July Monthly Market Insight

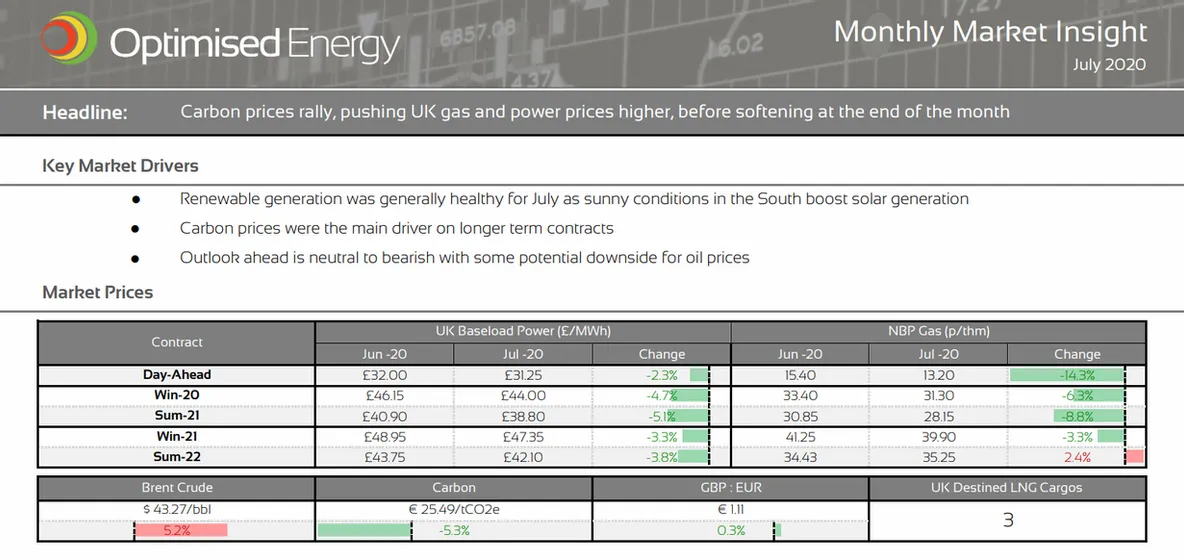

Carbon prices rally, pushing UK gas and power prices higher, before softening at the end of the month

Market Insight: Long-Term

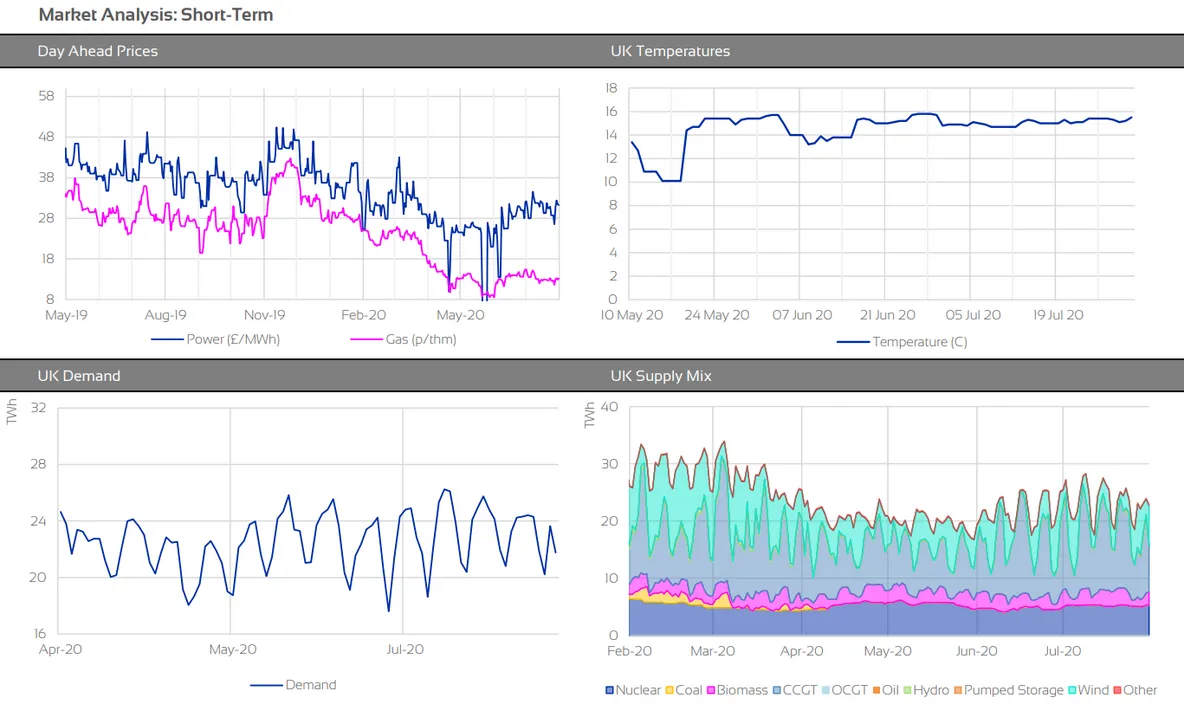

Rising carbon prices have been the main topic of conversation on longer term contracts for July. Prices had been steadily recovering from mid-May as European lockdowns were eased and the global equities markets remained generally positive. From the start of the month, carbon prices rallied, despite generally bearish fundamental drivers remaining. It was, however, the technical drivers that kept the rally going. The Dec-20 contract traded above the €30/tCO2e at times. The commodity did appear to hit it’s resistance level towards the middle of the month and has since settled to levels similar to mid June. The effect on far-curve UK gas and power prices is plain to see.

Oil prices have remained range-bound throughout the month, mostly trading between the $41-43/bbl mark. Fears over ever rising US virus cases seem to have been kept in check by a more balanced supply/demand picture.

Market Outlook

The short-term outlook for the coming weeks is bearish to neutral. Dry and settled conditions are expected for much of August, particularly in the South. The North-West is likely to see some wetter, windier weather at times. Generally, temperatures should sit at or just above seasonal norm, meaning demand should remain within expected seasonal levels. Norwegian flows are expected to remain steady into August. If prices remain bearish, we may see increased gas demand for injection into storage as facilities continue to build stocks ahead of winter.

Further ahead, markets could be driven by more volatile oil prices as we move into August. OPEC+ cuts will officially reduce by over 2 million bpd from the start of the month and rising second-wave virus concerns across Europe, coupled with the situation in America, could see the supply/demand balance start to slip once again.

With markets posting monthly losses for July, fixed term renewals should be considered. The markets continue to exhibit contango characteristics so advice on fixing out no further than 24 months remains. Alternatively, clients should select a longer-term flexible strategy.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.