS ?

Short-Term ENERGY MARKET TRENDS & INDICATORS

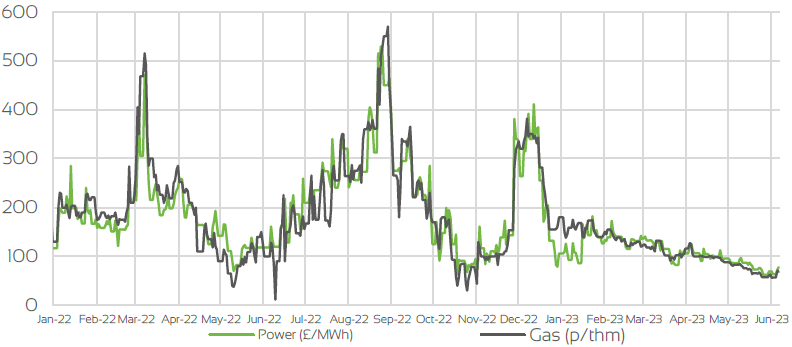

Day Ahead GAS & POWER Prices

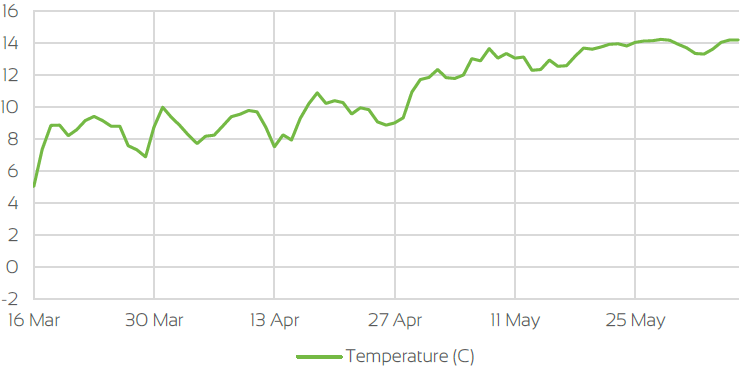

UK Temperature CHANGE

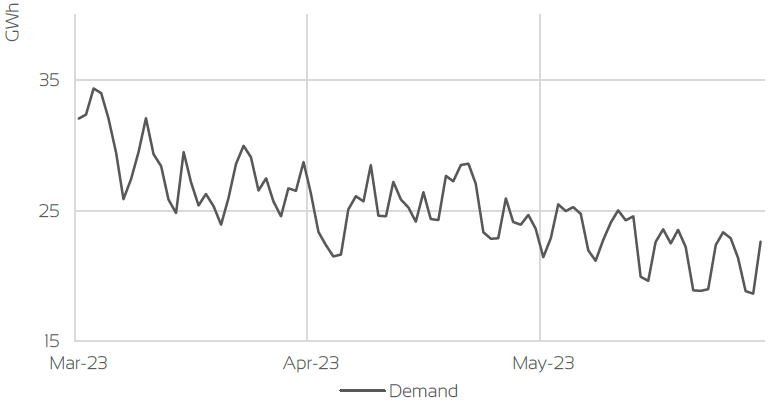

UK Gas Demand - Gigawatt hours (GWh)

UK GAS SUPPLY MIX

Market Insight: Short-Term

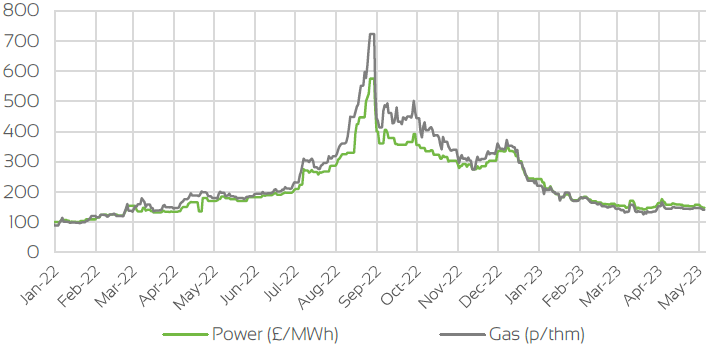

Day Ahead and Prompt contracts continued to trend lower throughout May, with the continued strong fundamental outlook continuing to weigh on prices. Arrivals of LNG into UK & Europe continued to be healthy, with global supply remaining strong coupled with weak Asian demand. This is despite the spot Asian LNG price falling to a 2 year low towards the end of May. Weak Asian demand for spot LNG, in addition to allowing a strong LNG supply into Europe has also allowed for strong injections into storage into the region.

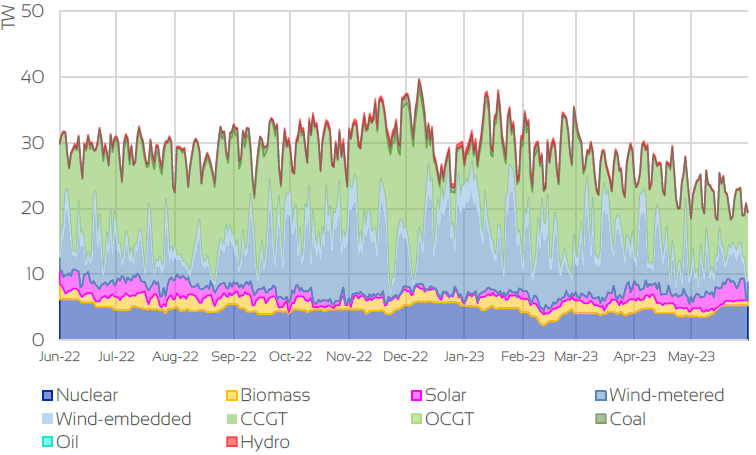

Injections into European storage facilities were also strong throughout the month, ending the month just below 70% full. This has helped to alleviate some of the pressure caused by a heavy period of scheduled maintenance across Europe, particularly Norway, which saw Norwegian gas flows heavily reduced. In addition, maintenance has also been carried out on the UKCS, reducing output, as well as across the French Nuclear fleet, which also saw a reduced output throughout the month. As well as the strong arrivals of LNG into the region, which have helped to offset the tightened supply due to maintenance, both LDZ and gas for power demand has also been heavily reduced throughout the month.

