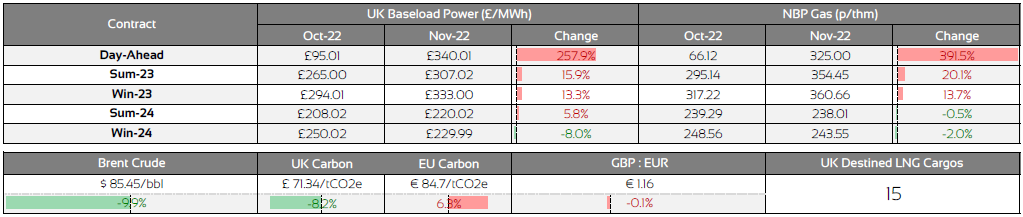

Energy Market Insight | November 2022

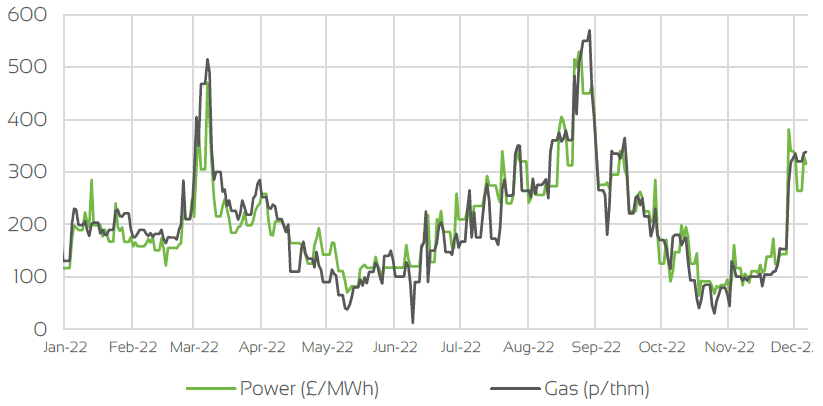

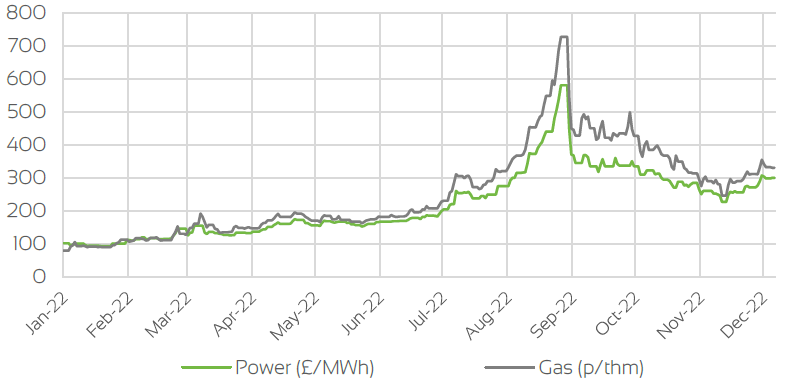

Day Ahead Prices

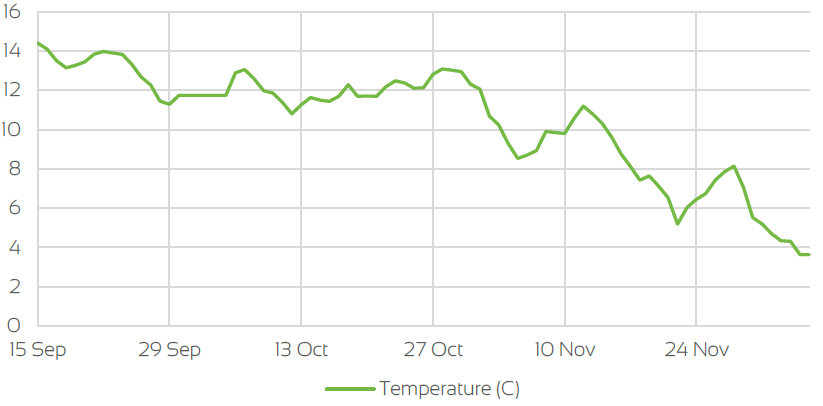

UK Temperatures

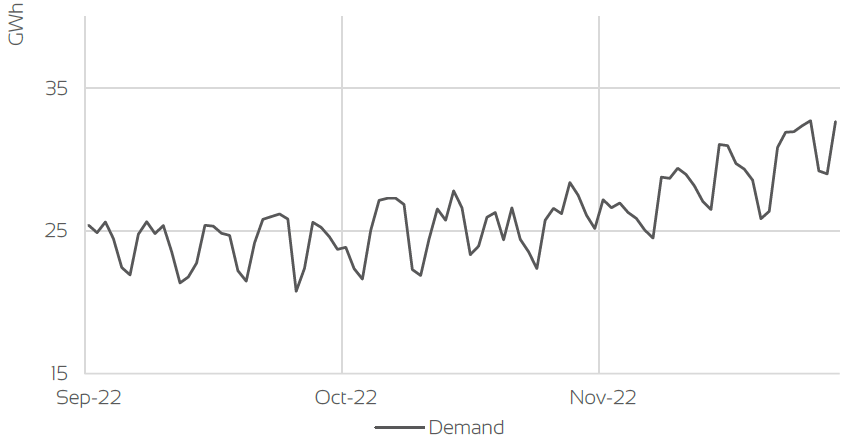

UK Demand

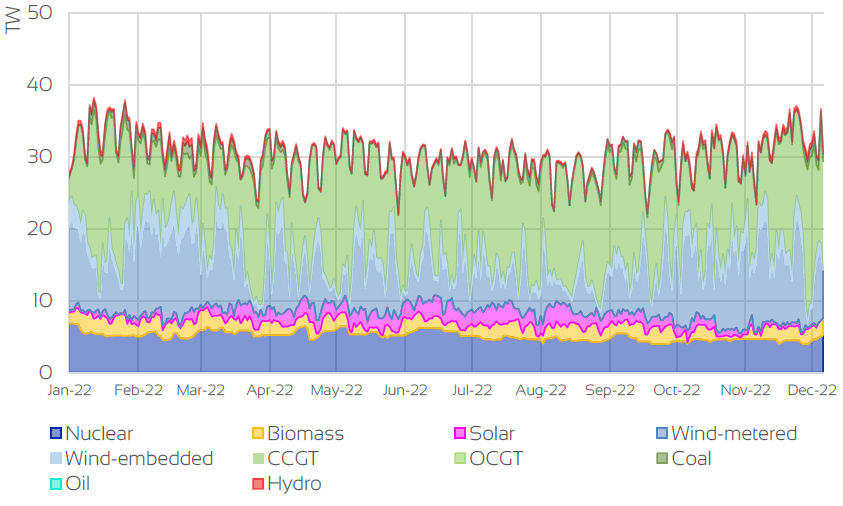

UK Supply Mix

Market Insight: Short-Term

Both Gas & Power Day Ahead & Prompt contracts found support towards the end of November, largely driven by cooler temperatures and an increase in both LDZ and gas for power demand. The cooler weather coincided with low wind speeds and reduced nuclear output as three reactors were also offline during this period for maintenance.

For the majority of the month, these contracts traded in a general sideways channel with the risk of cooler weather and the intermittent unplanned maintenance at Norwegian gas fields, which reduced output, offset by the continued strong fundamental outlook of healthy LNG arrivals and send out as well as strong storage levels, and a natural reduction in demand due to milder weather and a conscious effort by users to reduce costs. Support for prices was also tempered by the IUK interconnector going offline for maintenance for a two week period, which prevented exports to the continent via this pipeline during this period.

Risk still remains around the security of energy infrastructure in Europe following the attacks on NS1 & 2 pipelines and a targeted attack on Ukrainian infrastructure by the Russian military. The increased Russian attacks also increased fears of damage being caused to the Velke Kapusany pipeline, which runs through Ukraine and is the only one of the three main pipelines transporting gas from Russia to Europe still in operation.

These concerns were exacerbated when Gazprom threatened to reduce flows into Ukraine as it accused Ukraine of holding on to gas that was meant for Moldova, however, an accord was reached and gas flows into Ukraine have remained steady, albeit heavily reduced from peak capacity.

