Monthly Market Insight June 2021

Bullish movement, seen throughout June, expected to continue in July on soaring global gas prices.

Key Market Drivers

- Medium range storage levels remain a key concern for the UK, with LNG slowdown and lower Norwegian gas flows in June

- Oil prices find strength from positive global recovery picture, with particularly strong summer demand in the Northern hemisphere

- Russia fail to book additional July gas transit capacity through Ukraine, adding to European supply and storage worries

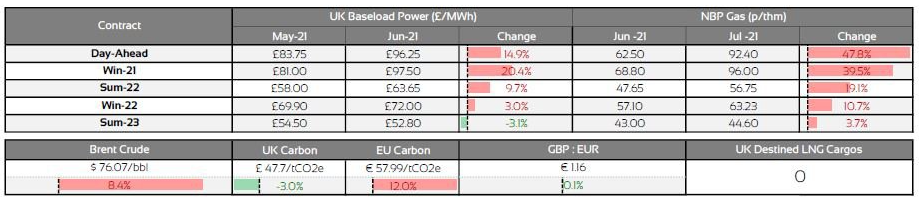

Market Prices

Market Insight: Short-Term

The bulls were firmly in control of short-term UK energy contracts throughout June. Day-ahead prices climbed consistently through the month, to gain 14.9% and 46.4% on power and gas respectively, with monthly contracts following suit. A strongly bullish fundamental picture supported upwards movement. The main story, globally, has been the gas demand/supply balance. Rising Asian gas hub prices have begun to tempt LNG cargoes to the Far East, a pattern we saw in January. Consistently increasing demand can be seen from countries such as China and Japan, as they try to meet summer cooling demand and top up storage ahead of winter, following last winter’s freezing weather resulting from the La Nina event. A noticeable slowdown in LNG cargos arriving into the UK was observed throughout June, with no cargos yet scheduled to arrive in July.

UK medium range gas storage levels remain a key concern with levels still sitting at multi-year lows. Heavy Norwegian maintenance projects continued throughout the month of June, having started in May. This cut the amount of gas being exported to the UK via the Langeled pipeline. This week, exports have begun to increase slightly as these projects wind down. A ramp up in exports is expected again on 6th July and 10th July. Whether this will translate to high injections into storage remains to be seen. It has been another relatively subdued month for wind output in the UK and the picture is not set to improve significantly. Output is forecast to increase steadily back to seasonal norms by Tuesday next week, however, the forecast for the remainder of July sits below norms, keeping gas demand for power generation strong.

Market Analysis: Long-Term

Market Outlook

The outlook for July remains bullish. Whilst Norwegian imports will increase at the start of the month, as maintenance winds down, there are still no LNG cargos scheduled for UK arrival and wind output is expected to remain subdued. Given these conditions, it is unlikely we’ll see significant storage injections in the first half of the month. Temperatures are expected to sit at or above norms through July into August, however, if temperatures increase significantly, demand for cooling will also increase. Furthermore, with Russia failing to book any additional capacity through Ukraine for July, the European gas picture is likely to remain tight. On seasonal contracts, we also expect the picture to remain bullish. With no sign of demand slowing, oil prices are likely to remain strong, especially if OPEC+ continue with their conservative production increase plans. Strong gas and oil prices will also continue to support carbon, and thus gas and power markets.

Following last year's significant lows, most clients will now see an increase on renewal prices. Particularly risk averse clients may wish to consider fully fixing out any Win-21 volume immediately. Backwardation is still in full play across gas and power markets. Where volume warrants, clients may wish to switch to a flexible strategy to begin taking advantage of lower prices further along the curve.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.