Monthly Market Insight September 2021

Supply concerns, and poor renewable output, continued to support prices through September

Key Market Drivers

- European gas storage levels remain a significant concern, as Chinese demand for gas increases amid power crisis

- Oil prices reach multi-year highs as global demand for fossil fuels continues to recover

- UK carbon prices sit at £18/tCO2e premium to EUAs as interconnector fire and poor renewable generation support demand for permits

Market Prices

Market Insight: Short-Term

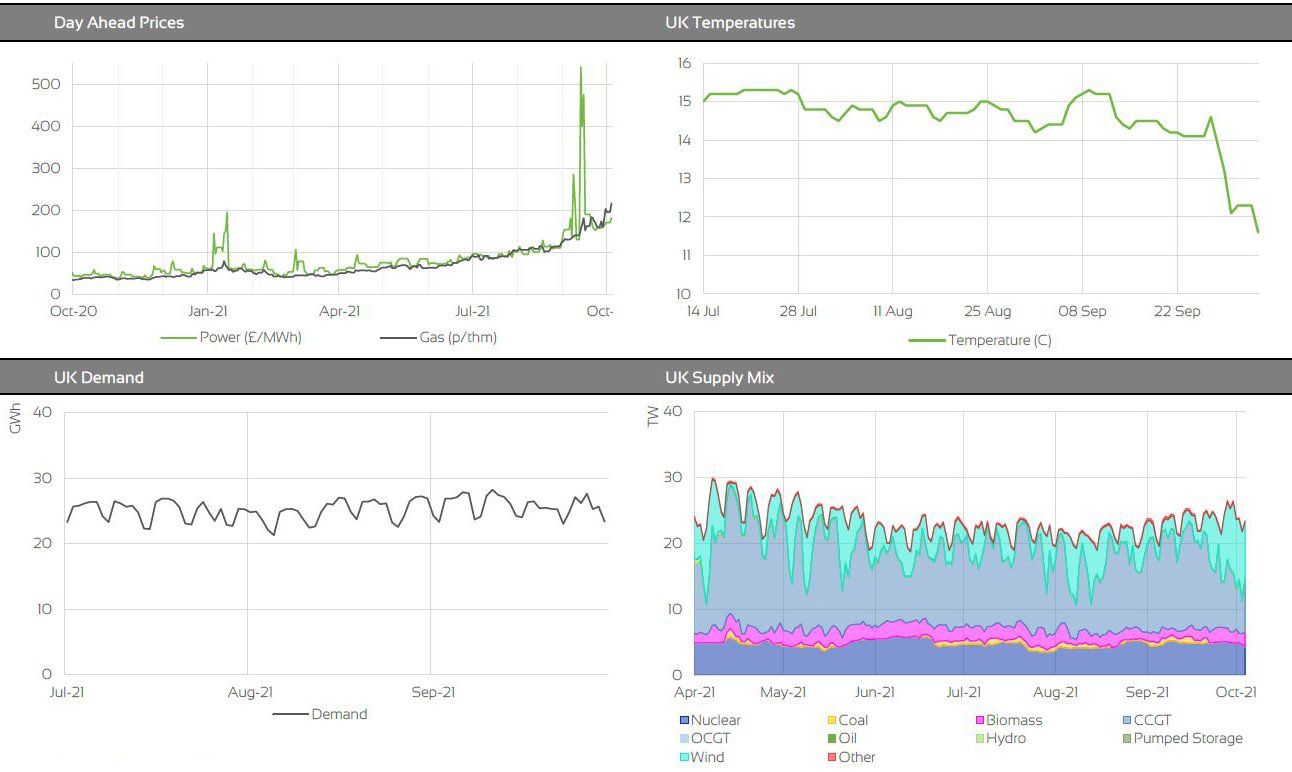

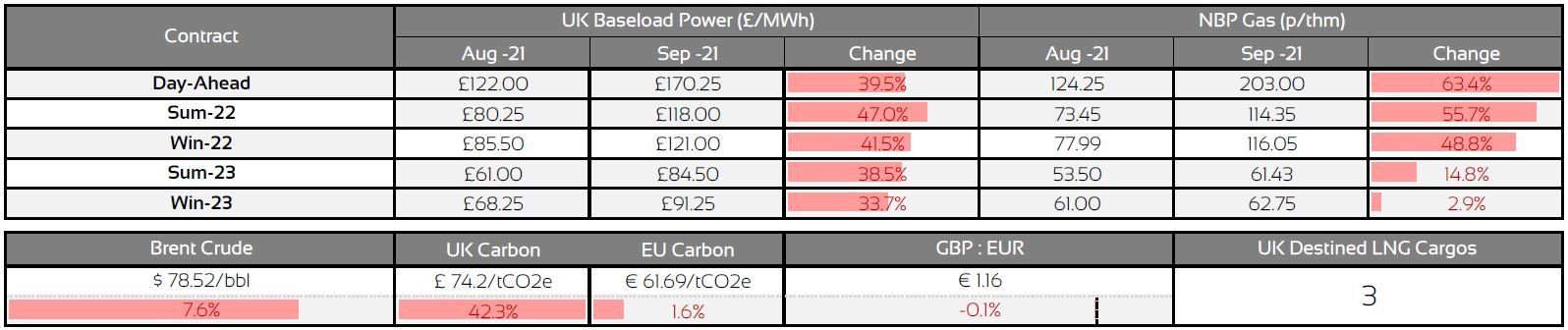

Tight supply margins continue to support short-term gas and power prices throughout September, with day-ahead prices reaching record levels. On the renewables side, wind output remained poor throughout the month, only improving as September drew to a close and cooler weather began to take a stronger influence on short-term pricing. Heavier than normal maintenance on Norwegian infrastructure, and a fire on the IFA1 interconnector, exacerbated price increases. The fire has resulted in the complete shutdown of the 2GW interconnector until later this month, with only half of capacity expected to return before March/April 2022.

Whilst UK MRS now sits at healthy levels, European MRS levels remain a concern at only around 70% fullness. Furthermore, Russia booked no additional gas transit capacity through Ukraine. Russia is keen for the commissioning of Nord Stream 2 to be completed, and some perceive its failure to book additional capacity, at a time of European gas shortages, a way to assert its authority over the process. Chinese appetite for LNG continued to keep cargos away from Europe. Many spot Chinese traders had paused buying, amid record spot prices, with the hope of some softening. This didn’t materialise, as China faces its own energy crisis, and so traders are now rushing to purchase gas, supporting prices further. China is currently experiencing blackouts, as its coal supplies run low. With around 2 weeks of coal left., it’s embargo on Australian coal, coupled with several of its own mine closures, due to safety concerns, has massively impacted import volume. China is importing record amounts of coal from Indonesia, which impacts other large coal consumers such as India, and they also accepted their first, more costly, delivery of Kazakh coal this week.

