Monthly Market Insight | May 2022

Gas prices trading higher as concerns of certainty of supply persist

Key Market Drivers

- Russia halts gas flows to Finland, Netherlands & Denmark

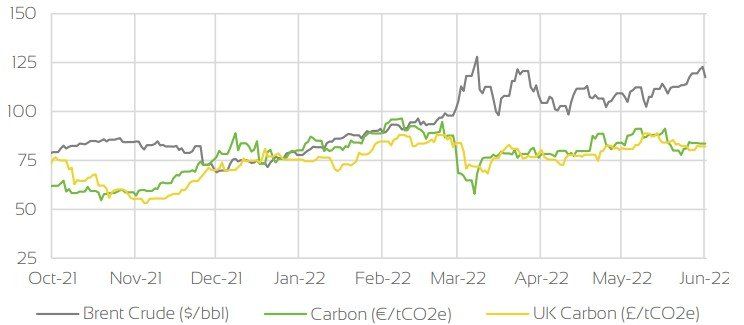

- Brent Crude ends May at highest level since March 28th

- UK gas prices continue to be at a discount to Europe, exports at full capacity

Day Ahead Prices

UK Temperatures

UK Demand

UK Supply Mix

Market Insight: Short-Term

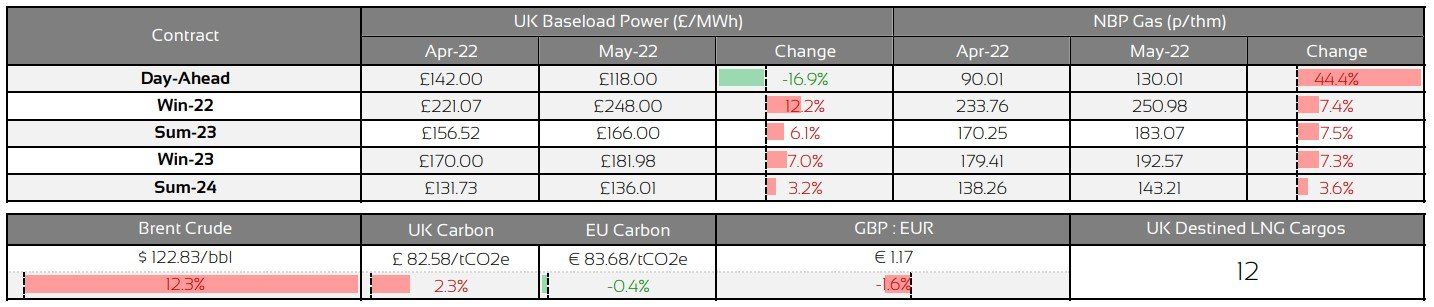

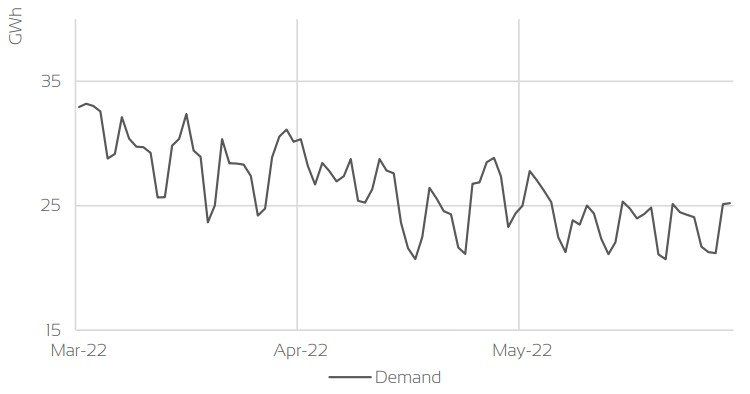

May saw high levels of volatility in the day ahead and prompt contracts for both gas & power. The UK gas market started off the month significantly oversupplied. This was caused by healthy supply of LNG, warmer weather reducing demand, strong flows from NCS and longer than expected maintenance at the IUK interconnector, which all weighed on prices. Day ahead gas prices fell to 25p/Th, the lowest price since September 2020. Prompt contracts for both gas & power followed a similar suit, albeit prices continued to find support because of the uncertainty surrounding Russian gas. As the GB gas price continued to be at a discount to its European counterpart, once the interconnector came back on line, exports to Europe were at full capacity. This, coupled with ongoing concern of Russian flows pushed prices higher throughout the back half of the month, and all contracts are now sitting higher than at the end of April.

