March Monthly Insight

After a strong start, oil prices end the month down as OPEC+ cuts 2021 demand forecast by 300,000 bpd.

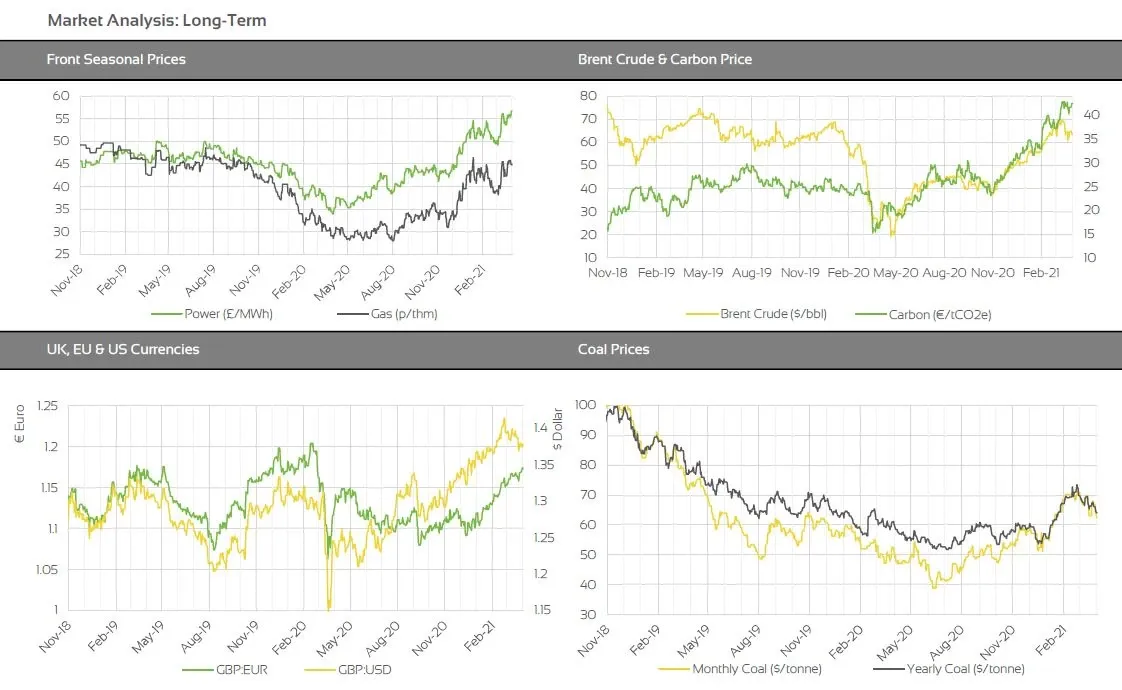

Market Insight: Long-Term

Seasonal contracts were supported by a strong commodity complex throughout March. Oil prices continued to increase in early March, following the approval of a huge US financial stimulus package, as a boosted economy points to rising oil demand. Prices were further supported when OPEC+ agreed to keep current production cut levels in place for April. Saudi Arabia also agreed to extend its additional voluntary cut, of 1 million bpd. However, gains were eventually reversed as rising European virus cases and reports of a third virus wave, reignited fears for a slowdown in demand recovery. Demand fears appear to have been confirmed as OPEC+ revised it’s 2021 global demand forecast by 300,000 barrels per day.

Carbon prices followed oil upwards with improved global financial sentiment. Increased investor interest, coupled with more aggressive EU emissions reduction targets and vaccine rollouts, have driven Carbon prices since Q4-20. Some downside was provided by weaker European equities markets, as continental virus cases began to surge. Towards the end of March, forecasts for cooler European weather and continued investor interest, pushed

prices back above the €40/tCO2e mark.

Market Outlook

The short-term outlook is neutral to bullish. Temperatures are expected to sit below norms for the first week of April, boosting demand for gas for heating. Delays to LNG cargo arrivals will also provide support, following the Suez Canal blockage. Wind output is expected to sit close to norms for April. In the coming weeks, Norwegian gas maintenance projects will ramp up, as several projects from 2020 were delayed due to COVID-19. Although, some supply support will be provided by more flexible gas fields, such as Troll. Looking ahead over summer, utilisation of US LNG export capacity is expected to increase by up to 80%, compared with summer 2020. This increased supply should be absorbed by Europe as it races to refill storage capacity ahead of winter. In the longer term, seasonal contracts continue to be driven by oil and carbon prices. Whilst the picture for oil is potentially more bearish, with rising European virus cases, the picture for carbon is certainly bullish.

Backwardation is still in full play across gas and power markets. Fixed clients with October 2021 renewals should look to conduct first rounds for renewals in the coming weeks to be fully prepared to act over the summer months. Alternatively, clients should select a longer-term flexible strategy to take advantage of any emerging opportunities to secure volume further ahead.

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.