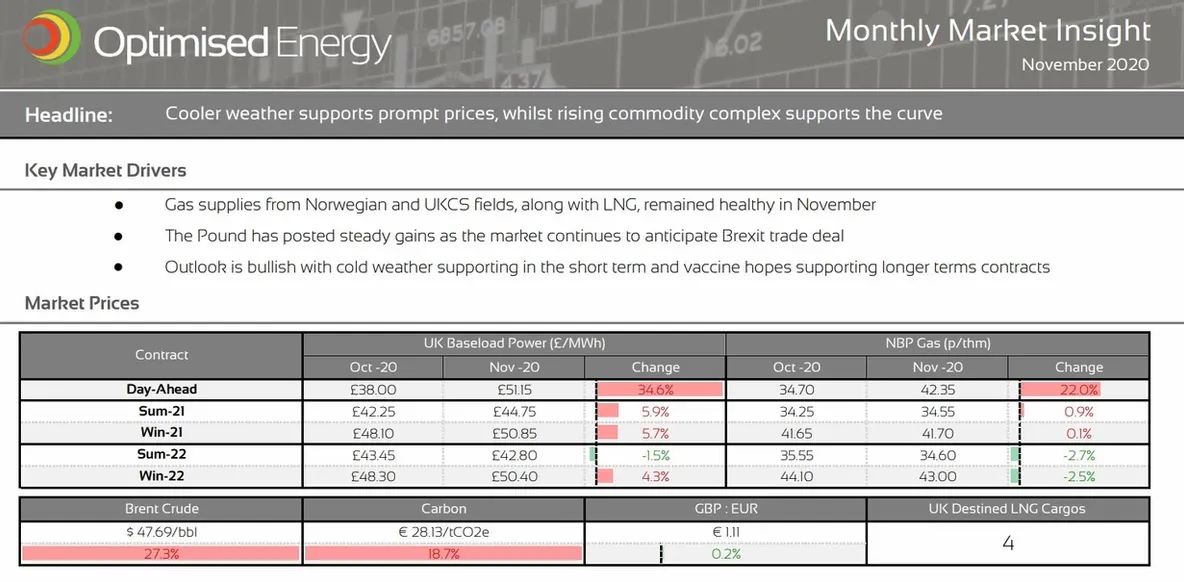

November Monthly Market Insight

Cooler weather supports prompt prices, whilst rising commodity complex supports the curve.

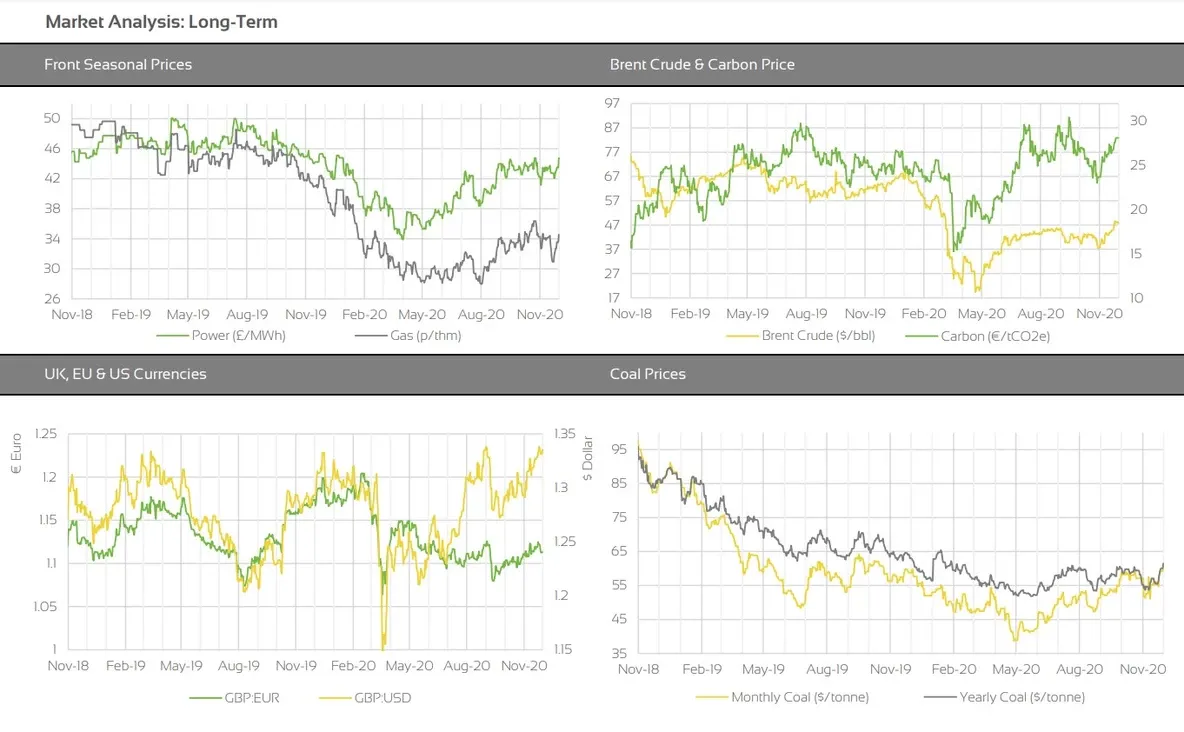

Market Insight: Long-Term

Oil has undergone a significant recovery throughout November to end the month over 27% up on month. Early in the month, the toughing of many national lockdowns, pressured oil, however, as news of several potential vaccines emerged, we saw prices gradually start to climb. Further upside was provided by the market’s anticipation of extended OPEC+ production cuts, from January to March 2021. The commodity was knocked off highs in excess of $48.50/bbl, last week, as news emerged of errors within the trial of AstraZeneca’s vaccine.

Carbon prices have also posted significant gains on month with the commodity initially finding strength from rising oil markets and a more positive global economic outlook. A pause in auction supply from mid-December, along with cold European weather forecasts, have further supported prices. EU ETS auctions will cease whilst adjustments are made to the scheme, including those needed following the UK’s exit and it is thought auctions will only resume in late January.

Market Outlook

In the shorter term, the outlook is bullish with temperatures set to remain at or below norms for at least the first half of December. The LNG picture continues to look strong, but concern around the sustainability of this remain as Asian hub prices strengthen and a cool second half of winter is expected in the far East. Further ahead, the picture is also bullish. The commodity complex has strengthened throughout November and vaccine updates, along with the expected 3-month extension to OPEC cuts, should keep prices supported.

Backwardation has emerged on seasonal power contracts, with the contango on gas contracts continuing to soften. Fixed clients should consider the opportunity backwardation could present for securing volume further ahead. Alternatively, clients should select a longer-term flexible strategy to take advantage of any emerging opportunities to secure volume further ahead.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.