Monthly Market Insight January 2022

Geopolitical tensions in Europe adds further bullishness into markets despite healthy LNG imports.

Key Market Drivers

- The threat of Russia invading Ukraine could lead to further delays to Nord Stream 2

- Record numbers of LNG imports coming into Europe and the UK, eases some supply concerns

- Regular Norwegian plant outages supported the upside in January

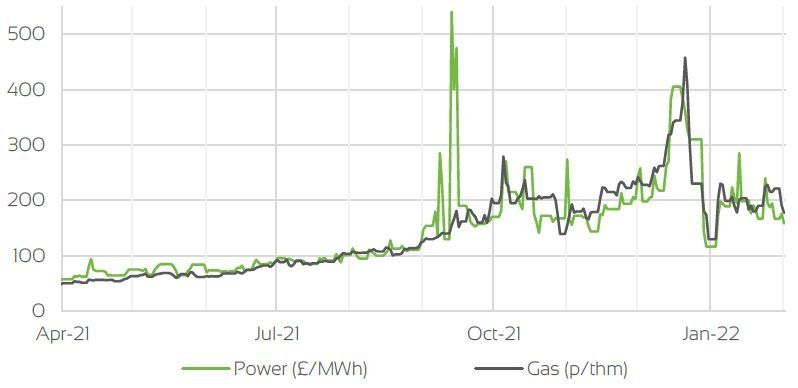

Day Ahead Prices

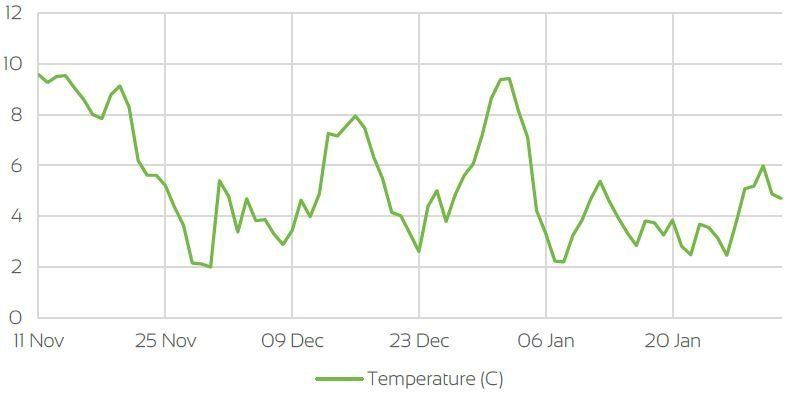

UK Temperatures

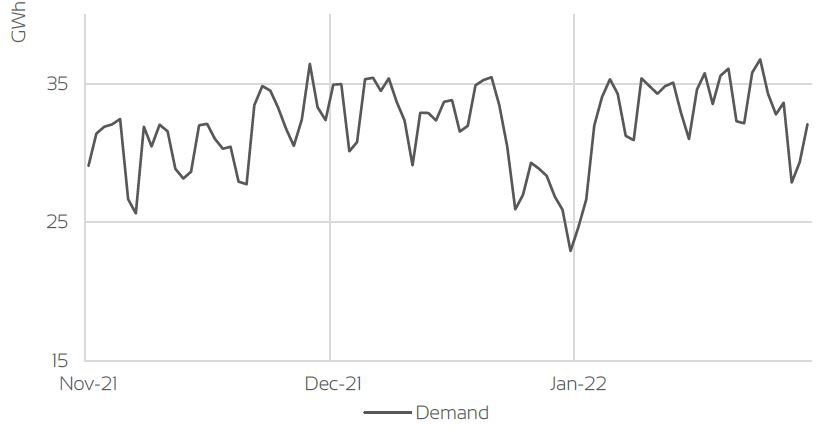

UK Demand

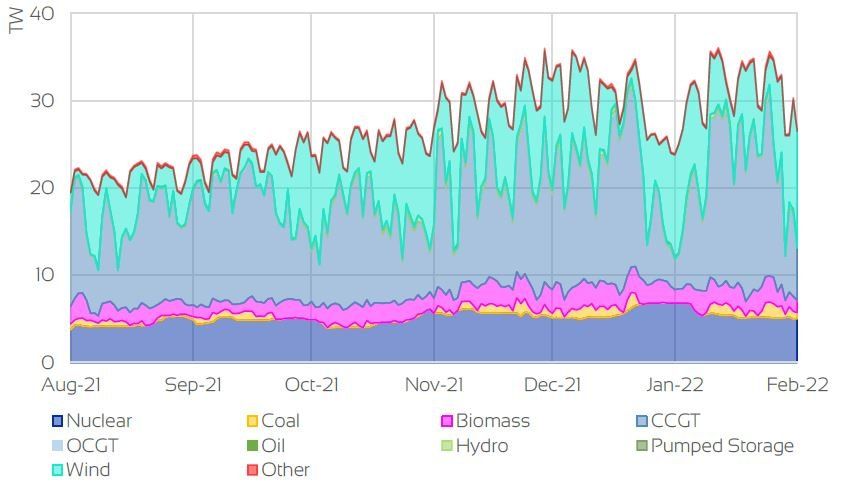

UK Supply Mix

Market Insight: Short-Term

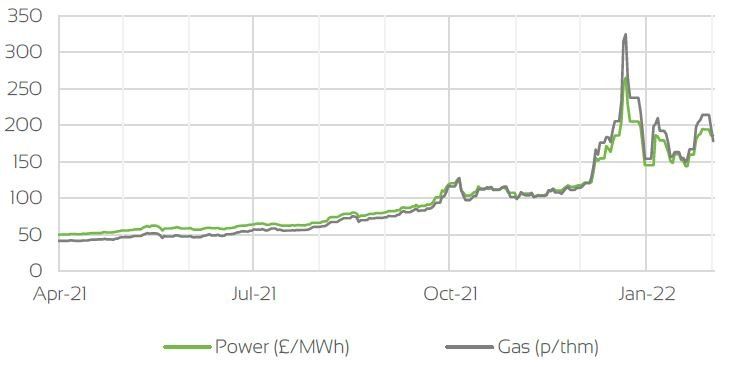

Front month gas and power contracts have seen a vast reduction in levels of volatility month-on-month, despite trading rangebound in spreads of 83.11p/thm and £115.00/MWh respectively. An increase in LNG supply and wind generation, alongside milder temperatures have kept near curve prices capped, in spite of ongoing geopolitical tensions in Eastern Europe keeping daily movements unstable.

Levels of LNG to the UK were up throughout January, seeing an increase of 93.5% month on month, with a total of 3.34bcm of volume imported; 50% of which was imported from the United States. Increases in imported volumes were also seen across Europe, with an additional 4.23bcm of volume imported relative to December, easing short-term supply concerns during the peak winter months. This hit a new monthly imported volume record, up 18% from the previous record of 12.6bcm in March 2021. Price volatility has remained strongly correlated with gas and LNG markets, as CCGT continues to contribute 44% of the UK supply stack, with gas for power demand up 4% month-on-month

Market Insight: Long-Term

Seasonal contracts were subject to similar movements as near-term curve products, with temperature, LNG, gas supplies and geopolitical tensions driving market prices. Seasonal prices remained largely rangebound, struggling to penetrate support and resistance levels set early in the month.