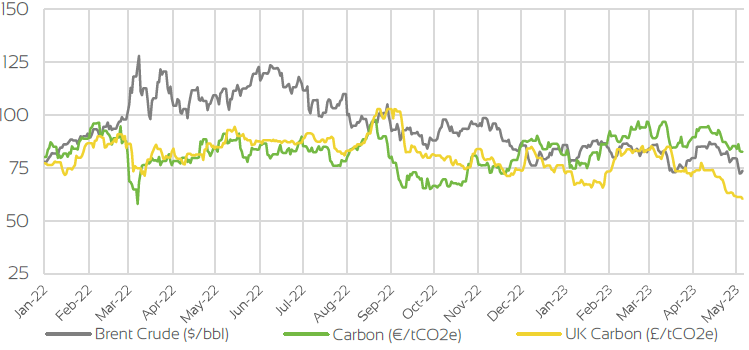

This is largely due to favourable weather conditions, which have seen temperatures remain above seasonal norms, reducing LDZ demand, however, they have not been too warm whereby there has been an uptick in demand for cooling. This has been coupled with strong renewable generation, lessening gas for power demand. Similar to gas & power contracts, Brent Crude has also trended lower throughout May. This was largely due to economic concerns, in particular the delay in the US agreeing a new deal to raise their debt ceiling which had caused concern that financial markets could collapse and in turn lead to a global recession, which would cause a downturn in demand.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

Front Seasonal gas & power Prices

Brent Crude & Carbon Price

UK, EU & US Currencies

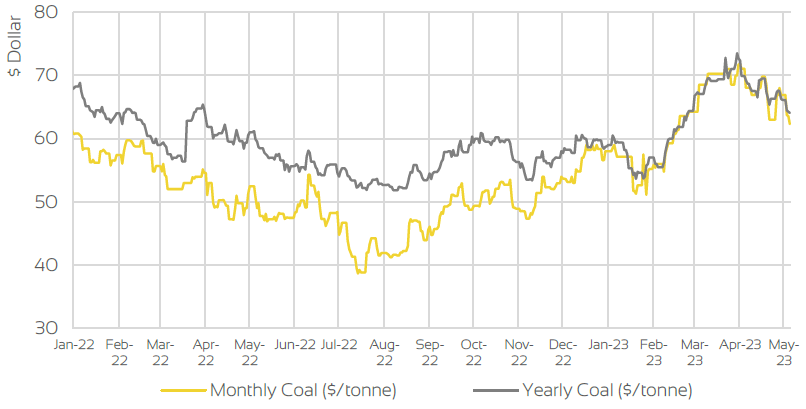

Coal Prices

Market Insight: Long-Term

Seasonal contracts have taken direction from the prompt contracts throughout the month and have also trended lower, ending the month

significantly lower than where they were at the start of the month. Similar to the prompt contracts, the strong fundamental supply outlook has helped to weigh on these contracts. LNG arrivals are forecasted to continue to be healthy throughout the summer period, which in turn is expected to allow European gas stocks to be fully replenished.

The weakened demand in both Europe & Asia has also removed some of the risk sentiment around supply shortages for the Winter contract and has helped to weigh on prices. Current weather outlook has also helped to weigh on seasonal contracts, as temperatures over the upcoming 6 weeks are expected to remain above seasonal norms, reducing gas demand, whilst also increasing renewable generation. At the same time, there is not currently expected to be a significant uptick in demand for cooling, allowing injections into storage to continue.

Although longer term risk still remains, this is largely around weather, especially if we see the arrival of an El Niño weather front, which is currently has a 75% chance of occurring this Winter into next Summer according to the Australian Bureau of Meteorology. If this does occur, we can expect to see a colder, drier Winter for the UK & Europe as well as a drier, hotter Summer in 2024. Additionally, we may see an increase in demand in the Southern hemisphere as they experience hot, dry weather throughout summer.

Market Outlook

We may start to see some upside throughout June, particularly for prompt contracts as the maintenance schedule across Europe increases and also includes the complete shutdown of LNG terminals. Should this occur, we may start to see this filter into the seasonal contracts, particularly if there are any unexpected issues which may cause an extension to the planned maintenance, especially in either France or Norway.

The majority of the maintenance that is scheduled is expected to be completed before the end of June. Should these facilities come back online, as expected and temperatures outturn as they are currently forecast, which is expected to continue to weigh on demand across Europe then it is entirely feasible that we will see further downside towards the end of the month, heading into Q3. However, due to the changing nature of the supply mix and Europe's current reliance on LNG, a close eye will need to be kept on Asian demand, particularly as we approach the end of rainy season when typically, temperatures start to increase.

If we do start to see an increase in Asian demand, this may provide support to spot LNG prices, which in turn would be expected to provide support to both gas & power contracts.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.