Monthly Market Insight | April 2022

Front month prices have traded lower throughout April

Key Market Drivers

- Russia halts supply of gas to Poland & Bulgaria due to refusal to pay in roubles

- North West Europe receives 5.4% increase in LNG April volumes YoY

- Seasonal contracts across the curve trading higher as fears persist over certainty of Russian supply longer term

Day Ahead Prices

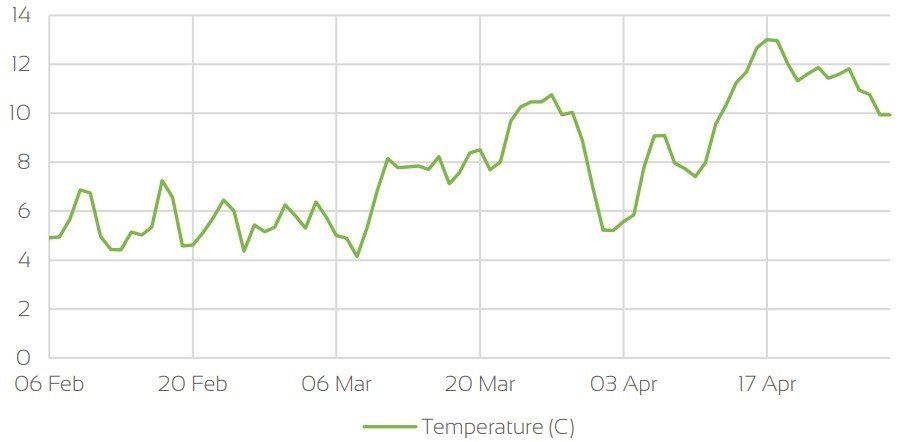

UK Temperatures

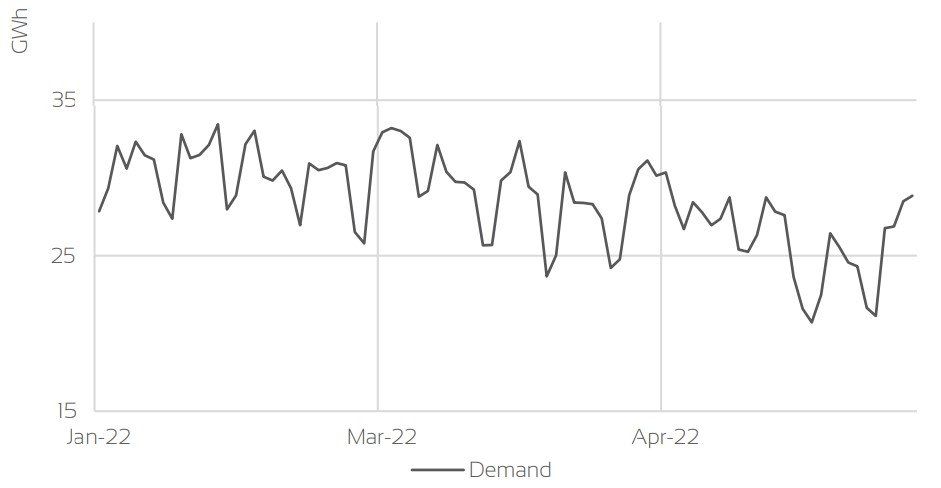

UK Demand

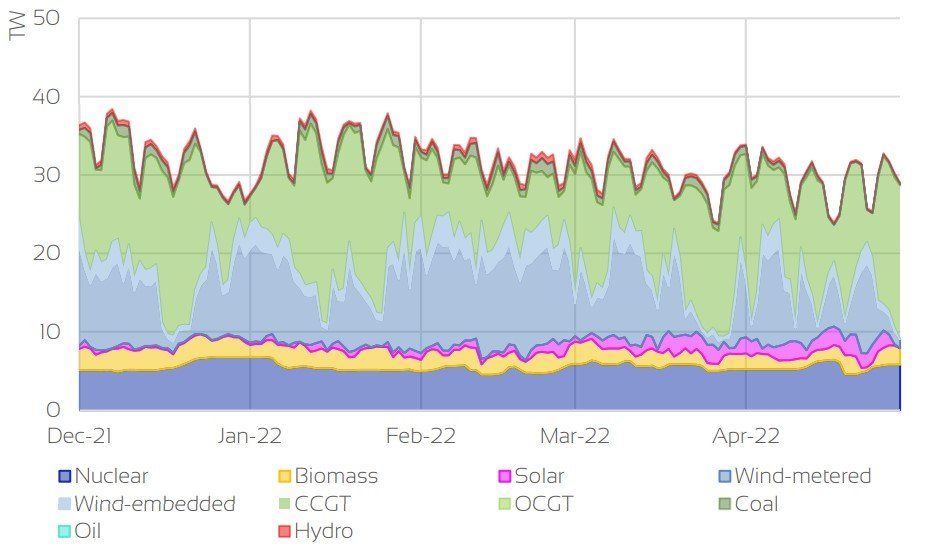

UK Supply Mix

Market Insight: Short-Term

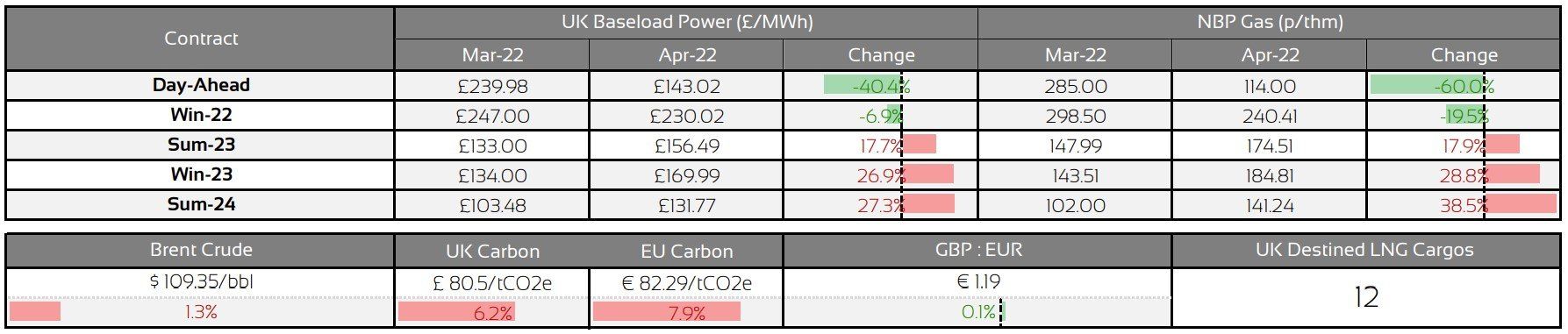

April saw prompt contracts trade lower throughout the month, despite the market continuing to be volatile, although nowhere near the same levels as February & March. The predominant driver continues to be the flow of Russian gas into Europe amid fears that there will either be sanctions placed on this by the EU & US, or, Russia will merely turn the taps off and stop supplying gas to Europe. Throughout April, gas flows remained steady through all major routes and for large parts Russian exports were actually higher than pre-invasion levels. The market continues to be susceptible to any shift in circumstances in Russia, as illustrated towards the end of the month when prices jumped 20% intra-day due to Russia halting gas supply to Poland & Bulgaria over their refusal to pay for gas in roubles. While the market quickly retraced these gains, as supply concerns were alleviated short term, the fear remains that Russia may do this again in future to other countries/routes, with little to no warning.

Fundamentally, as well as Russian gas flows continuing in line with expectations, April also saw an increase in LNG volume for North West Europe (up 5.4% YoY), as high gas prices means it continues to be a desiable destination. Following the announcement by the European Commission that storage European storage levels must be at 80% by the end of October, injections into storage have been strong throughout the month, and UK inventories are sat close to record levels for this time of year, helping to offset some of the short term concern over a potential shortfall in supply. The abundance of supply has weighed on prices through the month, and has seen day ahead price for both electricity & gas drop by 40% & 60% respectively.