All eyes were focussed on growing geopolitical tensions in Eastern Europe, during January, as prices acted in a reactive fashion to daily fundamental developments. With Russia’s military presence along Ukrainian borders exceeding 100,000 strong, and an already tight gas market, an imminent crisis was keeping pressure on prices; especially as Russia is responsible for delivering up to 35% of EU gas. Concerns still remain around Nord Stream 2 timelines and any military invasions could add additional delays, exacerbating EU gas shortages.

Although increased levels of LNG and milder temperatures tried to weigh on prices, a continual eastbound flow along the Yamal pipeline (reversed from the typical westbound direction) kept prices buoyed.

Front Seasonal Prices

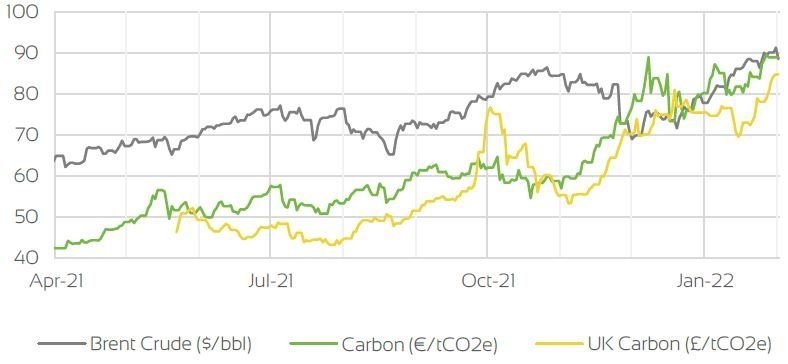

Brent Crude & Carbon Price

UK, EU & US Currencies

Coal Prices

Market Outlook

High levels of volatility are expected to continue dominating the market over the coming weeks. But as the winter begins to draw to a close, with forecasted temperatures above seasonal norms, prices may feel some long awaited downside with any residual supply concerns starting to ease.

This, however, will likely not outweigh any potential market volatility in reaction to any of Russia’s actions over the coming month.

LNG forecasts remain healthy, with a further 13 cargoes scheduled to reach the UK throughout February. This will help alleviate any residual short term supply concerns and continue to weigh on prices. February can often be the penultimate month of winter storage withdrawals, prior to injection season. With UK storage levels currently in line with the 2020 & 2021 at circa 59% fullness, EU stocks at 32%, marginally below 2017, 2018 & 2021 levels, and forecasts of milder temperatures, it is possible that the coming month may realign storage levels with historic years.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.