Energy Market Insight | October 2023

Energy Market Trends: october 2023

geopolitical risks add volatility into markets

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

Day Ahead GAS & POWER Prices

UK Temperature CHANGE

UK Gas Demand - Gigawatt hours (GWh)

UK GAS SUPPLY MIX

Market Insight: Short-Term

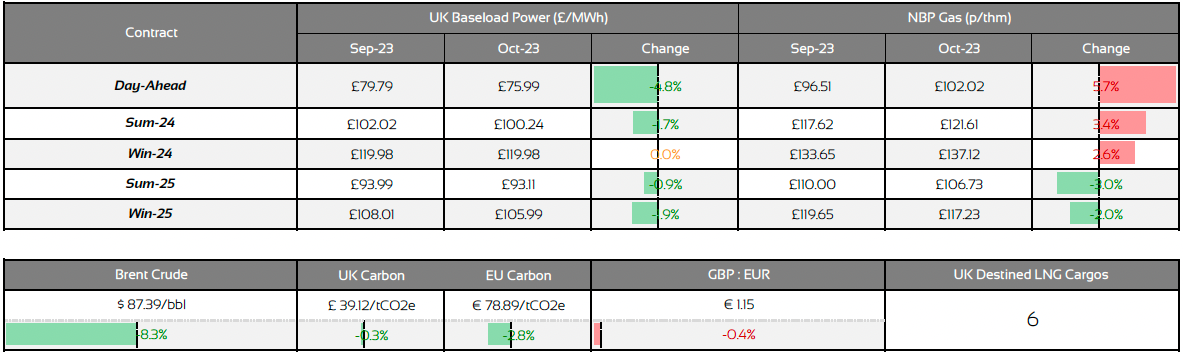

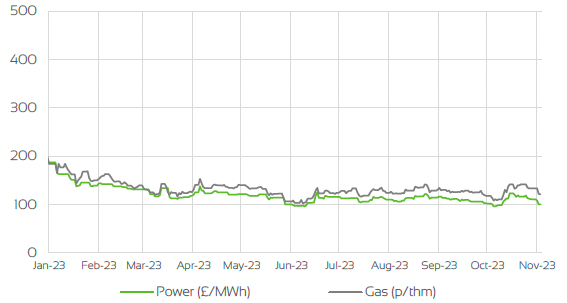

October was a month full of unpredictability’s, with markets experiencing higher levels of volatility due to wider global concerns. The month of October has left prices in somewhat of a bearish trend now we have entered into November. Power contracts on the near curve and front seasonal saw some index’s hitting double figures with November -23 dipping below the £100/MWh and Summer-24 also just sitting above that mark.

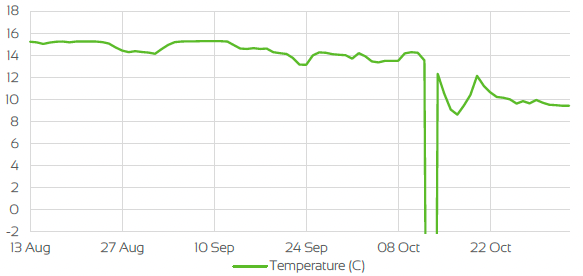

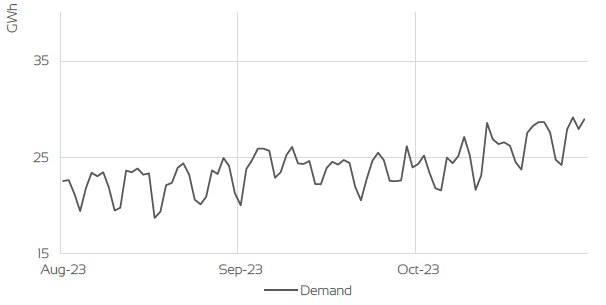

October started in bearish fashion with a mild start to the month as temperatures sat above seasonal norms curbing demand for this time of the year. LNG woes coming out of Australia looked to have been resolved with the LNG firm Chevron, but unions had accused them of going back on their promises which led to some bullishness creeping back into prices despite a healthy supply picture.

Notice of a strike was given to Chevron which would mean they could commence within a 7-day period, but a resolution was agreed shortly after which ended any concerns. It was shortly after this, news broke out that Hamas had led an attack in Israel which caused markets to jump, adding a lot of the volatility to contracts. The main concerns were fears of the conflict escalating and spreading further into the Middle East where exports of LNG and oil could be disrupted.

Contracts had rallied as focus weighed on these concerns, but due to an extremely healthy supply picture, any further gains were limited. Storage levels across Northwest Europe hit record levels for this time of the year as LNG imports and Norwegian flows remained robust for the majority of the month. European storage levels ended in October nearly at capacity at 99% fullness.

