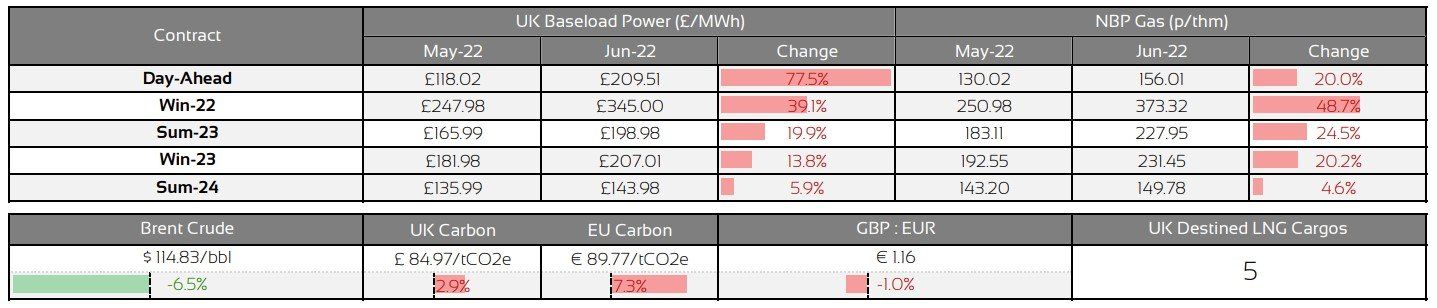

Energy Market Insight | June 2022

Day Ahead Prices

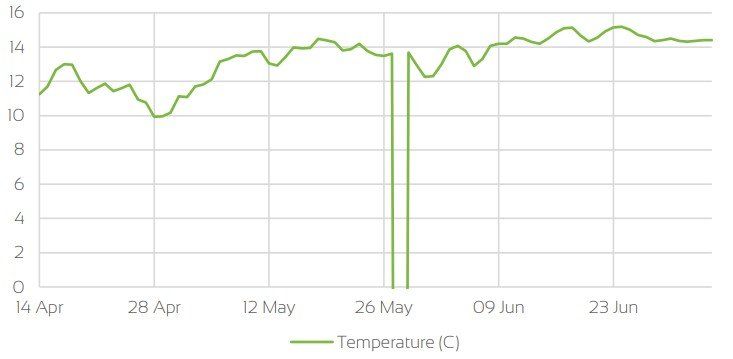

UK Temperatures

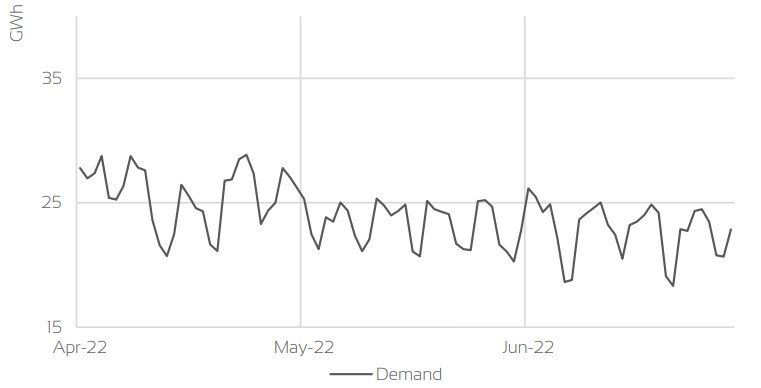

UK Demand

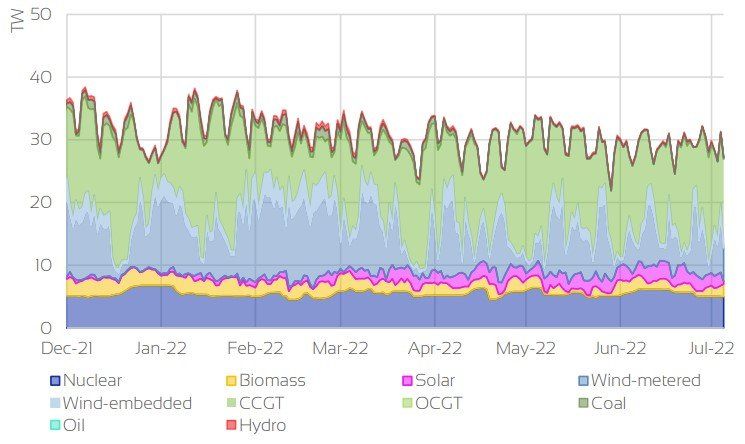

UK Supply Mix

Market Insight: Short-Term

Market volatility continued throughout June, as concerns continue to persist over the security of gas supply into Europe, both short term and long term. Firstly, there was an outage at Nord Stream 1 pipeline, due to unexpected maintenance which reduced Russian flows into Europe via this route. Maintenance was on a turbine, which had to be sent to Canada to be repaired by Siemens and has since been unable to be returned due to sanctions imposed on Russia. Following this, flows were further reduced and it is now currently operating at ~40% of capacity. The same time these issues with Nord Stream 1 were occurring, there was also a fire at the Freeport LNG plant in the US, which has caused this to close. This plant accounts for ~20% of US LNG production, and put further pressure on global supply as Europe continues to look for alternate sources of generation to offset the reduced Russian gas flows. With Russian flows significantly lower and LNG supply and demand tighter, we saw prompt contract prices increase throughout the month.

