Monthly Market Insight October 2021

Markets soften on month on mild start to winter and potential for additional Russian gas to flow to Europe

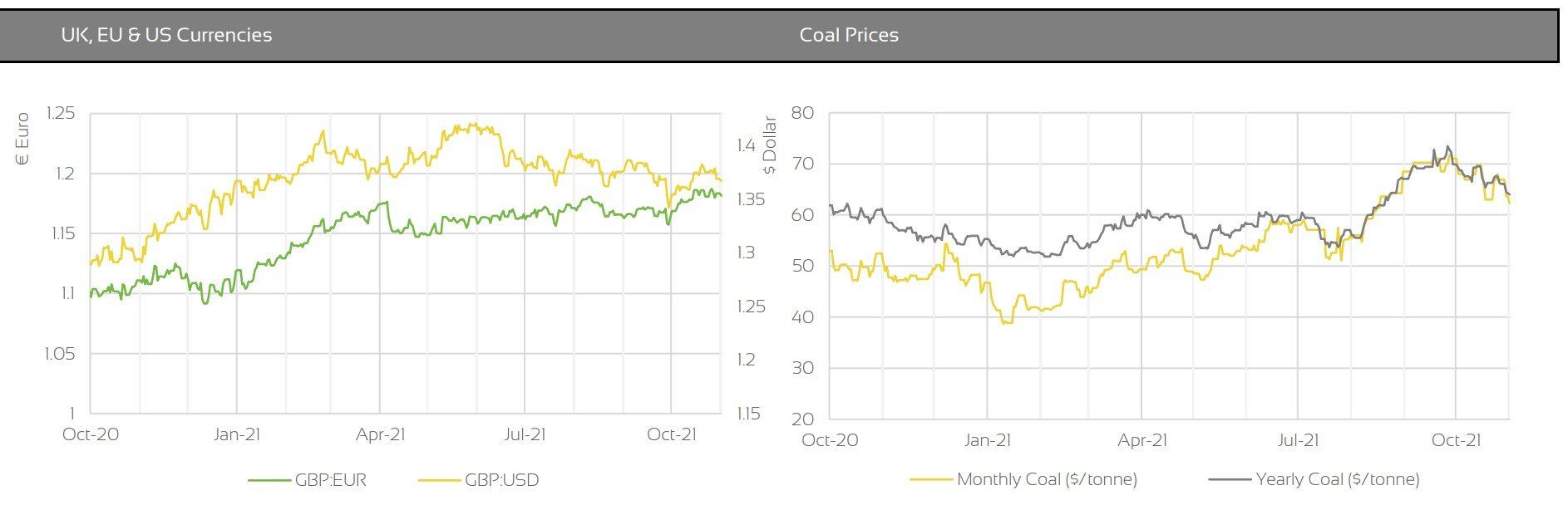

Key Market Drivers

- La Nina conditions in the Eastern pacific continue to strengthen which could point to further cold weather risk ahead

- Oil prices continue to maintain strength, despite China's attempt to balance the market, as global demand remains high

- UK carbon prices continue to sit above CCM trigger level, increasing likelihood of price easing action from UK ETS authority

