Energy Market Insight | November 2023

Energy Market Trends: NOVEMBER 2023

markets SHIFT LOWER THROUGHOUT NOVEMBER AS MARKET FUNDAMENTALS OFFSET GEOPOLITICAL RISKS

WHAT IMPACTED ENERGY PRICES IN NOVEMBER 2023?

TOP 3 FACTORS AFFECTING ENERGY PRICES

- Markets fall throughout November as geopolitical risks fade and the supply picture remaining healthy

- Demand expectations in December curbed as milder temperatures are forecasted

- Oil prices throughout the month see week on week losses

WHAT ARE THE SHORT-TERM ENERGY PRICE IMPACTS?

Short-Term ENERGY MARKET TRENDS & INDICATORS

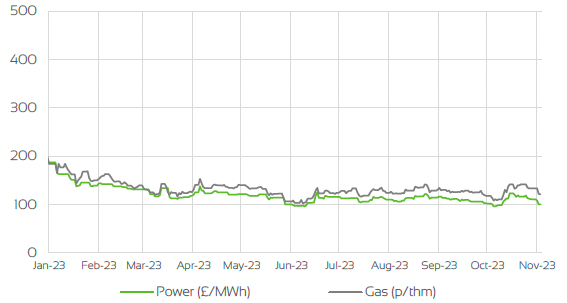

Day Ahead GAS & POWER Prices

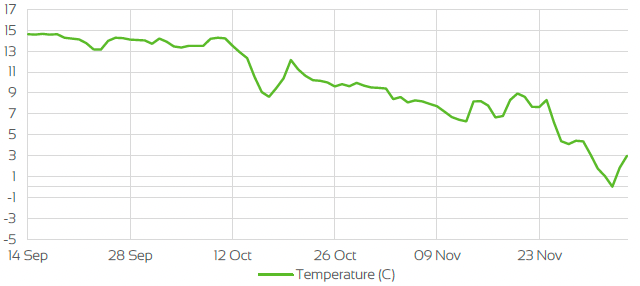

UK Temperature CHANGE

Market Insight: Short-Term

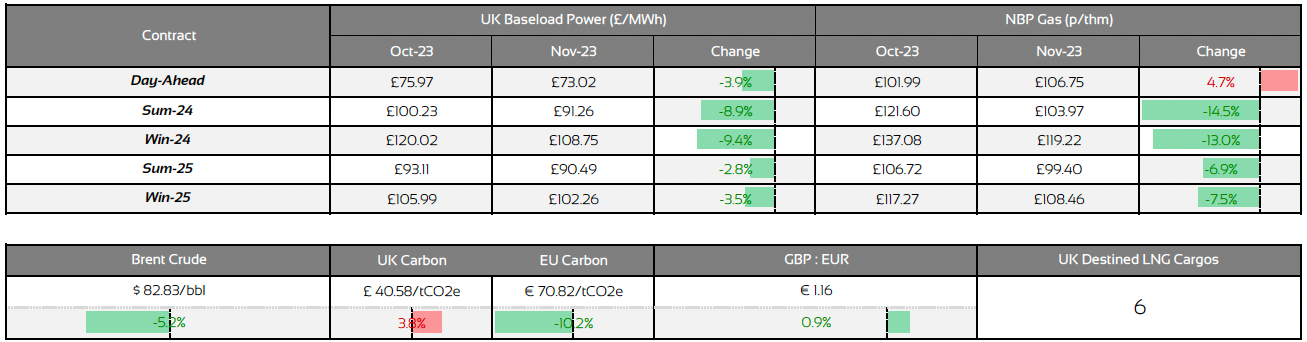

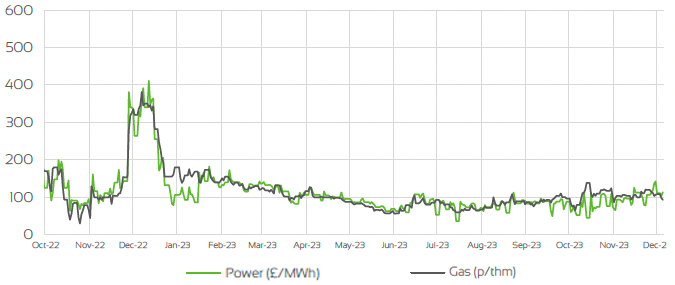

Markets during November have been less unpredictable than last month as prices across both Prompt and seasonal index’s shifted lower, as risks associated with geopolitical concerns faded and expectations of milder weather conditions added bearish sentiment into markets. Gas prices across prompt contracts (Dec-23, Jan-24 & Feb-24) had all seen significant downside through out the month and are now closer to double figures.

