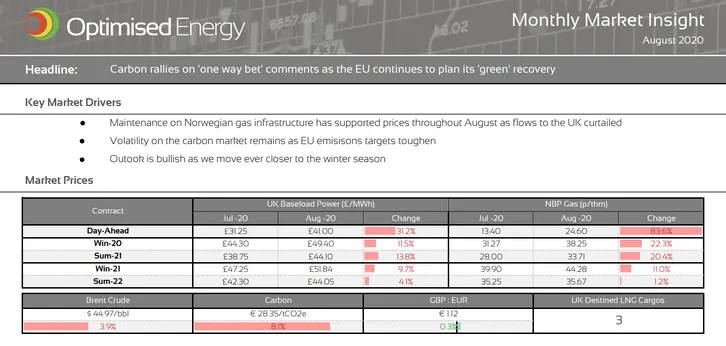

August Monthly Market Insight

Carbon rallies on 'one way bet' comments as the EU continues to plan its 'green' recovery

Market Insight: Long-Term

Longer term energy prices have been on an upwards trajectory, for most of August, as we move ever closer to the winter season. In the last week, we have seen Carbon prices rally yet again, but not quite to the levels seen in July. An article in Sunday’s Financial Times, suggested carbon trading was a ‘one-way bet’ as the EU’s green recovery plan toughens up on emissions levels. The article speculated that prices could breach €40/tCO2e by 2022. Prices have also been supported by record European demand, despite COVID-19 lockdowns.

Oil prices have remained flat throughout August trading in the range of $41-45/bbl. The market failed to react with much enthusiasm even when US inventories posted multiple weekly draws. This week, storms in the Gulf of Mexico have kept prices steady but prices have softened today, as it appears the storm has passed with minimal impact on US oil production infrastructure.

Market Outlook

In the shorter term, the outlook is neutral to bullish with movement being mainly supply/demand driven. Temperatures are expected to sit at seasonal norm for most of September, however, temperatures will move down with seasonality potentially increasing demand. The renewable outlook and gas supply picture will likely continue to drive day to day fluctuations. Norwegian maintenance will continue to curtail Langeled flows into the first week of September at least. We may also see an uptick in demand for injection into storage as October becomes the front month contract.

Looking ahead, the outlook is bullish. Contracts will continue to react to developments on the carbon market and closely follow updates on the LNG market as we move into winter. Flat oil prices will likely keep movement on the far-curve subdued.

It is unlikely prices will revert back to the lows seen at the end of July, at least for the remainder of 2020. However, markets are still sitting relatively low so securing some forward seasonal volume could still have its benefits. The markets continue to exhibit contango characteristics so advice on fixing out no further than 24 months remains. Alternatively, clients should select a longer-term flexible strategy.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.