Monthly Market Insight | March 2022

Front month gas prices peak at 800p/thm as Russia invades Ukraine

Key Market Drivers

- Ongoing tensions around the Russian invasion of Ukraine keeps markets volatile

- Continual threats to cut off Russian gas supplies not executed, with stable flows throughout March

- North West Europe receives 7.2% increase in LNG March volumes YoY

Day Ahead Prices

UK Temperatures

UK Demand

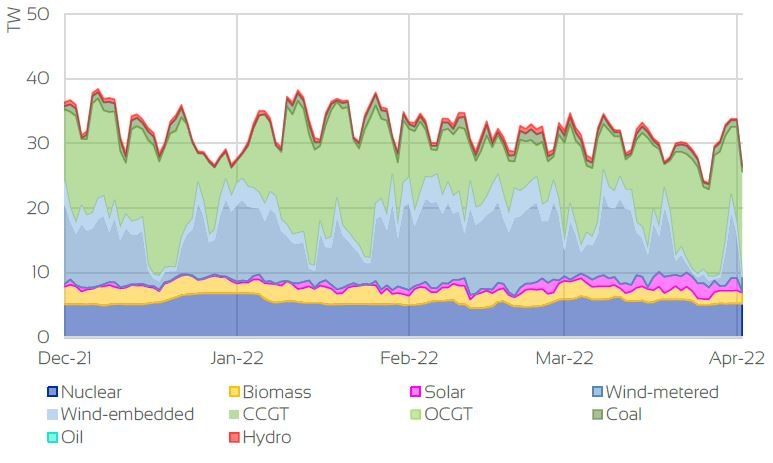

UK Supply Mix

Market Insight: Short-Term

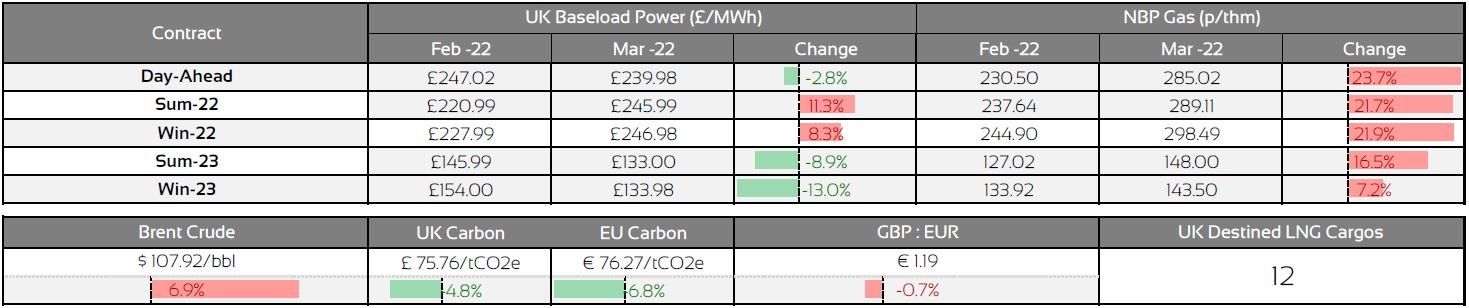

March saw extreme levels of market volatility, with prices reacting excessively to the Russian invasion of Ukraine. Concerns of Russian gas flows being cut off from mainland Europe posed an imminent threat, causing unprecedent price increases in contracts across the curve. Front month gas and power contracts experienced a 220% and 137% increase respectively within the first week of trading. Upside momentum was exacerbated with global pressure to embargo Russian exports and Europe's scramble to implement solutions to achieve Russian gas independence. As such the UK proposed to be completely independent of Russian gas by the year end, whilst continental Europe seek to reduce reliance by two-thirds by year end.

With gas supply concerns rising throughout the month, near-curve prices remained buoyed as wind generation dropped 40% month-on-month, increasing reliance on CCGT to meet demand levels. Nonetheless, seasonal demand is reducing as we transition away from the winter season, with March experiencing multiple intra-month periods of temperatures in excess of seasonal norms.

Market Insight: Long-Term

Seasonal prices also felt the effects of increased levels of volatility as conflict in Eastern Europe and numerous threats to cut-off oil and gas supplies to continental Europe exacerbated bullish momentum. March saw prices move in a reactive fashion, building in significant market risk, in response to numerous "what if" scenarios, subsequently disregarding traditional fundamentals early in the month. Seasonal prices subsequently retracted a large portion of increases as the month progressed, settling somewhat as the market received some clarity around the methods Europe were looking to adopt to transition away from Russian gas dependency.

Despite commitments to embargo and transition away from Russian exports, Russia continued to pose threats to global commodity markets, indicating intentions to turn off the taps and demanding payment for exports in roubles; a strategy aimed to counter the numerous global sanctions imposed on the Russian economy and ease the economic impact to Russia.

Front Seasonal Prices

Brent Crude & Carbon Price

UK, EU & US Currencies

Coal Prices

Market Outlook

The market still remains largely driven by ongoing developments with the Russia-Ukraine conflict, and continued price volatility should be

expected for the foreseeable. From a fundamental perspective the market still remains largely balanced, with demand levels reducing as we transition into the summer period and healthy LNG flows complimenting the continued delivery of Russian gas. The focus will now turn to storage injections over the coming months, with nations such as Germany proposing minimum thresholds to be reached prior to entering the upcoming winter season.

Curve prices are very much awaiting their next direction, with technical drivers suggesting another sharp movement in prices on the near-term horizon. Uncertainties around the ongoing conflict would suggest a greater upside price risk, but the current fundamental outlook, focussing on supply and demand levels, would lean towards a potential softening of prices.

Clients with forward exposure should consider their budgets and appetite for risk and act accordingly. For further information, or to discuss options, please get in touch with your Optimised Energy account manager, or call the number below to speak to one of our experts.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.