Monthly Market Insight | February 2022

Market prices soar as Russia initiates invasion of Ukraine

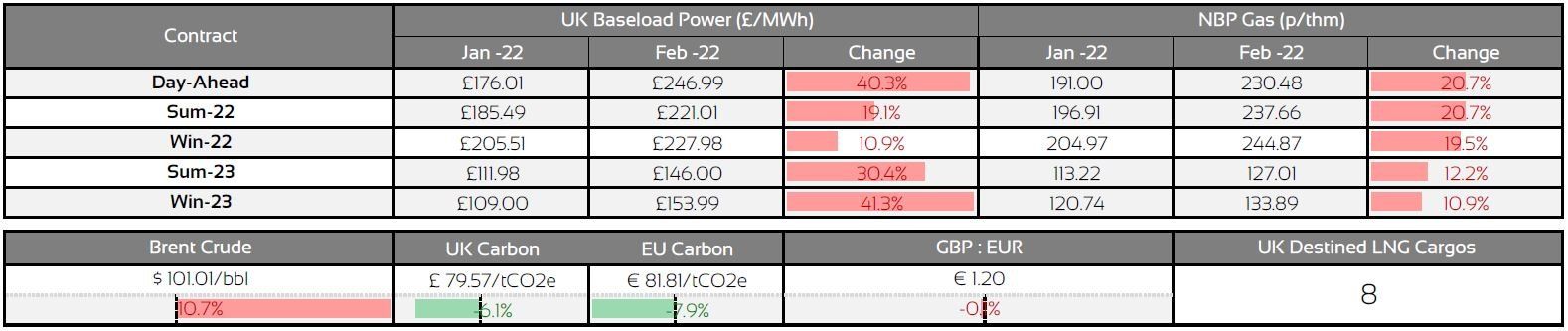

Key Market Drivers

- Putin recognises independence of 2 states prior to initiating a full-scale invasion of Ukraine

- Global sanctions imposed on Russia, its exports and assets leading to high level volatility in multiple markets

- Short term prices jumped on the first day of the attack 63% for March gas and 40% for March electricity