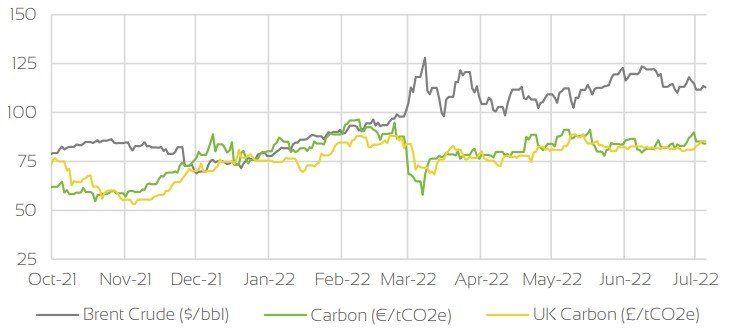

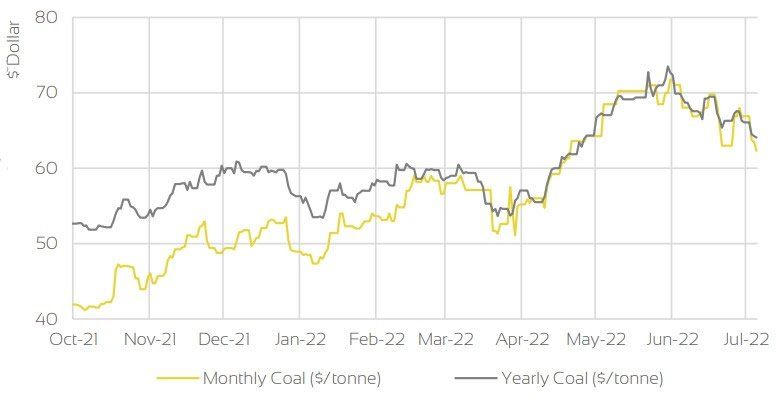

A knock on effect of these outages, is that we saw Italy, Poland, Ukraine, Germany, Austria & Netherlands all announced they would be either completely removing or altering their current production caps on coal fired generation, looking to reduce gas demand on the network. Whilst only a short term measure due to the continued renewable targets in place, this may help to alleviate some of the upward pressure on the gas price. However, the increased demand for coal has pushed the coal price higher and has also helped to increase demand for Carbon certificates adding pressure to the Carbon price and also providing support to power contracts.

Market Insight: Long-Term

Seasonal contracts have traded higher throughout June, as similar to the prompt market, concerns persist over the certainty of gas supplies into Europe into the Winter period and beyond. Nord Stream 1 is expected to be completely offline from 11th - 21st July for planned maintenance and in the current geopolitical climate, there are serious concerns in the market whether flows will return after this period, even if only back up to the current level of ~40% of capacity. Freeport LNG plant have said they expect the site to remain completely offline until September and don't expect to be back at full capacity until December. However, a similar fire at Hammerfest LNG plant in Norway saw that facility offline for nearly 20 months, which raises concerns that this plant may be offline for a similar period of time, further tightening global supply-demand, particularly as Europe looks to move away from Russian energy sources.

As flows have tightened short term, it has also caused a reduction in the rate of gas being injected into storage, across Europe. Whilst storage facilities European wide are currently in line wih the five year average for this time of year, they have slowed quite drastically over the latter part of the month due to a reduction in the surplus of gas.d to eventually also be sanctioned.

Front Seasonal Prices

Brent Crude & Carbon Price

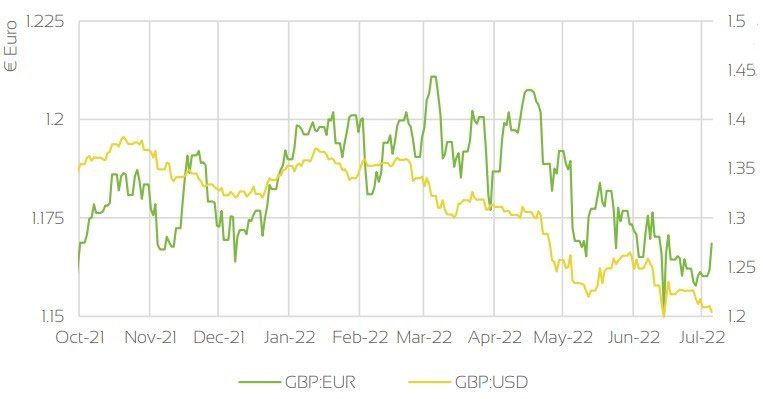

UK, EU & US Currencies

Coal Prices

Market Outlook

Market remains in a bullish trend as supply concerns persist both short term and for contracts across the curve. Although countries across Europe are all looking to alleviate pressure on the gas price by looking at alternate sources of generation, reducing demand, or both, unless there are significant changes to fundamental drivers, these are expected to remain the predominant price drivers. If the turbine for Nord Stream is returned and we see flows increase back up to close to full capacity following the planned maintenance, we may see prices start to soften.

Conversely if flows do not return and remain completely turned off, this could exacerbate the already tightened system and push prices even higher. Similarly, if the outage at Freeport LNG is pushed back and is longer than currently expected, it is expected that this will also provide support to prices. Even if flows do return back to a normal level prior to the Winter period commencing, if injections into storage cannot resume at the rate they were carried out prior to these outages, the system is expected to remain tight during this period, and will further add support to Winter prices as well as Summer '23 & Winter '23 prices.

Clients with forward exposure should consider their budgets and appetite for risk and act accordingly. For further information, or to discuss options, please get in touch with your Optimised Energy account manager, or call the number below to speak to one of our experts

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.