As concerns of the conflict escalating further into the Middle East started to fade, the healthy supply picture meant prices started to see losses which were also supported by milder temperature expectations for the latter part of November and the beginning of December. Norwegian flows also added bearish sentiment into markets as the majority of maintenance works were completed with flows gradually increasing throughout the month.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

Front Seasonal gas & power Prices

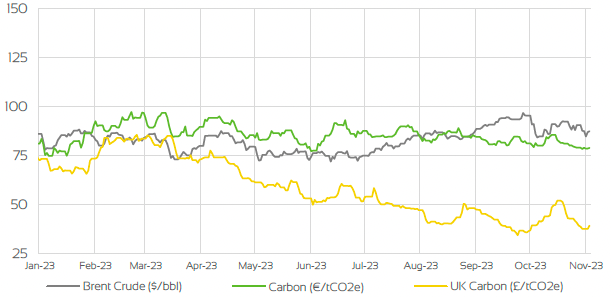

Brent Crude & Carbon Price

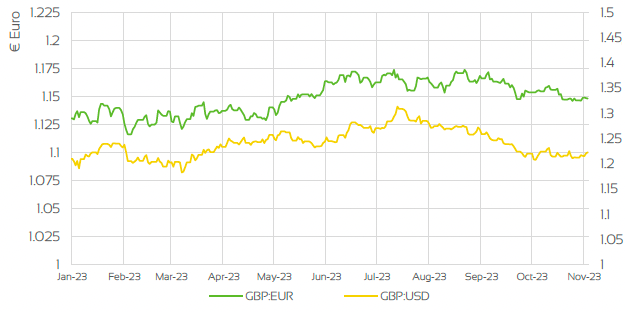

UK, EU & US Currencies

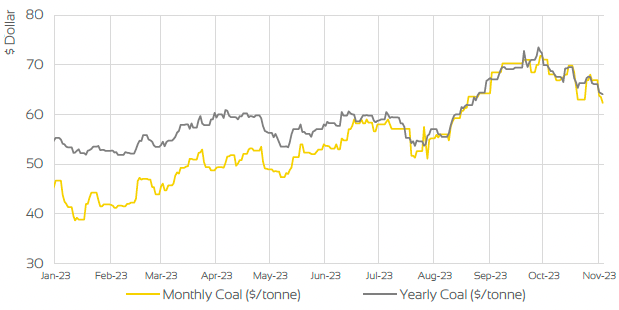

Coal Prices

Market Insight: Long-Term

Longer term contracts both on power and gas have remained relatively rangebound, despite the volatility we have seen across the month especially amongst prompt index’s. The latest tensions in the Middle East brought concerns around the war spreading and potentially disrupting the flow of LNG and oil as regions close by are key exporters. This brought much of the bullish sentiment which had offset the strong supply picture we already have in the EU and UK.

If the Hamas-Israel conflict was to escalate the impact it would have on the winter period would be minimal considering the current gas storage levels, and as we continue to meet demand year on year without the reliance on Russian energy the longer term outlook remains bearish as a whole. With that said given the current climate, the war in Ukraine is still ongoing which can still pose a risk along with the conflict in the Middle East if this was to also continue. This is likely to add some bullish sentiment in contracts further out on the curve. With current temperature forecasts suggesting a milder outlook for the latter part of November & the start of December, Summer-24 & Winter-24 contracts have seen bearishness feed into prices but remained rangebound overall due to bullishness from the geopolitical risks. The damage to the subsea gas pipeline in Finland had led to some longer-term security concerns as it was damaged and deemed as sabotage but was later revealed that it was an anchor from a ship passing by.

This also supported some of the volatility in contracts but reiterated that markets are still very much in a sensitive state. Oil index’s experienced similar levels of volatility throughout the month as the conflict in Israel prompted fears that neighbouring regions could get involved impacting the global supply, in an already tight supply. As the focus shifted between interest rates and the conflict in the Middles East, prices overall have fallen and ended the month around the $87/Bbl mark.

Market Outlook

October was a month dominated by the current geopolitical risks we are seeing in the Middle East, which had meant volatility had crept back into markets. The main concerns were surrounding the disruptions of LNG and oil from neighbouring regions as the war intensified. In an already sensitive market, contracts did see gains across the curve on both gas and power contracts.

Concerns of the war spreading have eased and due to an extremely strong supply picture with storage levels nearly at capacity and Norwegian flows robust, markets look set to follow a bearish trend which is likely to be supported by the latest forecast of temperatures being milder than initially expected. Weather models have suggested a milder end to November and the start of December which could suggest storage levels will remain robust for Q4, and as LNG imports & Norwegian gas flows remain healthy.

Overall, the current fundamentals will sway towards a bearish outlook for the remainder of 2023 for now, but with the latest geopolitical risks, markets could shift in the opposite direction or limited any further losses.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.