Energy Market Insight | Februrary 2023

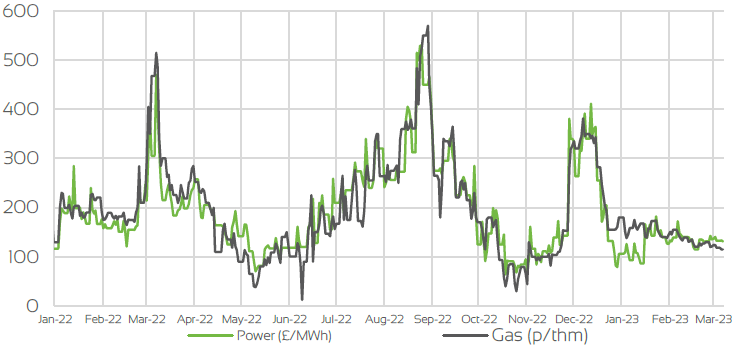

Day Ahead Prices

UK Temperatures

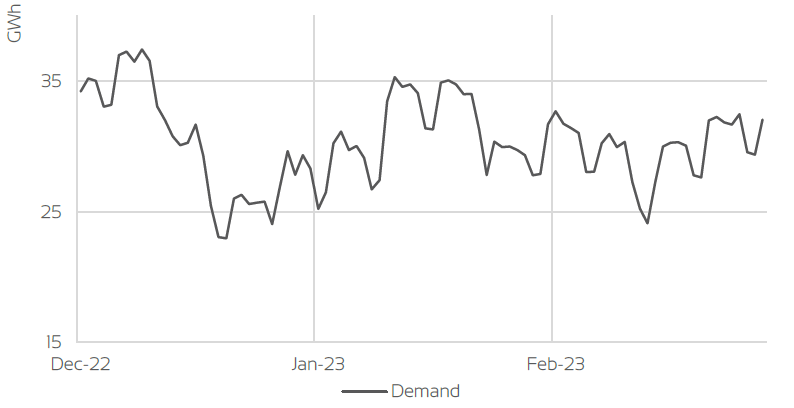

UK Demand

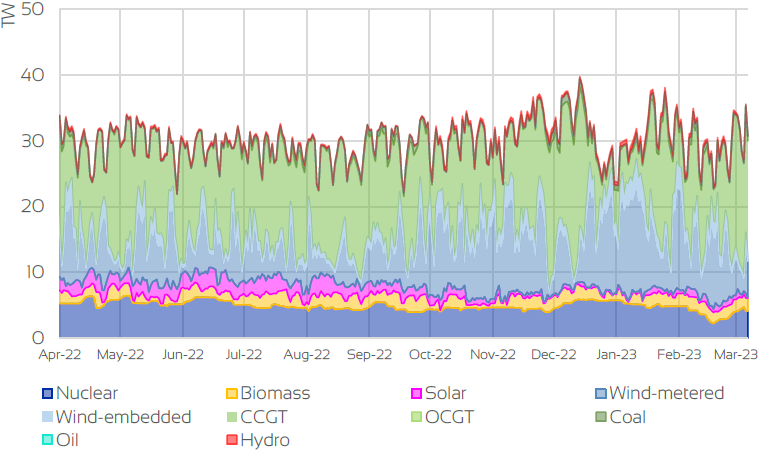

UK Supply Mix

Market Insight: Short-Term

Day Ahead contracts continued to trade in a volatile manner throughout February, albeit this volatility was reduced as contracts traded in a narrower range. Weather remained the key driver for these contracts, as cooler spells brought about an increase in demand, lending support to prices. Both Gas & Power contracts were also affected by wind speeds, with wind generation dipping throughout the month as wind speeds were reduced, increasing gas for power demand. Also provided bullish to these contracts was the intermittent outages experienced by Norwegian gas fields throughout the month, which caused reduced flows to both UK & Europe.

Increases to these contracts were, however, restricted as the strong fundamental outlook that has been evident throughout Winter continued to be in place. European storage levels remain around multi year highs, ending the month ~63% full. In addition this, and inspie of the cooler weather, demand across Europe continues to be reduced from previous years. LNG arrivals into UK & Europe also continued to remain strong, and subsequently, so was sendout. Global LNG supply was also boosted in February, following the return to production of the Freeport LNG facility in the USA which has been completely offline since June last year, after a fire at the site forced it to close. Freeport facility is the 2nd largest LNG plant in the USA and accounts for ~20% of US LNG production.

The bearish facotrs have also been the predominant driver on the prompt contracts, as they continued to trend lower as the Summer season approaches and any risk factored into these contracts is reduced.

