Energy Market Insight | October 2022

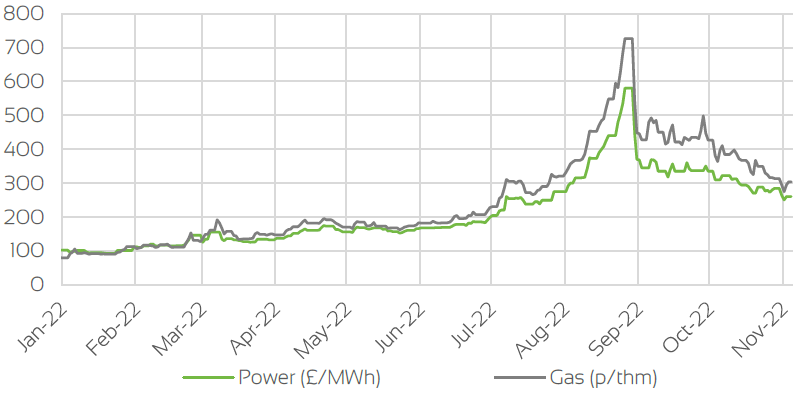

Day Ahead Prices

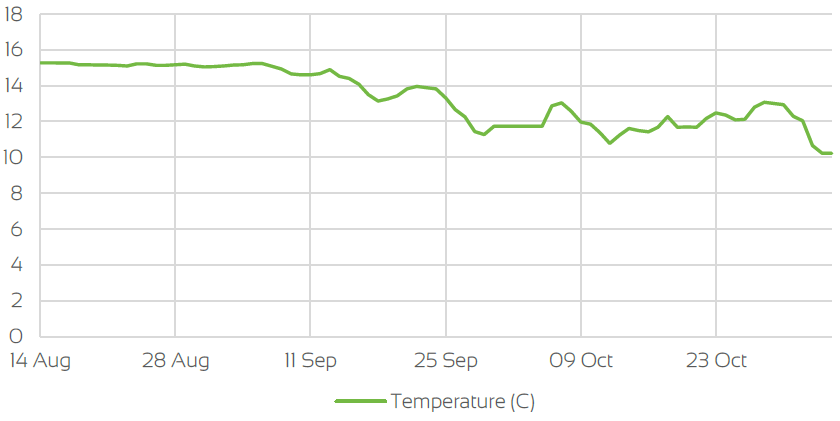

UK Temperatures

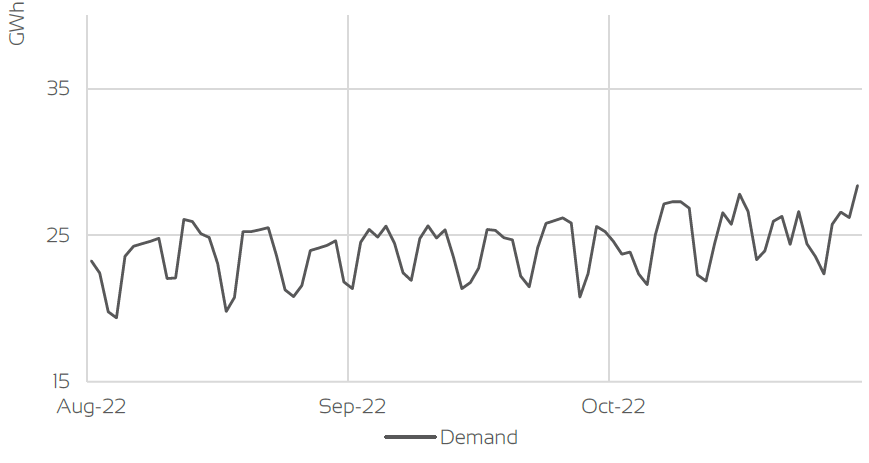

UK Demand

UK Supply Mix

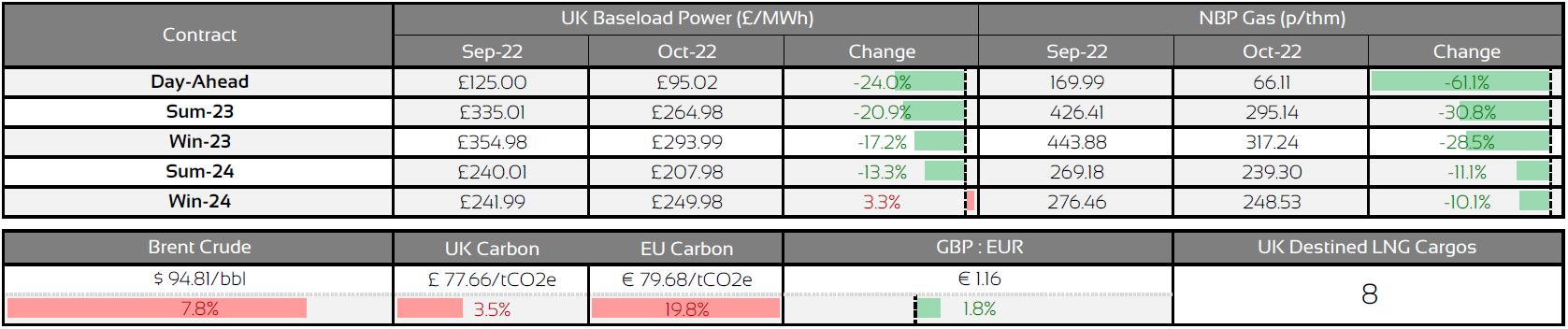

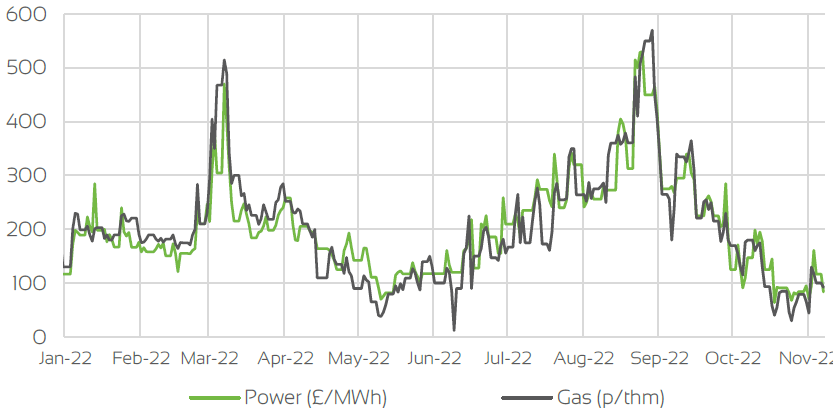

Market Insight: Short-Term

Both Day Ahead & prompt contracts retraced sharply throughout October, as a strong fundamental outlook was the predominant driver on prices. Following maintenance, Norwegian gas output increased, in addition to this, LNG arrivals into both the UK & Europe remained extremely healthy with cargoes queueing up to dock in both areas. This in turn has caused send-out from LNG terminals to be ramped up to allow space for these new cargoes to dock. LNG supply is expected to remain healthy in the coming months, with Freeport LNG facility in USA still expected to be back online this month at ~80% of capacity.

There has also been minimal impact of the Malaysian LNG facility being offline, as orders to Japan have been replaced by cargoes from Papua New Guinea & Australia. In addition to these factors, ongoing Covid-19 restrictions in China have reduced Chinese demand, with Chinese production slowing considerably in October, which has subsequently dampened their demand for LNG.

These strict restrictions are not expected to be relaxed until April, further alleviating global demand throughout the Winter period. With the abundant supply, this also allowed strong injections into storage to continue, in turn easing some of the risk around the Winter months, weighing on prompt contracts, as European storage levels currently sit ~96% full. Injections into the UK's Rough storage remained steady, and if conditions continue to be favourable in Q4, this could also weigh on prices in Q1 2023, particularly as injections for this Winter are capped at 30% of its total capacity.

In addition to the strong supply fundamentals, the warmer weather and higher prices have also caused a natural reduction in demand. This was evidenced in the UK's October demand, which was the lowest it had been for 12 years. Whilst risks remained in the market, largely around the security of European energy infrastructure following the attacks on Nord Stream 1 & 2, these fears were considerably outweighed by the strong fundamental drivers.

