Monthly Market Insight November 2021

UK energy prices continue to rise on European supply risk premia

Key Market Drivers

- German regulator delays certification of Nord Stream 2, in blow that could delays gas flows via new pipeline to Sept-22

- Oil and carbon prices have fallen in recent days as new heavily-mutated COVID varient causes global concern

- Cold-weather continues to grip NE Asia, supporting Asian gas hub prices

Market Prices

Market Insight: Short-Term

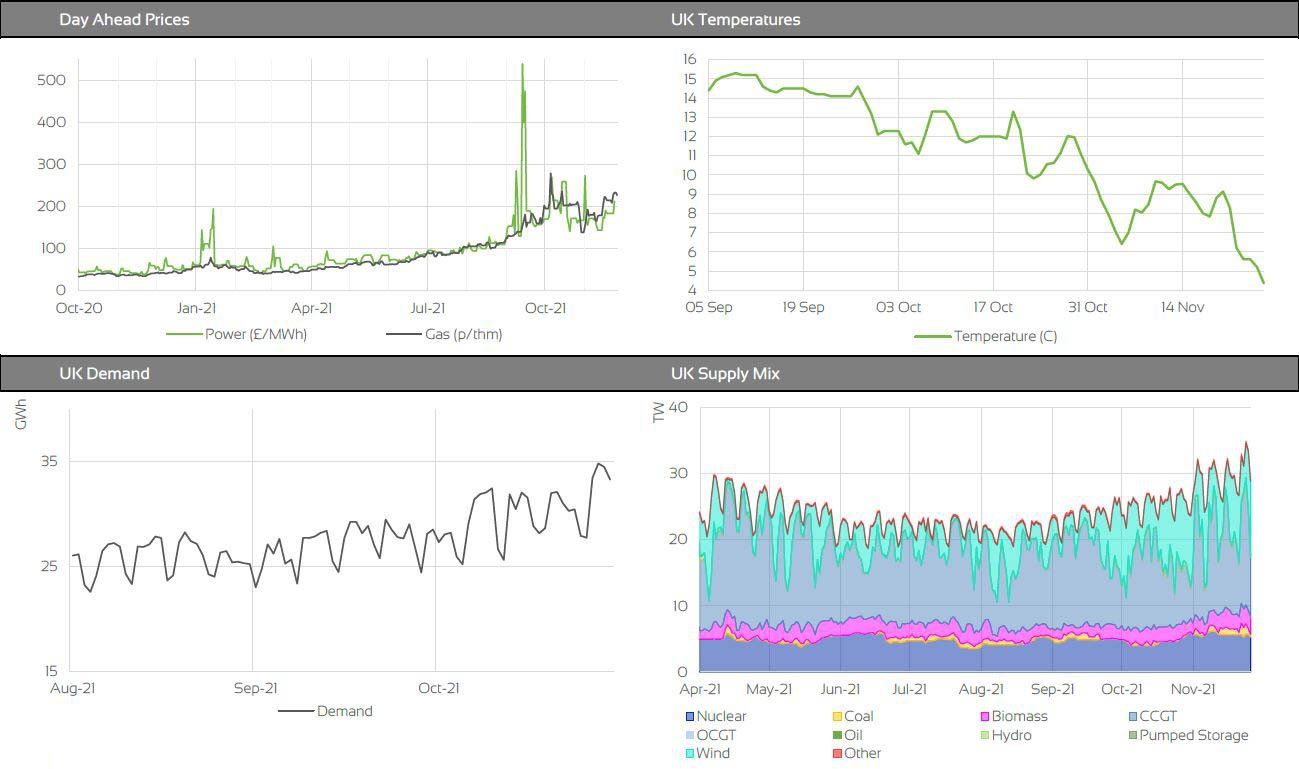

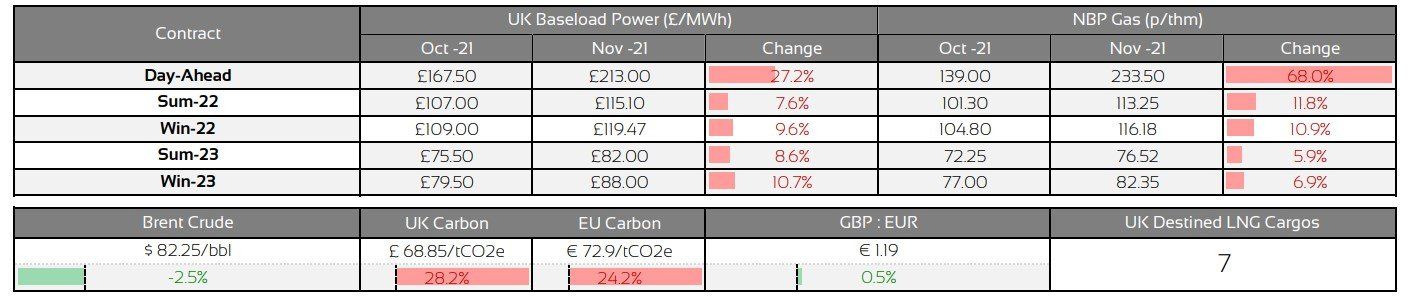

The front end of UK energy markets have seen significant increases throughout November. Day-ahead gas prices have jumped in excess of 68%. Prices are being driven by cooler weather, as we move further into the winter season, and rising risk premiums as the European gas supply picture remains uncertain. Furthermore, Russia failed to book additional monthly Ukrianian transit capacity for December.

The German regulator, responsible for the certification of the Nord Stream 2 pipeline, has put the process on hold indefinitely as it emerged that the Gazprom-controlled company, which owns the new pipeline, was registered in Switzerland, not Germany. Nord Stream 2 AG has agreed to set up a German subsidiary but the regulator said “The certification procedure will remain suspended until the main assets and human resources have been transferred to the subsidiary.” Some market participants are speculating that gas will not being to flow via the pipeline until Sept-22. This comes as a significant blow with European gas storage still sitting below norms.

Putting European gas woes aside, the picture is fairly neutral for the UK. Colder weather is forecast to lift by the end of November, with current forecasts showing both temperatures and wind output sitting around norms for the remainder of the year. UK gas storage is sitting at 5 year highs. Some concern is being felt from rising Asian gas prices. As cold weather grips the region, gas buying is increasing and we may see a similar situation to this year, come January, with high Asian gas prices incentivising LNG cargos to the far East, away from Europe.

Market Analysis: Long-Term

Market Insight: Long-Term

