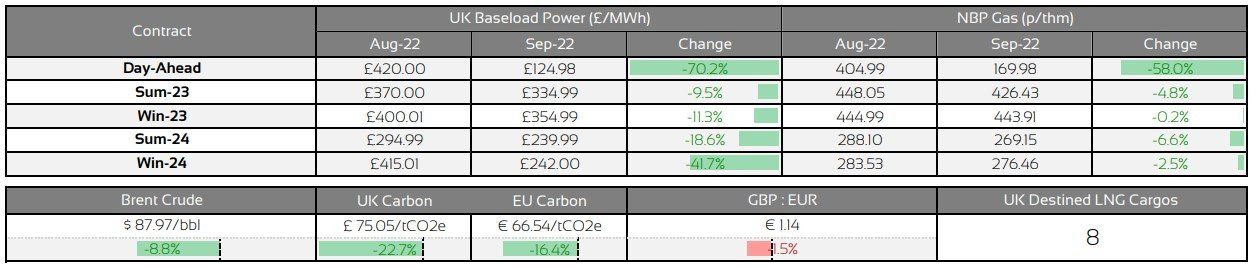

Energy Market Insight | September 2022

Day Ahead Prices

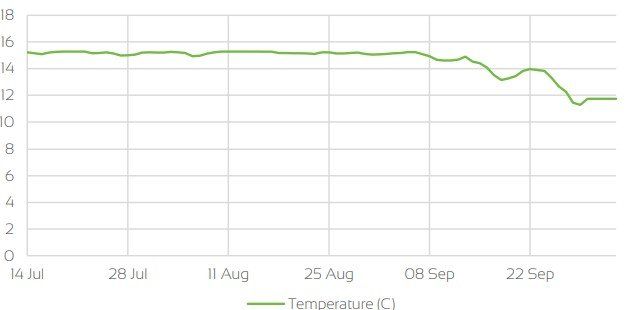

UK Temperatures

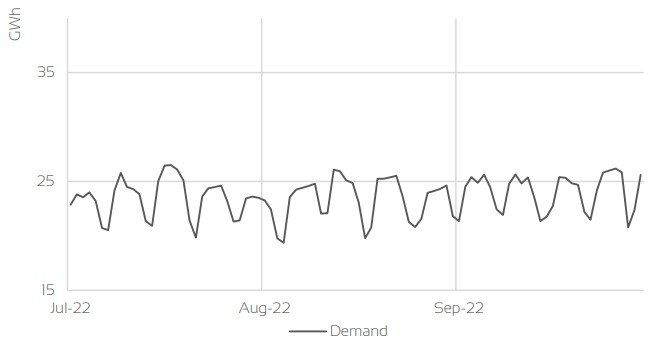

UK Demand

UK Supply Mix

Market Insight: Short-Term

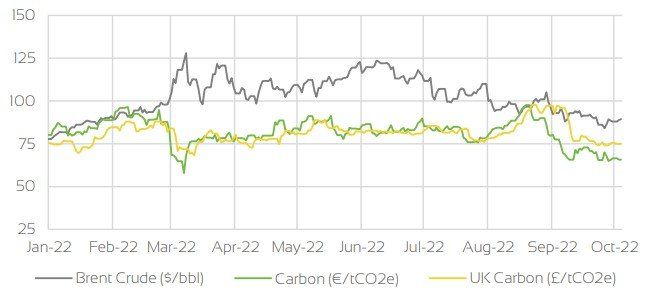

Both Day Ahead & prompt contracts retraced sharply during September, as a positive fundamental outlook outweigh supply concerns and risk as we approached the beginning of the Winter period. This is despite Gazprom confirming at the start of the month that Nord Stream 1 would remain offline indefinitely, following the discovery of an oil leak after a planned 3 day shutdown at the end of August. Firstly, EU announced that due to strong injections into storage, the target for storage facilities to be 80% full by 1st November was met in early September. This was despite initial fears that this wouldn't be met. Storage levels for the whole Bloc currently sit ~91% full. There was also the expectation that both the EU & UK would introduce a price cap on the wholesale gas price.