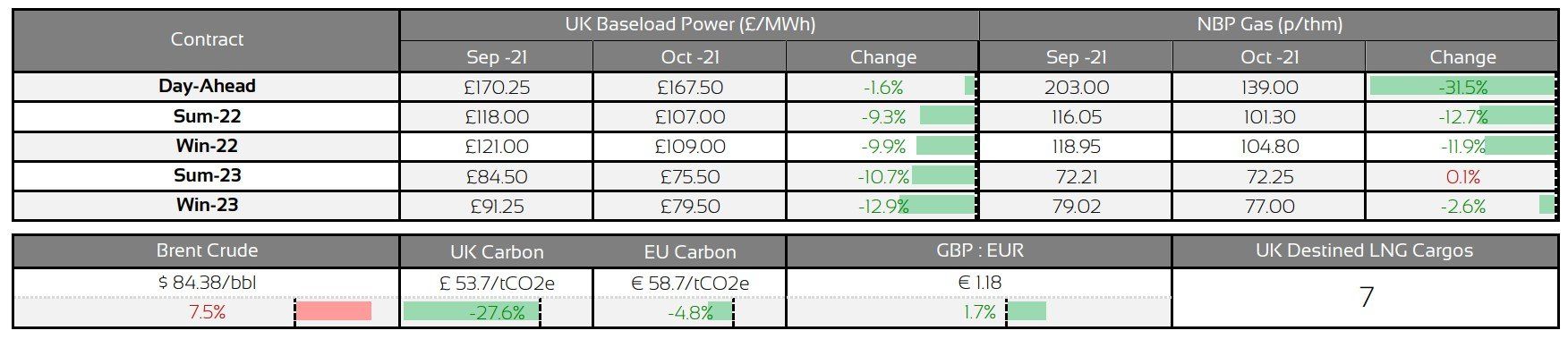

Market Prices

Market Insight: Short-Term

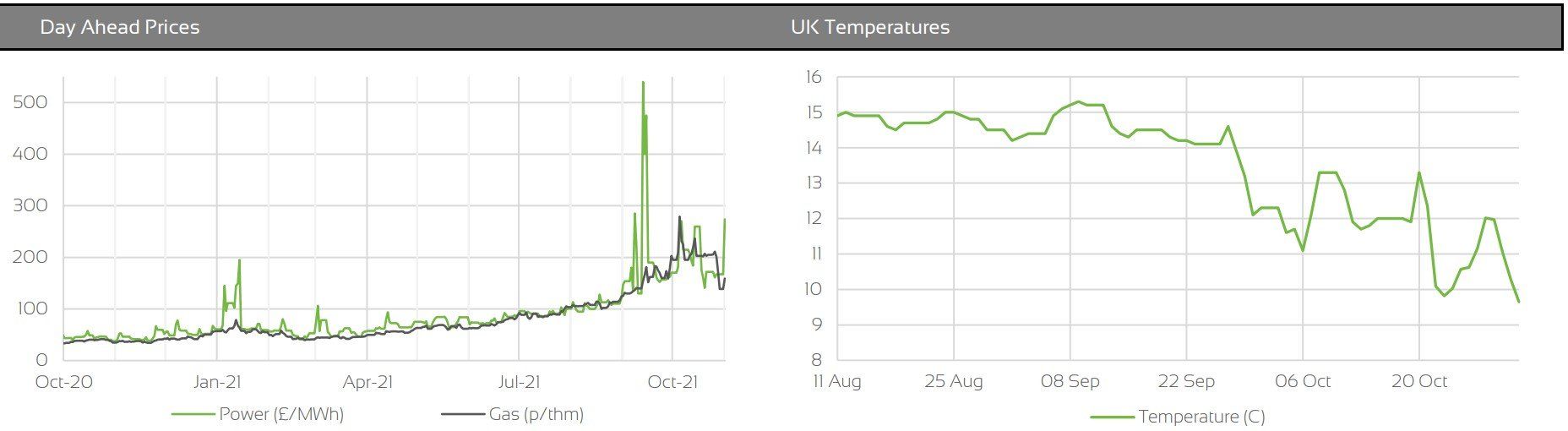

Volatility has been the theme throughout October across UK energy markets; however, most contracts ended the month at a discount to the previous month. As we moved into the winter period, wind generation output has begun to improve, and weather remained relatively mild throughout October. The LNG picture also improved with a marked increase to vessels arriving into the UK, when compared with last summer. European gas storage, and uncertainty around Russia’s European export plans, created the volatility seen. Despite positive comments from Russia early in October, Russia only booked a third of available Ukrainian transit capacity for November. However, last week, the country's president confirmed it would support European gas supplies as soon as its domestic supplies were full. A provisional date of 8th November was given but the market awaits any information on volumes. This will be welcome news, as it has emerged that Gazprom-controlled storage facilities in Eastern Europe, continue to sit considerably lower than non-Gazprom controlled facilities.