Oil demand continued to outweigh supply, during November, but rising global covid cases, European lockdowns, and talk of some major economies moving to release strategic reserves kept prices rangebound. In recent days, oil prices have taken a tumble as the emerging new virus variant, in Southern Africa, reignites worries than demand could start to slow from restricted travel and dampened economic growth. Travel restrictions are already being put into place and some market participants now anticipate a supply surplus for the first quarter of 2022.

It's been a record month for European carbon prices. Prices hit a record €75/tCO2e this morning, before retreating on new covid variant news. Both European and UK carbon prices increased by a quarter during November, as high global gas prices continue to incentivise coal-burning for power generation. This requires double the carbon permits, when compared with gas-burning for power generation. Further strength was provided as the new German coalition government stated it would now allow Carbon prices to fall below a floor of €60/tCO2e in Germany.

Market Outlook

In the shorter term, the outlook is neutral to bullish. Whilst the UK supply and demand picture looks balanced, with milder weather on the way and a healthy gas supply picture, the ongoing situation with European gas supplies will continue to feed risk premia into front curve contracts. Daily volatility can be expected, relating to Russia’s booking of Day-ahead capacity on overland European gas pipelines. All eyes will be on the monthly capacity auction for January capacity, taking place on 20th December. Further ahead, the picture is neutral to bullish once again. The market will continue to look for developments around the new, more heavily mutated, covid variant and sentiment from European gas supply woes will filter into the curve.

Backwardation is still in full play across gas and power markets. For fixed clients, with Apr-22 renewals, advice remains to get tenders set up ready to act on any potential downside over the coming months. Risk averse clients should consider signing 12m contracts now. Alternatively, clients should select a longer-term flexible strategy, where possible, to take advantage of any emerging opportunities to secure volume further ahead.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.