Whilst the EU haven't (as yet) introduced this, the expectation that this would be implemented caused suppliers to sell back previously purchased volume, alleviating buying pressure. Whilst the initial introduction of the UK price cap is deemed as a bearish factor, there was an initial increase in prices due to buying pressure, as people with Winter exposure looked to capitlise on the Government price cap. As part of the EU's energy reforms, they also announced they would be introducing a mandatory 5% reduction in demand during peak periods. In addition to the above factors, LNG arrivals to both the UK & North West Europe ramped up throughout September, further loosening the supply-demand outlook.

Global outlook for LNG improves significantly throughout the month, as Japan, which is the largest importer of LNG, agreed a supply deal with the Sakhalin 2 plant in Russia, alleviating pressure on the market. In addition, output at Australia also increased following the end of a workers strike.

As renewable generation has also been strong throughout the month, we have also seen this weigh heavily on both gas & power Day Ahead contracts.

Front Seasonal Prices

Brent Crude & Carbon Price

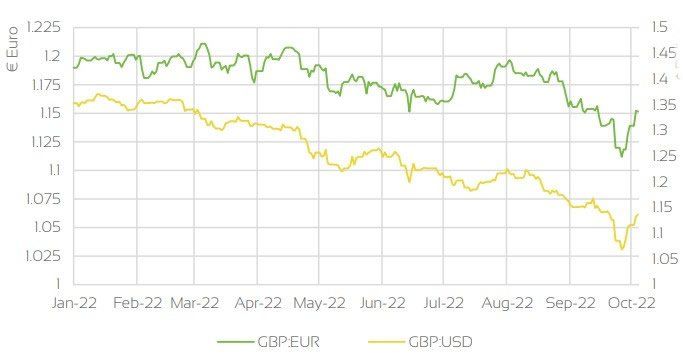

UK, EU & US Currencies

Coal Prices

Market Insight: Long-Term

Seasonal contracts followed a similar trend to prompt contracts throughout September, although losses along the curve were not as pronounced. The introduction of a wholesale price cap in the UK, in addition to mandatory demand reduction in the EU have heaped to soften the Winter outlook. Fundamentally, as storage levels remain extremely healthy and already significantly above the 1st November target of 80% full, along with strong arrivals of LNG forecast, the outlook is much more comfortable for the Winter period, than it had been through the end of Q2/early Q3. Test injections into Rough storage also began in September and no problems have been discovered. Injections are expected to increase throughout Q4, into Q1 2023, up to the capacity of 800mcm for the Winter period (~30% capacity).

This will then increase to 1.6bcm for Winter 2023, and should help to reduce some of the forecasted pressure on the system, next Winter. Russian gas flows into Europe are currently significantly lower than at the same point last year, however, storage levels & LNG look to be sufficient enough to replace this, for this Winter period. Norway have also pledged to increase gas flows to both the UK & Europe to replace any shortfall, as much as possible. To that end the risk of remaining Russian gas flows into Europe being cut off, has been reduced.

However, concern still remains over the energy infrastructure in Europe, following the gas leaks found at NS 1 & 2, which were a result of direct sabotage

Market Outlook

As we enter the Winter period, the market continues to be balanced with Seasonal contracts appearing to trade in a sideways channel. Fundamentally, the outlook remains Bearish as gas supplies remain healthy and the reduced gas flows into Europe, from Russia, appear to have been sufficiently replaced for the Winter period. Injections into storage are expected to remain strong as the month continues, and both LNG arrivals & Norwegian gas send out is forecast to continue to be healthy.

Fears over a global recession also persist, which is materialises should reduce demand. However, there are a couple of factors which potentially could still have a Bullish impact on the market. Firstly, the ongoing concern over the security of the energy infrastructure in Europe. Following the gas leaks discovered at NS 1 & 2, believed to be sabotage, fears have increased that other pipelines/facilities could be targeted, which would put further pressure on the system. The second factor, is weather. Australian Bureau of Meteorology have announced that they expect there to be a La Niña weather front, for the third year in a row.

Should this occur, it is expected to provide cooler temperatures in late Autumn/early Winter, which would increase demand, potentially depleting storage levels quicker than a milder Winter period would. Whilst La Niña provides warmer/wetter weather in late Winter, if we enter Summer '23 with lower storage levels this is expected to provide support for both Summer '23 & Winter '23 prices as demand & subsequent supply risk for these periods, is increased.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.