Market Insight: Long-Term

With the exception of the front Season (Winter '22), seasonal contracts all traded higher throughout April. Similar to the near curve, as Russia continues to provide gas to Europe alongside healthy LNG & storage levels, the outlook for this Winter isn't as bleak as it was at the beginning of the month, and prices have subsequently softened, albeit these prices are still at levels close to the market high.

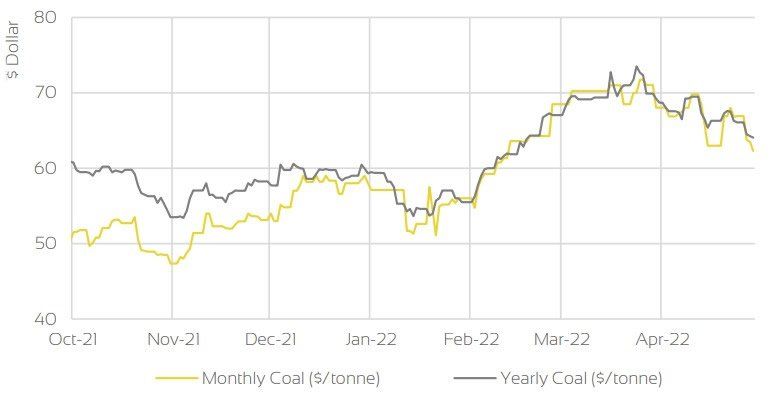

However, for the seasons beyond Winter '22, prices have pushed up, as the risk in the near curve reduces, and has subsequently been pushed to the contracts further away from delivery. The market remains in backwardation, but we are seeing this tighten. The predominant driver continues to be Russian supply, with the expectation that Europe will eventually completely move away from Russian energy sources (it will no longer import Russian coal from 10th August). It is uncertain when exactly this will happen, but in the current climate, it is almost guaranteed to occur. Shortmedium term, there is an expectation that this will tighten global supply-demand, which in turn may support prices; as a result, markets have seen an increase in the risk premium built into these later-dated contracts.

Front Seasonal Prices

Brent Crude & Carbon Price

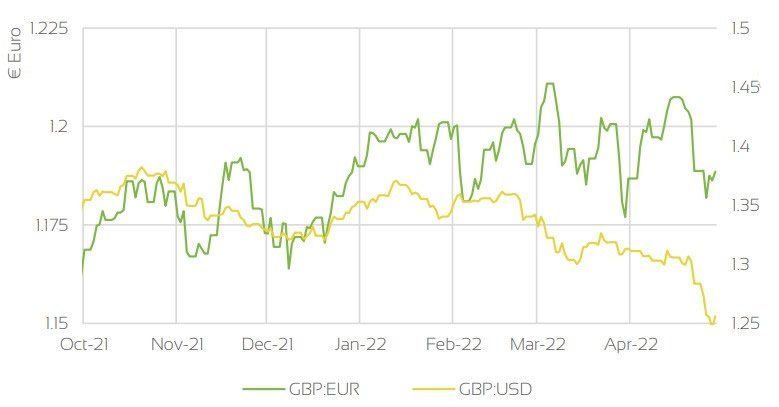

UK, EU & US Currencies

Coal Prices

Market Outlook

The market still remains largely driven by ongoing developments with the Russia-Ukraine conflict, and continued price volatility should be expected for the foreseeable. From a fundamental perspective the market is pushing towards being oversupplied, with continued healthy LNG arrivals coupled with strong Russian gas flows which is weighing on near term prices, as we have seen in April. Injections into storage are expected to continue at the rate they have in April, in order to meet the EU Commission target of 80% full by 31st October. Provided supply remains strong, this could continue to weigh on the Winter '22 contract as some of the risk around a supply shortfall in the Winter period is eroded. If supply is cut, and Europe has to continue injections at the same rate, this may lead to a further increase in near term contracts. Curve prices are very much on the increase, as longer term the risk remains over global energy supply. Backwardation continues to remain in place for future contracts, albeit the benefit is tightening sharply. Until an agreement is reached over security of supply longer term, it is expected that we will see prices further along the curve continue to increase.

Clients with forward exposure should consider their budgets and appetite for risk and act accordingly. For further information, or to discuss options, please get in touch with your Optimised Energy account manager, or call the number below to speak to one of our experts.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.