The war in Israel added much of the volatility in October prompting markets to jump, as concerns of the war spreading further into the Middles East disrupting LNG export were the main concerns. We have since seen those risks fade over the course of November, with fears of this happening becoming less likely despite the war continuing and in turn pushing prices down.

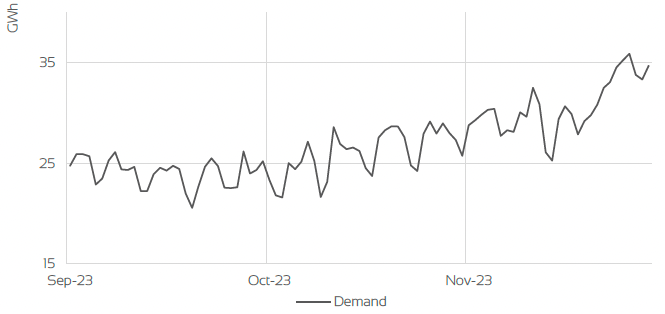

At the start of the month Dec-23 & Jan -24 gas prices sat close to the 130p/therm mark but were hovering around 105p/therm as November drew to a close. As the war in Israel started to have less & less impact on prices, focus shifted to the fundamentals, as temperatures at the beginning of the month sat above seasonal norms muting demand. Longer term weather forecasts suggesting milder temperatures from the middle of December also weighed on prices which meant the outlook in the short-term would remain strongly in favour of being bearish.

The last week of November has experienced a cold spell where temperatures fell below norms but due to a healthy supply picture, much of the bullish sentiment on the back of this was generally offset by extremely healthy gas storage levels across Northwest Europe. Despite withdrawals from storage, capacity was still at record highs for this time of the year, with November still showing storage levels of around 94% fullness.

Supporting this, is the continuation of LNG supply coming into the UK & Europe, which remains healthy along with Norwegian flows which have recovered throughout the month to keep the supply picture extremely healthy for the winter period.

WHAT ARE THE LONG-TERM ENERGY PRICE IMPACTS ?