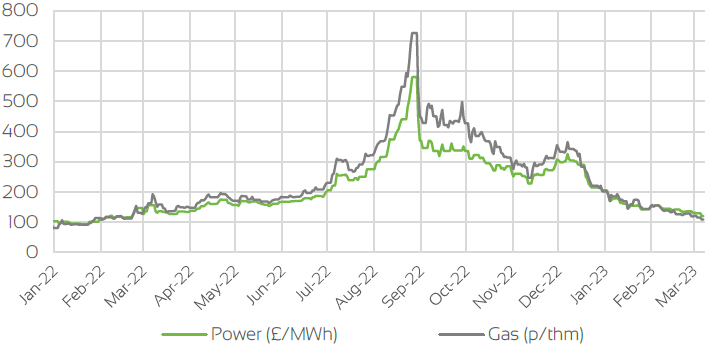

Front Seasonal Prices

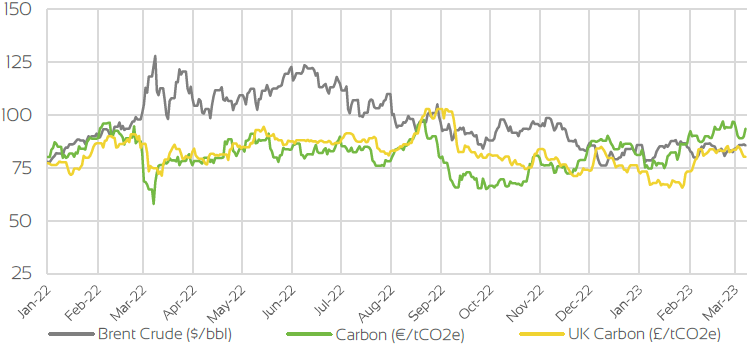

Brent Crude & Carbon Price

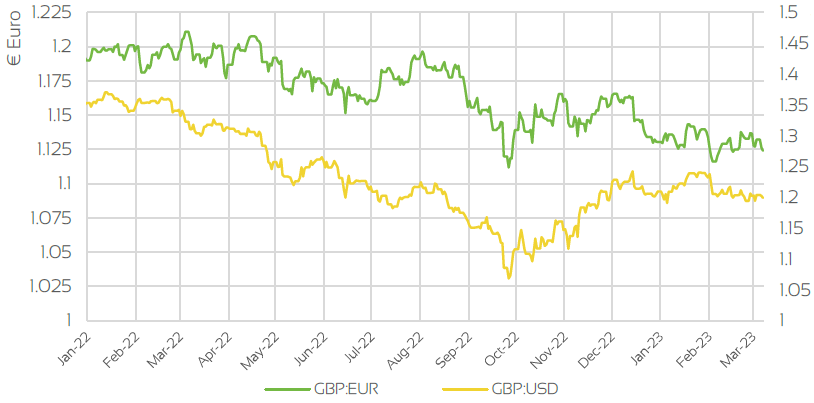

UK, EU & US Currencies

Coal Prices

Market Insight: Long-Term

Seasonal contracts have also traded lower throughout February, taking direction from the prompt contracts. Strong fundamentals continue to weigh on these contracts, particularly the storage levels, with the more gas in storage as we enter the Summer period, the lower the expected gas demand throughout the Summer period to replenish supplies to full capacity.

This also has an impact on the Winter '23 contract, as the expectation is that storage levels will be at, or close to, capacity as we enter into next Winter, alleviating some of the risk of shortage of supply that continues to be in place for that period. The downtrend for the Summer '23 contract is much more aggressive than contracts further along the curve, as we approach expiration of this contract and risk that has been factored into this contracts have been removed. Further out along the curve, the whilst contracts remain in a downtrend, the losses on these contracts are much more sedate.

Longer term risk still remain, particularly as Europe is largely dependant on LNG arrivals, which is a global commodity. Increased Chinese demand following the end of their strict COVID restrictions at the end of 2022, is expected to continue throughout 2023, and cause and subsequently cause an increase in Chinese demand for LNG. This is also in addition to an expected increase in European demand from Q3 onwards, as industrial output is forecast to increase from 2022.

Market Outlook

Short to medium term outlook continues to remain bearish with the current fundamental drivers expected to hold sway until at least Q3. We may see some short term support for prices if we see adverse weather conditions, particularly for near term contracts with another "Beast from the East" weather front expected to arrive in the UK in early March, but any price increases are expected to be short lived, unless there are significant changes to the current fundamental outlook. Longer term, due to the European shift away from Russian gas and shift towards LNG, there is potential for prices to find support during peak summer period, should we see extreme temperatures across both Europe & Asia, as was witnessed last year.

As 2022 showed, should this occur, demand for cooling increases, which subsequently increases demand for LNG and provides upward pressure on prices. This is likely to be the case over the next couple of years whilst the reliance on LNG remains, with prices being susceptible to volatility in times of extreme temperatures. Longer term, prices may also see support if we see continued increase in either, or both, Chinese and European production output throughout 2023, as is expected.

Clients with forward exposure should consider their risk and budgets and act accordingly. For further information, or to discuss options, please get in touch with your Optimised account manager, or call the number below to speak to one of our experts.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.