Daily Market Insight - 1st March 2022

Bullishness in gas prices remain amid supply disruption fears.

Key Market Drivers

- Gas prices continue to climb due to supply disruption fears

- Russian flows coming into Europe remain stable for now

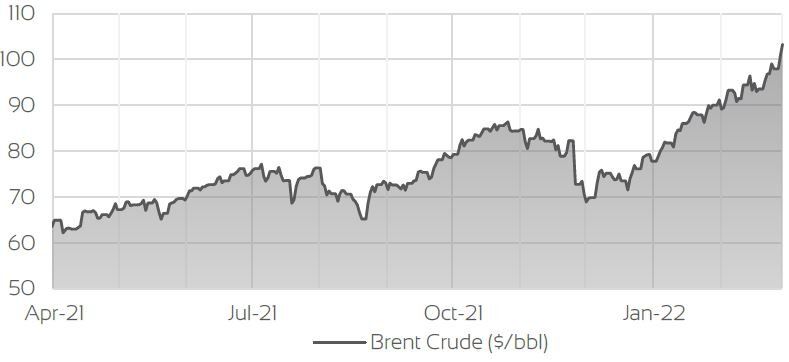

- Oil prices continue to climb despite efforts off a global crude stock release

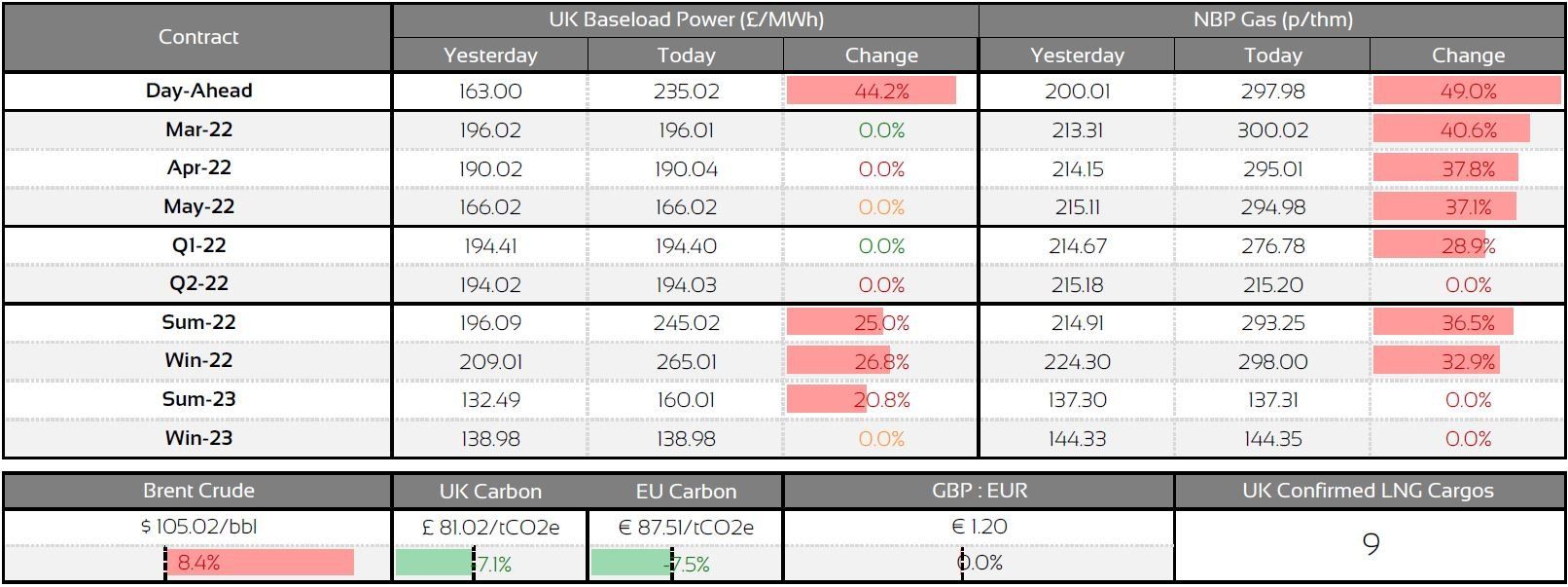

Market Prices

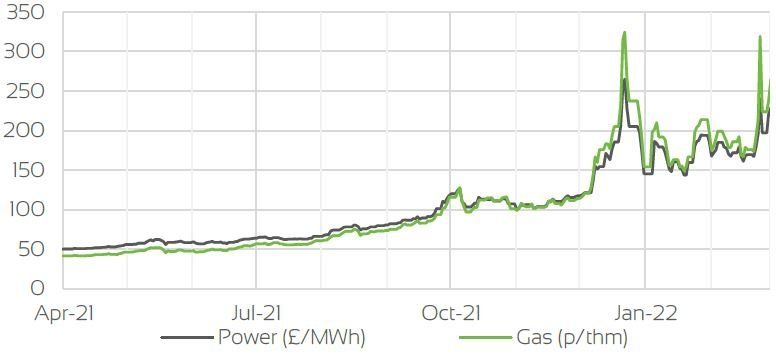

Front Seasonal Prices

Brent Crude Price

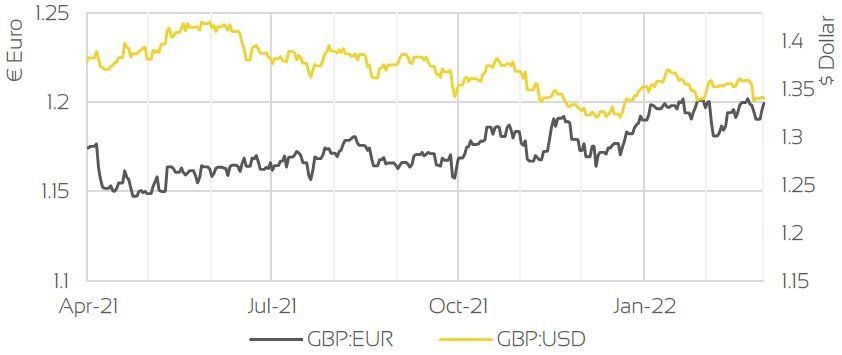

UK, EU & US Currencies

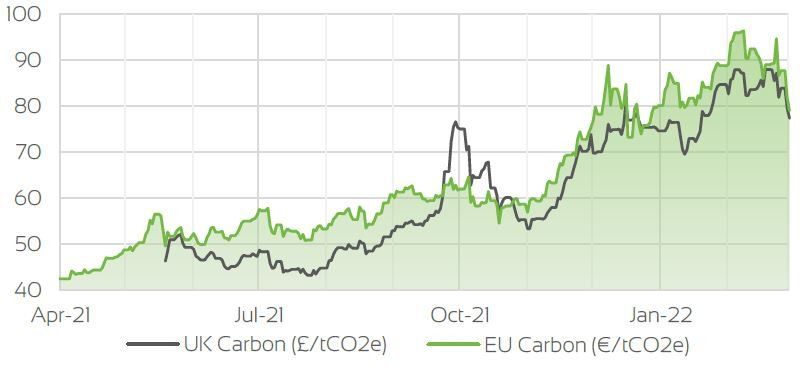

Carbon Price

Market Insight

Following yesterday’s gains markets have continued to rise but not at the same levels. Fears of disruptions to the supply are still driving a lot of the bullishness we are seeing despite Russian flows remaining stable.

Asian LNG prices have risen slightly in recent days and with tankers from Russia or connected to Russia being boycotted, LNG send outs could be limited to some extent after a strong couple of months of imports. Supporting todays upside are forecasts of cooler weather which is likely to last until next Friday along with a drop in wind generation today which contributed less than 5GW to the stack, and in turn resulted in gas system opening up 7 MCM/d short.

Carbon prices continued to fall despite the upside we are seeing in gas markets as both the UK and EU index’s dip below the 80/tCo2e mark. Oil prices continue to strive upwards despite a coordinated global crude stock release as fears of supply disruptions offset any downside in markets.

We're here to help

Our Energy Procurement team are on hand to assist and advise with your gas and power supply demands.

The market pricing information provided by Optimised Energy under this Agreement does not constitute recommendations, advice or guarantees. The Reader accepts that wholesale energy prices are subject to change.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.