Fundamentally, the market outlook remained bearish. With the exception of Finland, Poland & Bulgaria, who had flows halted, Russian gas continued to flow into Europe to meet requests. Concerns were initially raised mid-month when Ukraine stopped the transit of Russian gas via the Sokhranovka entry point, which accounts for ~25% of gas sent to Europe through Ukraine, however, after a brief retaliation from Russian where flows were reduced drastically, they have continued as required. After much to-ing and fro-ing it was also agreed that EU entities could set up account via Gazprombank to pay for gas, and this would not be in breach of EU sanctions. Russia were also prepared to accept payments via this method. The majority of Gazprom's customers in Europe set up accounts to pay this way, further alleviating concerns of tightened supply. However, Netherlands & Denmark have both had gas flows halted due to their refusal to comply with this.

Market Insight: Long-Term

Seasonal contracts have traded higher throughout May, and have ended the month higher than the end of April. Similar to the prompt contracts, the certainty of supply for Russian gas, longer term, continues to be the key driver. As Russia continues to halt gas into Europe to "non-friendly" countries who refuse to pay in the approved method, fears over a tightened supply going into the Winter period and beyond, remain. Following the EU sanctions on Russian oil, gas remains the only unsanctioned Russian fuel; whilst European dependence on gas is greater than oil, if war in Ukraine continues, gas is expected to eventually also be sanctioned.

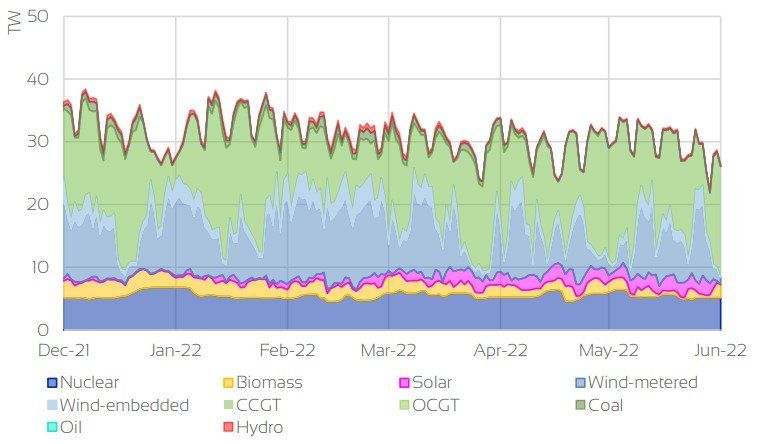

Both the UK and Europe are trying to alleviate some of this concern. The UK has proposed that coal fired power plants due to come offline this year will have an extension granted to cover the Winter period at least. The UK government has also began talks about the possibility of reopening Rough storage, although talks are at an early stage, if injections into this facility can take place with enough of a lead time prior to Winter, this may help reduce some of the concern over tightened supply. The EU has also introduced a law that states all members must have gas storage facilities at least 85% full by 1st November. As it stands, injections into European storage are strong and if this rate is sustained, it is expected to be above the 85% level at the November deadline, potentially weighing on Winter prices.

Front Seasonal Prices

Brent Crude & Carbon Price

UK, EU & US Currencies

Coal Prices

Market Outlook

The market still remains largely driven by ongoing developments with the Russia-Ukraine conflict, and continued price volatility should be expected for the foreseeable. From a fundamental perspective the market continues to be slightly over supplied with continued strong LNG arrivals and Russian gas flows continuing to meet demand. Following the halt to flows to Netherlands & Denmark however, this is expected to tighten. Injections into storage are expected to continue at the rate they have in April & May, in order to meet the EU Commission target of 85% full by 1st November. Provided supply remains strong, this could continue to weigh on the Winter '22 contract as some of the risk around a supply shortfall in the Winter period is eroded. If supply is cut, and Europe has to continue injections at the same rate, this may lead to a further increase in near term contracts. Curve prices are very much on the increase, as longer term the risk remains over global energy supply. Backwardation continues to remain in place for future contracts, albeit the benefit continues to tighten. Until an agreement is reached over security of supply longer term, it is expected that we will see prices further along the curve continue to increase.

Clients with forward exposure should consider their budgets and appetite for risk and act accordingly. For further information, or to discuss options, please get in touch with your Optimised Energy account manager, or call the number below to speak to one of our experts.

Download the full insight here:

BOOK YOUR 30-MINUTE ENERGY MANAGEMENT CONSULTATION

Fill in your details below to arrange a complimentary consultation with one of our experts. They will give you bespoke advice to help your business achieve all its energy needs, reducing cost, consumption and carbon.