Market Analysis: Long-Term

Market Insight: Long-Term

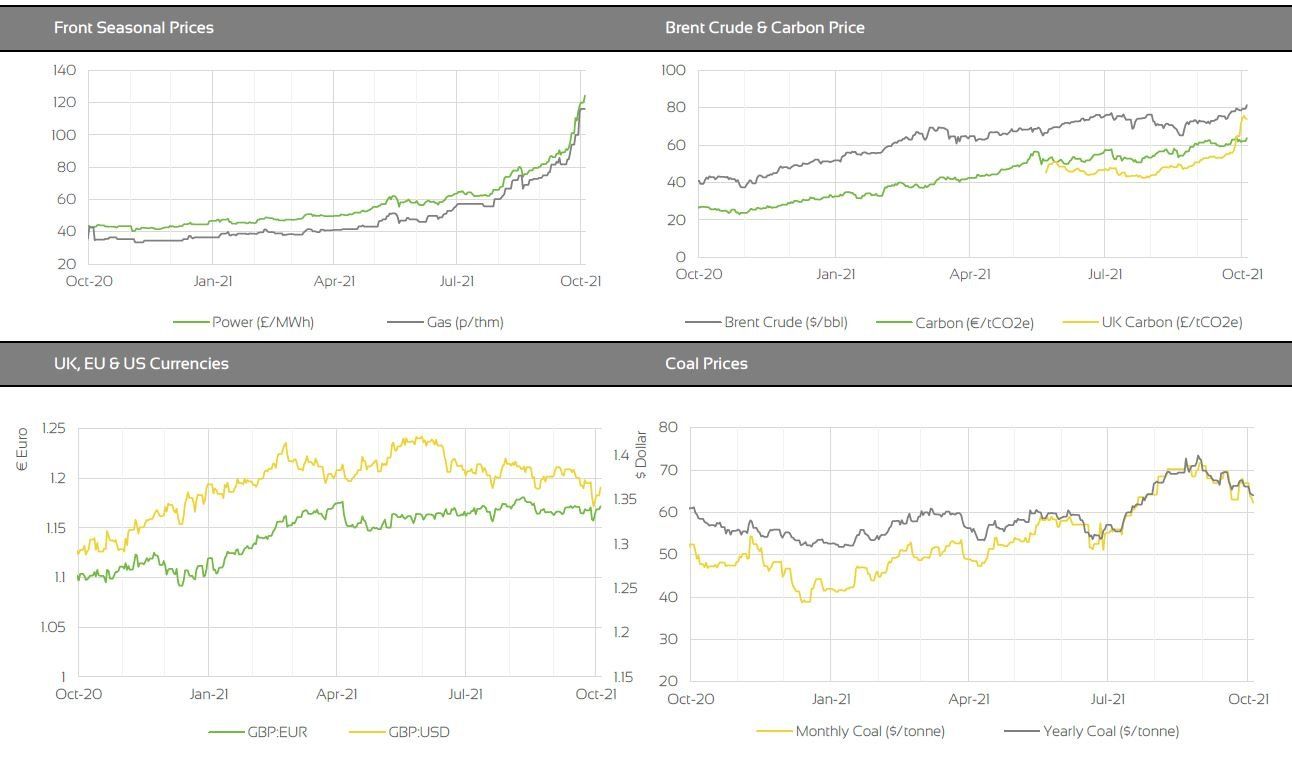

Front seasonal prices have continued to be supported by supply concerns ahead of winter, as a result of poor renewables, gas supply concerns, and the interconnector fire. Further ahead, rising global demand for fossil fuels, as pandemic recovery continues, has provided upside. Oil demand continues to increase, but September saw US Gulf output slashed by hurricane Ida. Furthermore, OPEC+ is unlikely to change its planned output increase of 400,000 bpd for November. The organisation will meet this week, further potential for coronavirus impacts, and Chinese power issues still threaten demand levels and so no increase to planned output is expected.

Both EUA and UKAs, increased throughout September, on the back of rising global demand for fossil fuels. Current gas supply shortages saw lignite as the largest fuel source in Germany, for Q321, with oil-fired generation climbing up the energy-generation mix in several European countries. UKAs were supported heavily by the IFA1 interconnector fire, which will increase the need for fossil fuel fired generation over winter, and the poor renewables picture throughout September. UK carbon prices currently sit at an £18/tCO2e premium to EUAs. If price increases are sustained, the UK ETS authority may be required to trigger its Cost Containment Mechanism (CCM).

Market Outlook

In the shorter term, the outlook remains bullish. Gas supply concerns rumble on and as the situation in China develops, concern will be increasing amongst market participants. Furthermore, we’re also seeing cold weather premiums feeding into market prices, as winter is upon us. Further ahead, increasing oil and carbon prices will continue to support prices. There is potential for some relief if Chinese industrial output continues to be affected by the power crisis, thus reducing oil demand. Furthermore, with UK carbon allowances sitting at such premiums, the likelihood of the CCM being triggered is ever increasing. The CCM would see interventions to reduce prices, such as bringing forward allowances from future years or releasing allowances from the Market Stability Mechanism account.

Backwardation is still in full play across gas and power markets. For fixed clients, with Apr-22 renewals, advice remains to get tenders set up ready to act on any potential downside over the coming months. Risk averse clients should consider signing 12m contracts now. Alternatively, clients should select a longer-term flexible strategy to take advantage of any emerging opportunities to secure volume further ahead.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.