January Monthly Market Insight

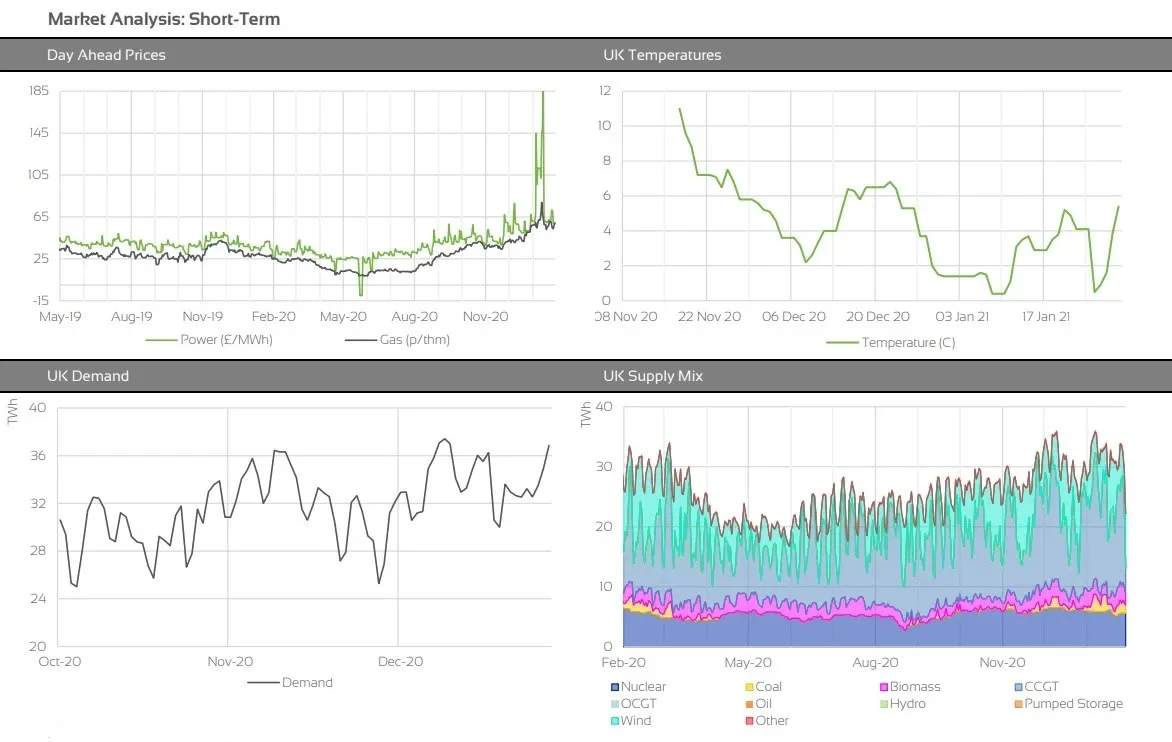

Cold weather and slowed LNG supply dominate markets in January.

Market Insight: Long-Term

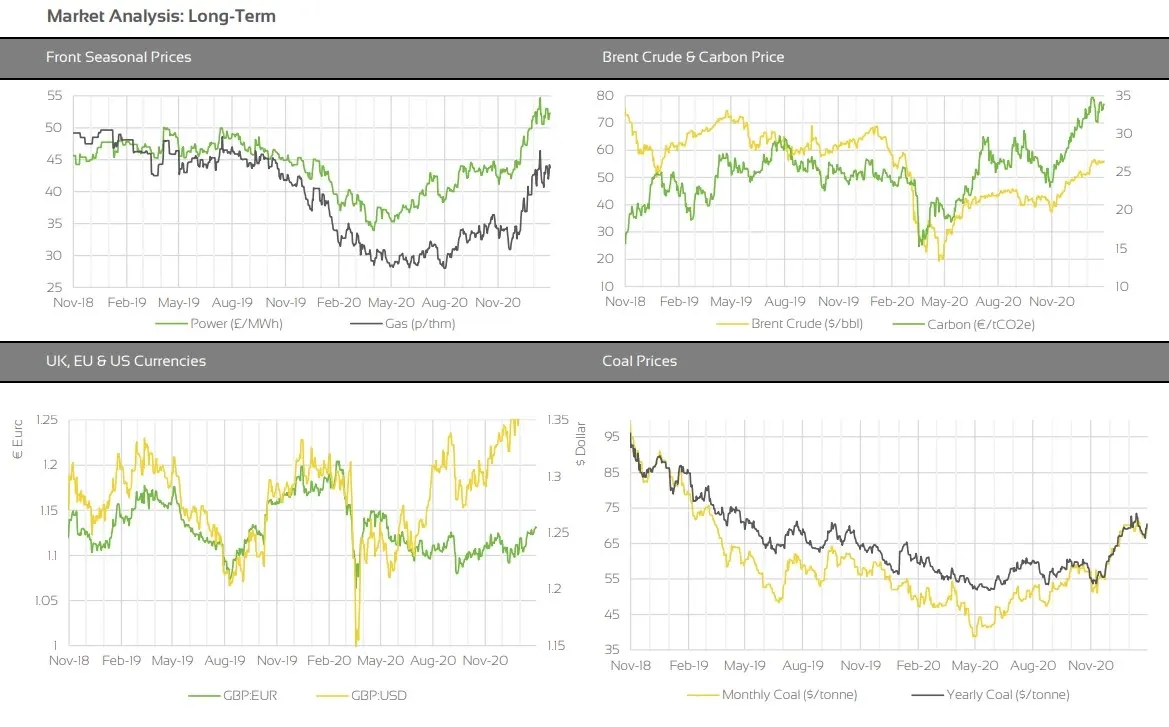

Oil managed to maintain its upwards trajectory throughout January, despite ever rising global virus cases. The recovery began in late 2020 with the announcement of several effective vaccines. As more doses have been administered, hope for returning demand has increased. Prices were further supported when OPEC+ agreed to keep production cuts largely the same in February and March, with Saudi Arabia even pledging an additional 1 million bpd voluntary cut. A weaker USD also pushed prices higher by increasing buying interest for commodities traded in USD.

Carbon prices have also made a significant recovery this month. As with oil, the recovery started on the back of vaccine news last year. A pause in the EUA auction schedule also supported prices. The first auctions, since December, are due to take place today in Germany and prices will likely move to reflect the outcome of the auction. Continued cold weather also supported carbon prices as the resultant higher heating demand pushed more fossil fuel power generation online. This has particularly influenced power prices, as fossil fuel power generators must by permits to offset their carbon emissions.

Market Outlook

In the shorter term, we expect volatility to remain as the current temperature outlook for February puts temperatures below seasonal norms. a healthier LNG picture will support supply in February but cold weather will take a hit on medium range storage. We'd expect the front seasonal contracts to continue to be driven by the shorter-term outlook. The more gas withdrawn from storage in winter, the more we have to replenish over summer. Looking beyond 2021, contracts will likely continue to track oil and carbon prices, which appear to be steadily, but consistently, rising.

Backwardation is now in full play across gas and power markets. Fixed clients should consider the opportunity backwardation could present for securing volume further ahead. Alternatively, clients should select a longer-term flexible strategy to take advantage of any emerging opportunities to secure volume further ahead.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.