LONG-Term ENERGY MARKET TRENDS & INDICATORS

Front Seasonal gas & power Prices

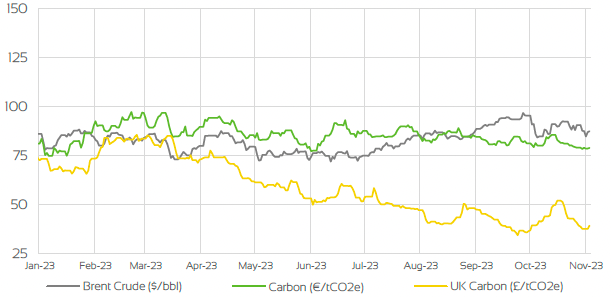

Brent Crude & Carbon Price

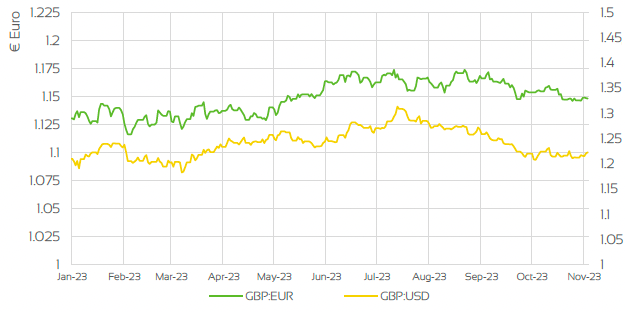

UK, EU & US Currencies

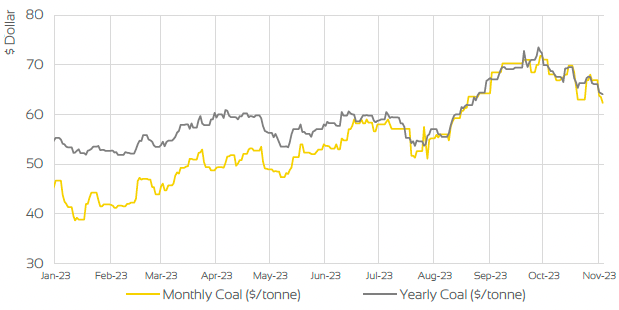

Coal Prices

Market Insight: Long-Term

Front seasonal index’s on gas have seen prices come off over the course of the month, as contracts for summer-24 & winter-24 have seen similar levels of losses as prompt markets. Further out on the curve for power has seen little change for the majority of the index’s as summer-24, Winter-24 & Summer-25 remained relatively rangebound throughout the month. With storage levels across Northwest Europe remaining at record highs and remaining that way, gas prices overall have taken up much of the bearish impact on the back of the fundamental drivers.

Summer-24 has fallen from 121p/therm to sitting just above the 100p/therm mark, which is a reflection of the healthy supply picture not only for the winter but as we move into the summer months. As Europe continues to strive largely without Russian energy for another year, a lot of the risk elements regarding supply for the winter months will continue to fade, though reliance on Norwegian gas flows and LNG imports will become more important than in previous years, especially before the energy crisis. Issues in Australia is an example of the reliance Europe now faces if there are any potential disruptions to LNG exports, despite the material impact on European shipments being limited. Markets are likely to react more on sentiment rather than actual supply infringements in instances like this in the shorter-term at least.

With that said due to high levels of LNG exports and storage levels being at record highs, it is reported that by the end of the winter period capacity still be around 50% fullness come April. This would leave Europe in an extremely strong position come Winter-24 and could potentially meet storage targets earlier than expected for a 2nd year running. The wider commodity complex has seen oil prices fall for the majority of November as week on week losses have been apparent despite the war in Israel becoming increasingly more intense.

Markets have hovered around the $80/Bbl mark for the latter stages of the month as concerns of oil exports being disrupted becomes less of a concern but will still be a risk as long as the war continues. High U.S inventories and concerns around global demand has also weighed on prices. This led OPEC+ organising a meeting on 27th to discuss further potential cuts in Q1 of 2024, but in the end led to scepticism around whether it would happen or not.

Market Outlook

A lot of the geopolitical risks that are still apparent caused concerns throughout October, but despite the war in Israel still deepening the impact on markets, especially prompt contracts has faded as the month progressed. The main reason behind this, is due to fears of the war spreading becoming less & less likely within the Middle East. Therefore, focus turned to more of the fundamental drivers which remain largely bearish as we move deeper into the winter months.

Gas prices have shifted downwards throughout November and close to double figures, and not only on prompts index’s but front seasonal contracts too. A mild start to November and forward forecasts of warmer temperatures for large parts of December has curbed demand expectations towards the end of the year. Bearishness has been buoyed by the extremely strong supply picture, where storage levels across Northwest Europe are still at record highs despite withdrawals in a recent cold spell and still sit at 94% fullness.

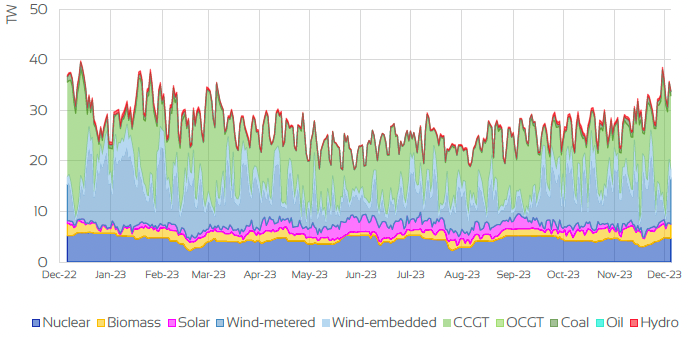

This combined with generous shipments of LNG coming into the continent and the UK, along with Norwegian gas flows, has only supported the downwards trend. Wind generation has been relatively steady, and with the fundamentals likely to remain unchanged throughout December, the current outlook would strongly suggest markets will continue to see downside as we move into 2024.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.