Front Seasonal Prices

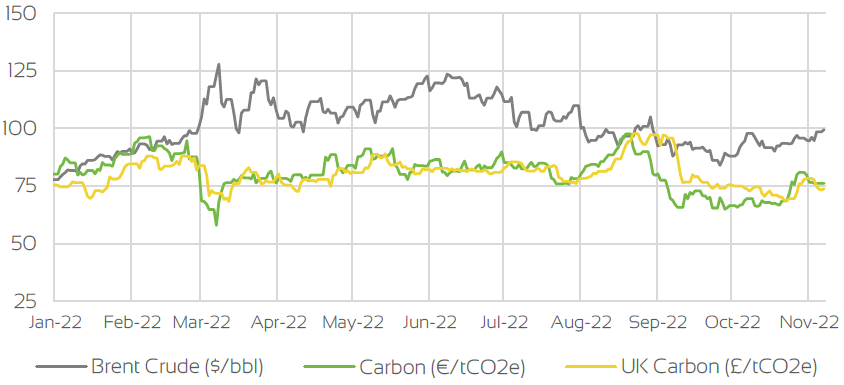

Brent Crude & Carbon Price

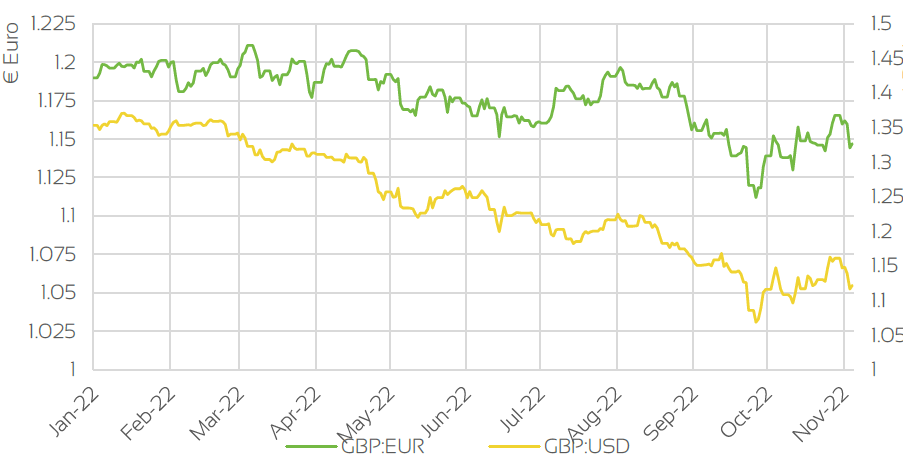

UK, EU & US Currencies

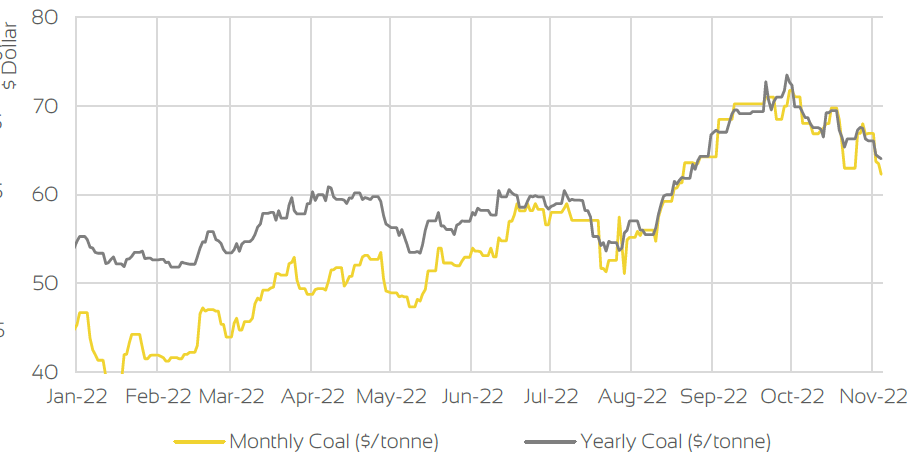

Coal Prices

Market Insight: Long-Term

Seasonal contracts followed a similar pattern to the prompt contracts throughout October and although losses were not as pronounced as the day ahead and prompt contracts, these were still substantial, with the largest losses seen on the Summer '23 contracts. Similar to prompt, these losses were driven by a strong fundamental outlook for the Winter period, which has eased some of the concern in the Seasonal contracts. The strong LNG arrivals and warmer than seasonal weather and subsequent demand reduction has allowed injections into storage to remain healthy, easing fears that storage levels will be extremely low coming out of the Winter period, and that strong injections into storage will be required throughout the Summer, further easing demand.

The impact for Winter '23 onwards is similar, as increases the likelihood of European storage hitting its target of 90% full by 1st November 2023. The same can also be said for Rough, albeit as injections for Winter '23 are limited to 60% of capacity, this impact this may have on demand is reduced. Although risk to Summer has been reduced, particularly as LNG arrivals are expected to remain strong throughout Winter period, risk does remain, which is why there is still a level of support for prices.

Concern still remains over weather, as if a colder than normal period of weather arrives, this is expected to increase demand, potentially tightening the supply-demand outlook and may add upward pressure to Seasonal contracts.

Market Outlook

We are now into the Winter period, and although risks still remain, the strong fundamental drivers have started to weigh on prices all across the curve. The strong fundamentals are expected to remain in place for the foreseeable future which is expected to weigh on prices and cause a general downtrend. We still expect to see some correction in the market which will be largely driven by periods of cooler weather, as we have seen at the start of November, however, any increases are expected to be both tempered and short lived as they are outweighed by the strong fundamental outlook. There is also expectation that any increases in demand will be curbed, with both residential & commercial users looking to reduce consumption throughout the Winter in an attempt to reduce costs based on the increased commodity costs. The expected restart of Freeport LNG terminal towards the end of this month and the continued Covid-19 restrictions in China is also expected to ensure that LNG supply to both UK & Europe continues to remain healthy.

Longer term risks do remain; if there is a sustained period of cooler weather which increases demand sufficiently to cause heavy withdrawals from storage. There also remains concerns over the security of the energy infrastructure in Europe following the attacks on NS 1 & 2, as it seen as a relatively soft target. However, provided strong fundamentals remain, this is expected to continue to weigh on prices, both short term and long aterm.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.