Monthly Market Insight August 2021

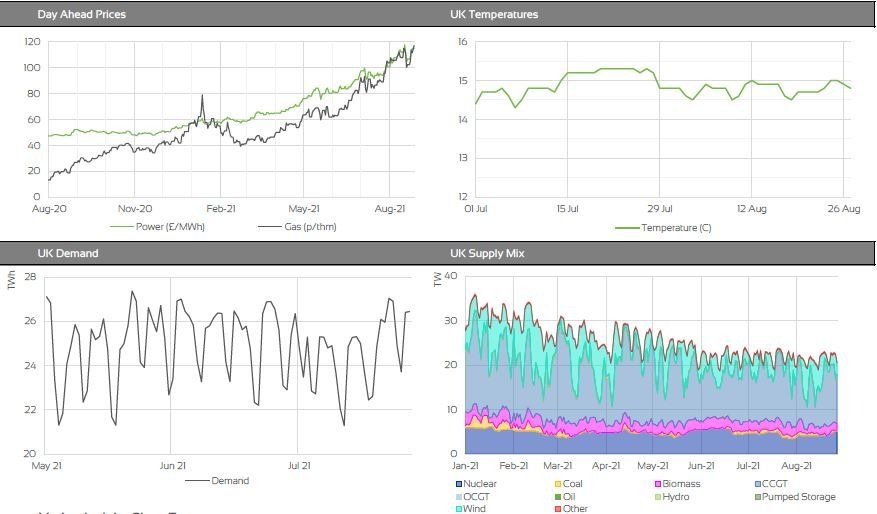

Front Seasonal contracts reside above the £100/MWh and 100p/thm levels for Power and Gas respectively.

Key Market Drivers

- Front seasonal contracts maintain multi-year highs, residing above the 100 mark throughout August.

- UK MRS levels increase from 31% to 68% throughout August, ahead of Winter delivery.

- Uncertainty over global demand recovery following as China battles with COVID case numbers.

Market Prices

Market Insight: Short-Term

Despite leading up to the Winter period, UK temperatures have resided marginally above seasonal norms in the most part, easing the requirement for additional demand and limiting the air-con demand typically experienced during the summer period. Nonetheless, wind generation levels have been below norms in the UK for the latter weeks of the month, increasing reliance on gas for power generation. This will be further exacerbated as the increase in demand levels in line with seasonality begin to take effect. Furthermore, LNG deliveries have been continually low throughout August, maintaining upside pressure on prices.

Nonetheless, following a slow start to the year, August has seen UK MRS injections gain pace, taking levels from circa 31% to 68% in a matter of weeks. This has resulted in levels exceeding the respective 2017 levels. With the proximity to Winter and global uncertainties that remain, is this too little, too late?

Market Analysis: Long-Term

Market Insight: Long-Term

Oil prices have been subject to bearish sentiment throughout August, with growing concerns around the global economic following the COVID-19 outbreak. Increased cases in China have hampered the rate of demand recoveries, weighing on prices. The Brent Crude contract fell in excess of 8% during one week mid-August, posting month-on-month losses of 5.3%. Earlier this month however,, the White House called upon OPEC to boost oil production levels in an effort to curb high petroleum prices due to its "risk harming the ongoing global recovery". OPEC and allies agreed to increasing production levels, but not to the level that would fully offset previous production cuts, limiting losses.

Carbon prices have maintained strength throughout August, with the EU EUA currently trading at €58.37/tCO2e. A strengthened European gas market supported prices this month as low Russian gas supplies booked via the UK pipeline. Although an underlying bullish trend still remains in place for EU Carbon pricing, the momentum is slowing, with prices remaining relatively rangebound since May-21.

Market Outlook

The short-term outlook remains bullish, with seasonality forecasting temperatures to continue declining on the lead up to winter and continued concerns for UK MRS levels. The UK will need to see an increase in storage levels, LNG volumes and renewable output in the UK stack for underlying short-term price trends to change.

Seasonally the expectation is for continued bullishness, with ongoing concerns of demand and global economic recoveries alongside insufficient weather forecasts for the upcoming Winter period. Front seasonal technicals are demonstrating continued strength, with early developments of a subsequent Bollinger Band pinch potentially indicating another significant movement.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.