The ESO and National Grid published their Winter 2021/22 outlooks this month. Both publications spoke of the expectation of a similar picture to last winter, with confidence that electricity and gas demand would be met this winter. This despite National Grid pushing back the return of 1GW of IFA1 capacity taken offline following September’s fire. Originally, the operator planned to have the capacity back online by March 2022, however, it now expects to return 500MW between October 2022 and May 2023, before getting the final 500MW back online by October 2023.

Market Analysis: Long-Term

Market Insight: Long-Term

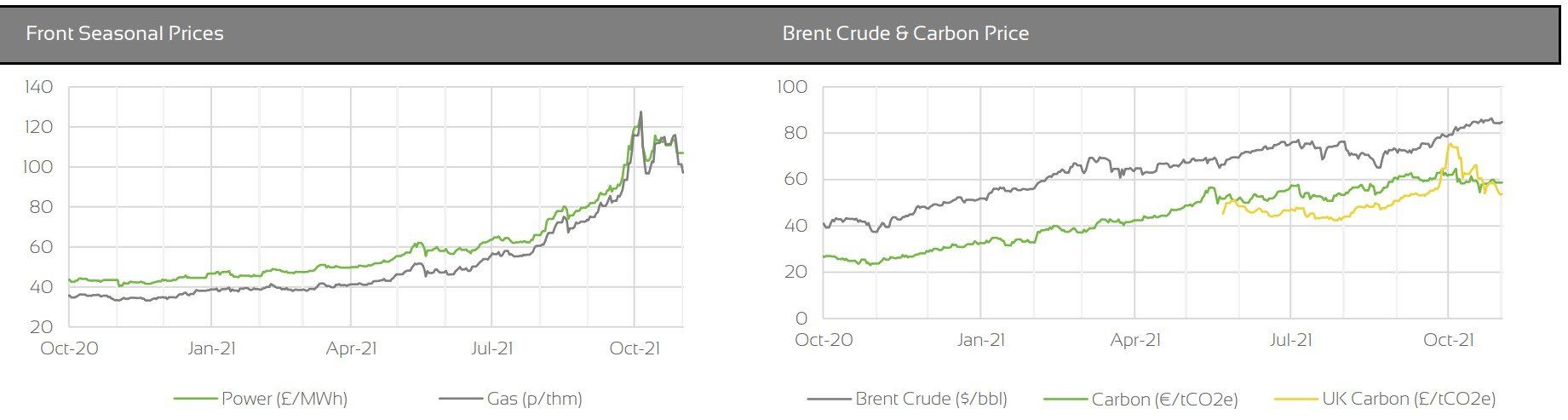

Oil prices posted further gains during October on strong global demand. The trajectory of price increases slowed however, as US inventories posted gains towards the end of the month, and the market anticipates the return of some Iranian supply. Worries around a potential slowdown in industrial activity, due to high global energy prices, also kept price increases in check, along with China’s move to release reserves of some oil-derivatives to increase market supply. In recent days, prices have been further supported as the market anticipates OPEC+ will not revise up output plans at this week’s meeting.

Carbon prices posted losses throughout October, with UK carbon permits shedding the most value. Concerns around an industrial slowdown, due to high global energy prices and rising covid cases, along with an improved renewable picture, pressured prices. Although, prices remain above the UK governments CCM trigger and so we could see the UK ETS authority move to increase market supply if this continues

Market Outlook

In the shorter term, the outlook is fairly neutral. The UK’s winter supply picture is currently positive, and if Russia follows through on it’s promises to support European supplies from next week, we could see further price decreases. On the other hand, we expect cooler weather in November with the potential for settled conditions emerging, which could inhibit wind output. La Nina conditions in the Eastern pacific continue to strengthen and the current Easterly quasi-biennial oscillation (QBO) winds, could point to further cold weather risk ahead. Oil prices are likely to remain strong unless OPEC+ decides to increase output, a move market participants do not anticipate.

Backwardation is still in full play across gas and power markets. For fixed clients, with Apr-22 renewals, advice remains to get tenders set up ready to act on any potential downside over the coming months. Risk averse clients should consider signing 12m contracts now. Alternatively, clients should select a longer-term flexible strategy, where possible, to take advantage of any emerging opportunities to secure volume further ahead.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.