Front Seasonal Prices

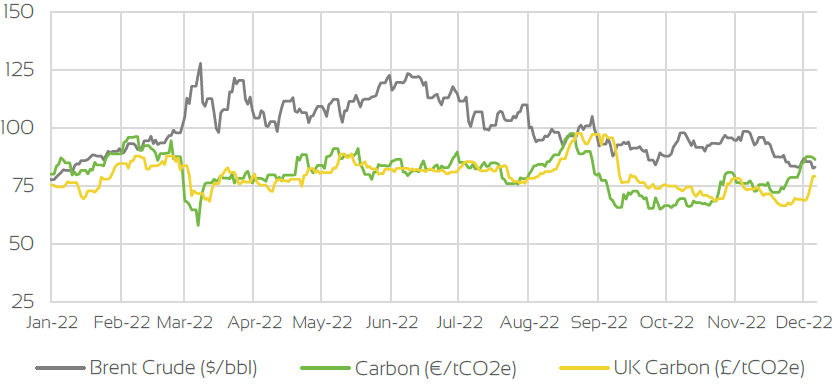

Brent Crude & Carbon Price

UK, EU & US Currencies

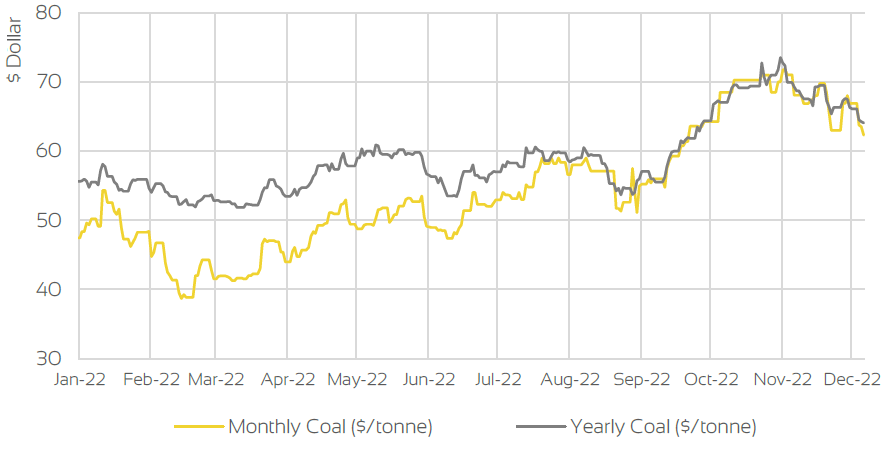

Coal Prices

Market Insight: Long-Term

Seasonal contracts followed a similar pattern to the prompt contracts throughout November, largely trading in a sideways channel throughout the majority of the month, however finding support and taking direction from the prompt contracts as they increased. Fundamental outlook for Summer '23 & Winter '23 remains relatively healthy with strong LNG supplies and both Freeport & Malaysia LNG facilities due to come back online before the Summer season commences in addition to strong storage levels which currently sit ~93% full. Upside risk still remains, largely around cooler weather and a potential increase in demand to seasonal norm levels.

The market may also find support from increased Chinese demand, following the Chinese Government's announcement that COVID restrictions will be eased in both Shanghai & Guangzhou, relaxing the current "Zero-COVID" policy in place which has caused Chinese production to decline rapidly. Europe's effort to replace Russian gas continues to gather pace, as Germany confirm that they have agreed a long term deal with Qatar for a guaranteed 2 million tonnes per annum of LNG.

French nuclear output also started to steadily increase towards the end of November, increasing output from a record low of 34%, to currently operating around 40% of capacity. EDF are hopeful that output will continue to increase throughout December & January, reducing France's reliance on imports and other sources of Power generation, further alleviating pressure on European supply.

Market Outlook

We are now into the peak Winter period of December & January and although upside risk still remains, the overall fundamental outlook continues to be bearish. We may see some support for Day Ahead and prompt contracts in the early part of December as temperatures are forecasted to drop significantly below seasonal norms, with demand subsequently expected to increase.

However, with the current forecast expecting temperatures to increase in line with seasonal norms and then for them to increase as we enter January, provided this forecast remains the same and the strong fundamental outlook also remains in place then we would expect any support to be tempered and increases to be relatively short lived.

In addition to the strong fundamental factors currently in place, Freeport LNG facility is expected to be back online at 80% of capacity in mid-December, further adding to the healthy global supply outlook of LNG. In addition to this, there is also expected to be increased output from Norwegian gas fields following prolonged periods of maintenance over the past 2 months, all nuclear reactors in the UK that have been offline are expected to return along with an uptick in wind generation following a 10-14 day period where generation was negligible and gas for power demand substantially increased.

All of these factors are expected to offset any expected increase in Chinese demand. Should these conditions remain in place at the start of Q1, we could see a large retracement of the Seasonal contracts, particularly Summer '23 as risk is reduced closer to delivery.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.