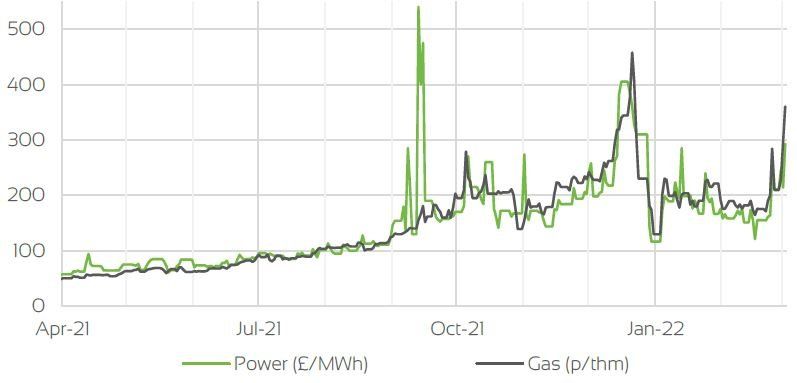

Day Ahead Prices

UK Temperatures

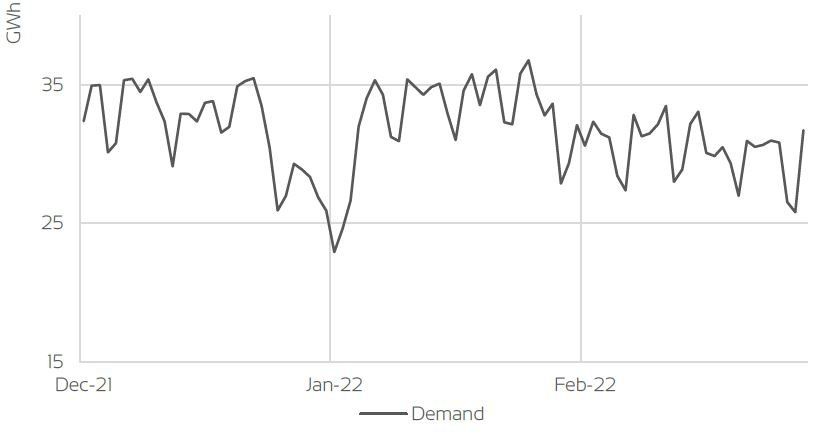

UK Demand

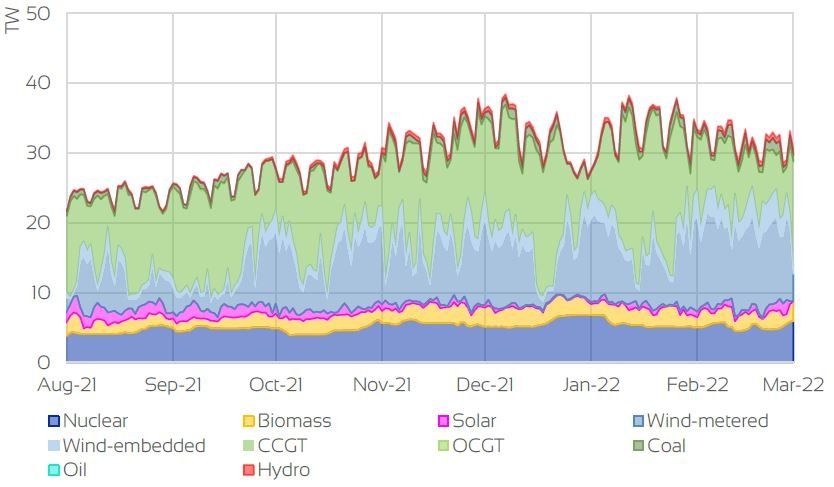

UK Supply Mix

Market Insight: Short-Term

This month saw the long anticipated Russian invasion of Ukraine with unsurprising consequences on both electricity and gas commodity markets (and oil as well).

Short term prices jumped on the first day of the attack 63% for March gas and 40% for March electricity reflecting the concern that the gas supplies would be cut off from transiting through Ukraine. In fact the gas has continued to flow and there has been swings back and forth on prices as the conflict lasts longer than initially anticipated with strong resistance and far more vocal support from EU, UK and USA together with promises of military equipment for the Ukrainian army.

In the last month there have been 20 LNG tankers compared to 18 in Feb 2021, yet an increase of 13% volume YoY, demonstrating the importance of these gas supplies to the UK/European markets. Storage levels in the UK remain high at around 67% and the 24% in Europe is now no longer a multi year low.

Market Insight: Long-Term

The Ukrainian invasion similarly affected the seasonal contracts and prices out to the end of the traded curve – some 3 years ahead. The market priced in the removal of any last vestige of hope that the still to be commissioned Nord Stream 2 gas pipeline from Russia to Germany would be operational in 2022, and indeed it currently seems unlikely that it will ever be given approval.

There are now strong arguments for reversing Germany’s closure of nuclear plants from the end of this year, and the EU Carbon market price has dropped by around €10 to €82 as an economic slowdown is expected and energy consumption drops.

Gas will probably be increasingly reliant on LNG shipments during winter periods as European countries let existing long term Russian pipeline supplied gas expire and where they do not have port facilities we could see more coal and lignite generation of electricity to reduce the overall gas demand.

Front Seasonal Prices

Brent Crude & Carbon Price

UK, EU & US Currencies

Coal Prices

Market Outlook

All eyes will now be on the ongoing developments around the Russia-Ukraine war and fast moving fundamentals. New concerns are arising in relation to gas supplies and the risk of Russia turning off the taps should geopolitical tensions escalate further. With increasing sanctions from the West, there will likely be additional indirect impacts to global economic and commodity markets, likely buoying prices further.

UK and EU energy markets have also experienced a diminished correlation from the Carbon market, as EUA prices tumble as the global equity markets weigh on prices.

It is nigh on impossible to foresee where market prices will be over the coming weeks and months, and therefore it is critical for clients to consider their appetite for risk when considering upcoming renewals.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.